Munters Group (OM:MTRS): Valuation Spotlight Following Record $215M US Data Center Contracts Announcement

Reviewed by Simply Wall St

Munters Group (OM:MTRS) shares jumped after the company announced its largest ever combined order. The company secured contracts worth about USD 215 million from a US hyperscaler for specialized cooling equipment that will be delivered over the coming years.

See our latest analysis for Munters Group.

The huge data center order has given Munters Group a real shot of momentum, capping off a dramatic 48% share price rebound over the last month. While the one-year total shareholder return remains mildly negative, Munters’ three- and five-year total returns, up 96% and 135%, tell the story of a company that’s delivered handsomely for patient investors and could be regaining its stride.

If this surge in demand for data center solutions has you wondering what else might be breaking out, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

This raises a pivotal question for investors. With Munters’ shares bouncing back and growth expectations riding high, is there still value left to capture or has the market already priced in all the upside?

Most Popular Narrative: 9.6% Undervalued

Munters Group’s widely followed narrative assigns a fair value that is notably higher than its recent close, pointing to latent upside according to prevailing projections. With strong price momentum and robust order activity, analysts are emphasizing strategic strengths that go beyond recent share performance.

Acceleration in demand for data centers and cloud infrastructure, as shown by record order intake and backlog in Data Center Technologies (DCT) and ongoing expansion of manufacturing capacity in the Americas, positions Munters to benefit from structural growth in digitalization, supporting sustained top-line (revenue) and margin expansion.

Curious why analysts are so bullish? This narrative is grounded in bold revenue and margin forecasts, plus a pricing multiple that implies confidence normally reserved for top-tier innovators. Wondering what assumptions propel this value? See what’s shaping the narrative’s profit outlook and market expectations beneath the surface.

Result: Fair Value of $185 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in battery markets or intensifying competition could put Munters’ rosy outlook and revenue growth path at risk, despite recent momentum.

Find out about the key risks to this Munters Group narrative.

Another View: Are the Multiples Sending a Warning?

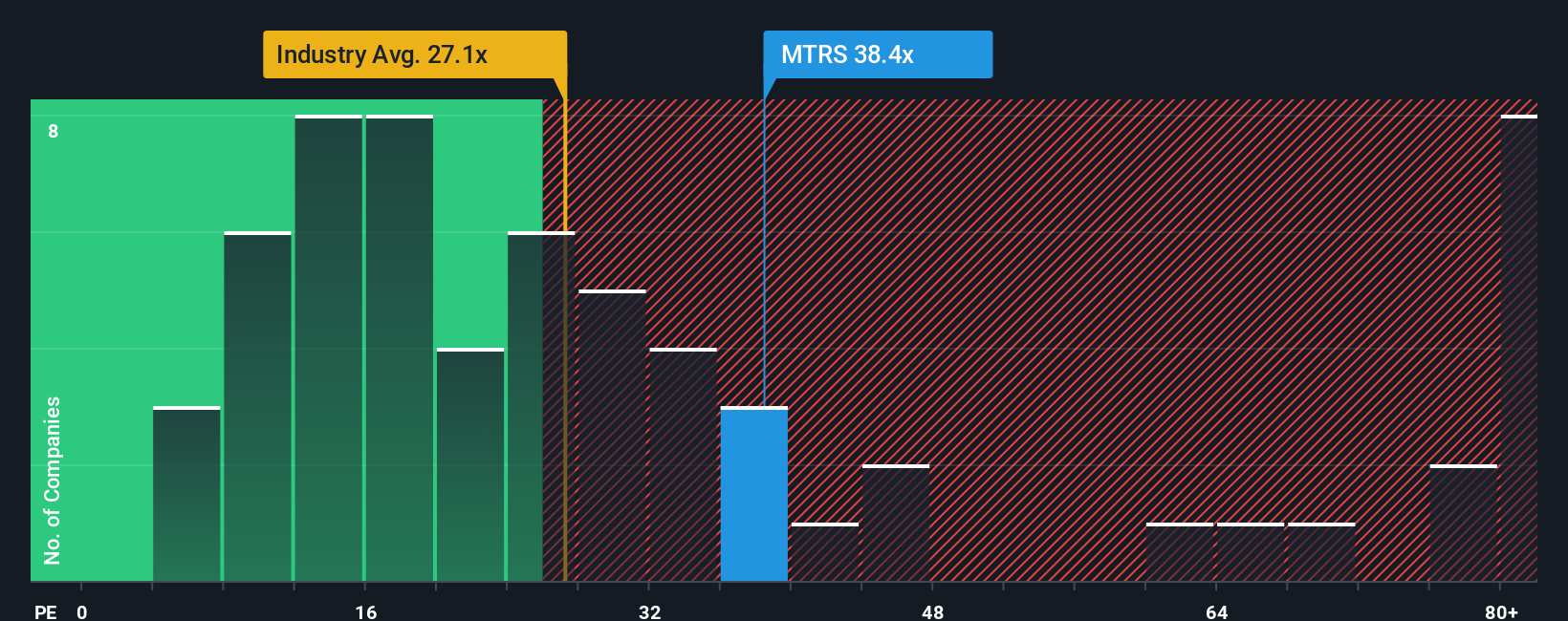

Looking beyond analyst forecasts, Munters Group trades at a price-to-earnings ratio of 39x. This is well above the European Building industry’s average of 26.7x and the peer average of 24.6x. While the market’s optimism is clear, the gap suggests investors may be taking on more valuation risk if expectations slip. The fair ratio sits higher at 46.2x, but can the company’s growth justify its lofty premium in practice?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Munters Group Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own investment story in just a few minutes. Do it your way

A great starting point for your Munters Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Serious investors don’t just stop at one breakthrough. Expand your opportunity set with tailored stock picks that could help you get ahead of the crowd.

- Uncover leading innovators in medical tech and AI by starting with these 31 healthcare AI stocks. This puts powerful trends in healthcare at your fingertips.

- Maximize value potential by zeroing in on hidden gems using these 868 undervalued stocks based on cash flows to spot companies trading below their intrinsic worth.

- Grow your income stream and strengthen your portfolio by tapping into these 15 dividend stocks with yields > 3% featuring stocks with standout yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MTRS

Munters Group

Provides climate solutions in the Americas, Europe, the Middle East, Africa, and Asia.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives