- Sweden

- /

- Construction

- /

- OM:NCC B

NCC (OM:NCC B) Earnings Growth Surpasses Long-Term Trend, Reinforcing Bullish Valuation Narrative

Reviewed by Simply Wall St

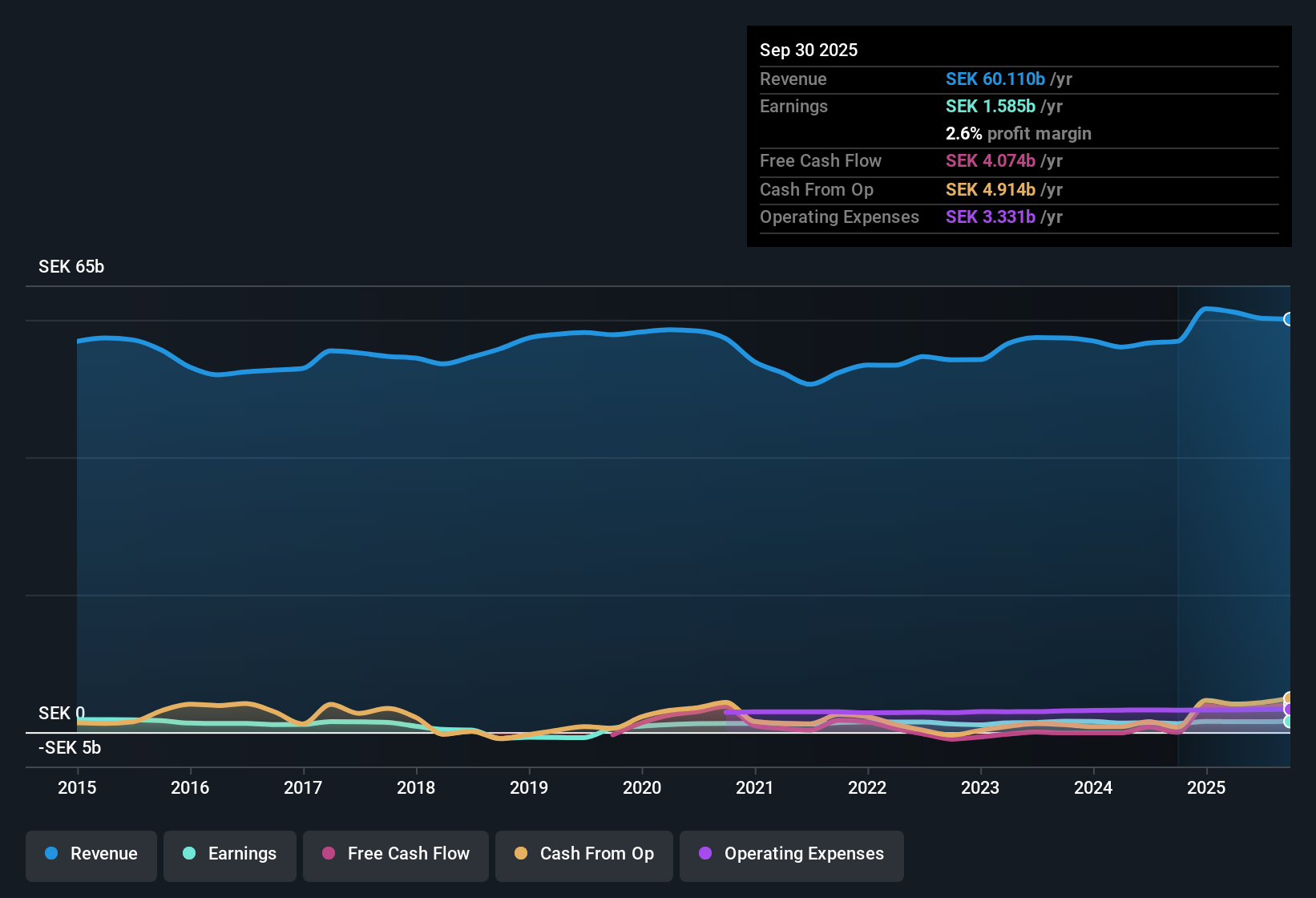

NCC B (OM:NCC B) reported annual earnings growth of 9.4%, surpassing its five-year average growth rate of 3.5%. While net profit margin held steady at 2.5%, the company’s revenue is forecast to rise 3.8% per year, which is slightly faster than the Swedish market. With shares trading at SEK 215, well below the estimated fair value of SEK 342.55 and at a price-to-earnings ratio lower than both industry averages, investors are watching solid profitability but remain mindful of future dividend sustainability.

See our full analysis for NCC.Next up, we’re putting these fresh results head-to-head with the major market narratives to see what gets confirmed and what could be up for debate.

See what the community is saying about NCC

PE Multiple Lags Industry Peers

- NCC B trades at a price-to-earnings ratio of 13.8x, which is not only below the European construction industry average of 14.6x, but also notably lower than the peer group average of 21.2x.

- Analysts' consensus view suggests that this discount reflects both strong historical earnings quality and broad agreement on steady profit margins. Some tension remains as future revenue growth is forecast to be just slightly above the Swedish market average.

- Consensus narrative notes NCC B's high quality earnings and solid balance sheet support sustained profit delivery. This supports the view that the PE discount could be an opportunity rather than a red flag.

- However, the consensus also highlights muted property market trends and competitive pressures that could limit upside. These factors help account for the relative valuation gap versus peers.

Steady 2.5% Profit Margin Defies Sector Pressures

- NCC B’s net profit margin held unchanged at 2.5%, resisting downward pressure even as the Swedish construction market remains subdued and competitors face shrinking profitability.

- Consensus narrative emphasizes the importance of margin stability for sustaining strategic M&A plans and new efficiency initiatives.

- Consensus view links stable margins with a stronger financial position, enabling NCC B to pursue selective mergers and acquisitions for future growth without eroding current profitability.

- At the same time, analysts express caution as property development delays and pricing pressure from smaller rivals could threaten this margin if market conditions worsen.

Dividend Sustainability Remains the Main Risk

- The main ongoing risk highlighted across both the filings and the consensus narrative is whether NCC B can keep its dividend stable. Future payouts may be challenged if muted property sales and FX headwinds persist.

- Analysts' consensus view points to NCC B’s financial strength and low net debt as buffers, but acknowledges that muted earnings growth and sluggish property transactions could pressure dividends.

- Consensus narrative reiterates that while NCC B’s strong balance sheet helps, a lack of recognized property development sales this quarter may reduce cash flow for dividends if it continues.

- Bears argue that if the Swedish Krona strengthens or if competition intensifies, maintaining the current dividend could become more difficult.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for NCC on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have an alternative take on these results? Shape your perspective into a personal narrative in just a few minutes, and Do it your way.

A great starting point for your NCC research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While NCC B’s strong profits and valuation are appealing, the biggest concern now is whether muted property sales and market headwinds will erode its ability to sustain dividends going forward.

If you want more reliable dividend income, check out these 1979 dividend stocks with yields > 3% with yields above 3% and find companies better positioned for stable future payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NCC B

NCC

Operates as a construction company in Sweden, Norway, Denmark, and Finland.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives