Why Munters Group (OM:MTRS) Landed a $30 Million US Deal Amid Restructuring Efforts

Reviewed by Sasha Jovanovic

- In October 2025, Munters Group announced a US$30 million order from a US battery cell producer for its AirTech dehumidification solutions, while also reporting strong quarterly order intake and restructuring initiatives impacting approximately 200 positions worldwide.

- This combination of a major US client win and ongoing operational changes reflects Munters' focus on expanding key technology markets and driving efficiency across its global operations.

- We'll explore how the major US order in AirTech influences Munters Group's investment narrative amid recent restructuring and market growth.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Munters Group Investment Narrative Recap

Munters Group’s investment case hinges on the company’s ability to convert record demand for data center and battery tech solutions into sustainable top-line and margin expansion, while navigating cost pressures and market cyclicality. The recent US$30 million AirTech order underscores continued penetration into high-priority battery markets, but does not materially reduce the biggest near-term risk: margin volatility from an unfavorable product and regional mix, particularly in Asia-Pacific, and continued earnings pressure from restructuring.

Among recent announcements, the divestment of the FoodTech Equipment offering stands out, highlighting Munters’ renewed focus on scalable, digital, and recurring-revenue business models in FoodTech alongside ongoing investments in its AirTech line. This context reinforces the company’s primary catalysts, demand acceleration in data center and industrial decarbonization markets, yet leaves Munters exposed to competitive and margin risks as mix shifts evolve. In contrast, while strong order intake is encouraging, investors should be aware that...

Read the full narrative on Munters Group (it's free!)

Munters Group's narrative projects SEK18.7 billion revenue and SEK1.5 billion earnings by 2028. This requires 4.6% yearly revenue growth and an earnings increase of SEK684 million from SEK816 million today.

Uncover how Munters Group's forecasts yield a SEK160.00 fair value, in line with its current price.

Exploring Other Perspectives

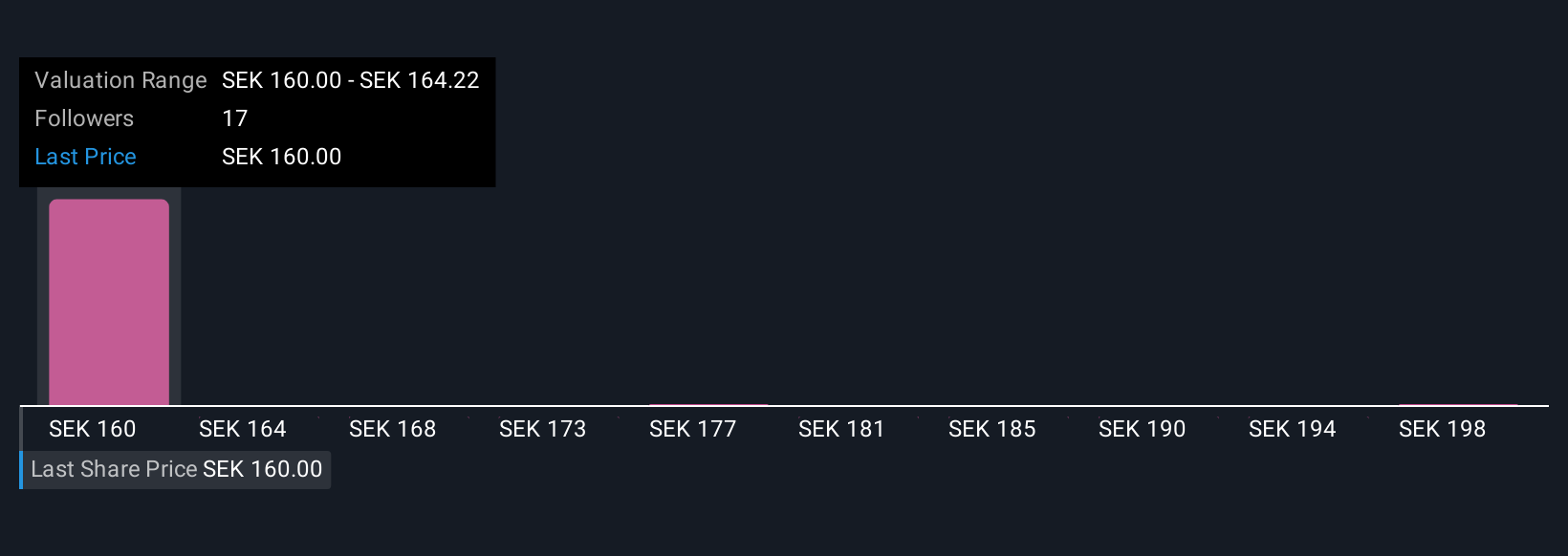

Four Simply Wall St Community fair value estimates for Munters Group range from SEK 160 to SEK 202.22, echoing broad differences in personal growth assumptions. These views often weigh catalysts like data center demand against persistent risks around earnings volatility, reminding you that forecasts and sentiment can vary widely.

Explore 4 other fair value estimates on Munters Group - why the stock might be worth just SEK160.00!

Build Your Own Munters Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Munters Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Munters Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Munters Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MTRS

Munters Group

Provides climate solutions in the Americas, Europe, the Middle East, Africa, and Asia.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives