Munters Group (OM:MTRS) Valuation After Securing Major US Data Center Chiller Order

Reviewed by Simply Wall St

Munters Group (OM:MTRS) just landed a sizeable order from a new US colocation data center customer, securing demand for its Geoclima Circlemiser chillers and services through early 2027.

See our latest analysis for Munters Group.

That backdrop helps explain why, even with a recent pullback that left the share price at SEK 170.4 after a strong 90 day share price return of 28.7 percent, longer term total shareholder returns of 67.2 percent over three years and 116.7 percent over five years still point to durable momentum rather than a fading story.

If this kind of data center driven growth theme interests you, it could be worth exploring high growth tech and AI stocks to see which other names are starting to attract similar attention from investors.

With revenue and earnings still growing solidly and the shares trading at a modest discount to analyst targets, is Munters Group quietly undervalued today, or is the market already pricing in years of data center led expansion?

Most Popular Narrative: 9.4% Undervalued

With Munters Group last closing at SEK 170.4 against a narrative fair value of SEK 188, the current price reflects only part of the growth story, not the full trajectory implied by the long term forecasts.

Analysts are assuming Munters Group's revenue will grow by 4.6% annually over the next 3 years.

Analysts assume that profit margins will increase from 5.0% today to 8.0% in 3 years time.

Want to see how steady top line gains, expanding margins and a richer earnings mix combine into that fair value call, and what long term multiple these assumptions quietly rely on, even after applying a meaningful discount rate to future profits?

Result: Fair Value of $188 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated leverage and potential slowdowns in AI or battery demand mean that any hiccup in orders could quickly challenge today’s upbeat growth assumptions.

Find out about the key risks to this Munters Group narrative.

Another Angle on Valuation

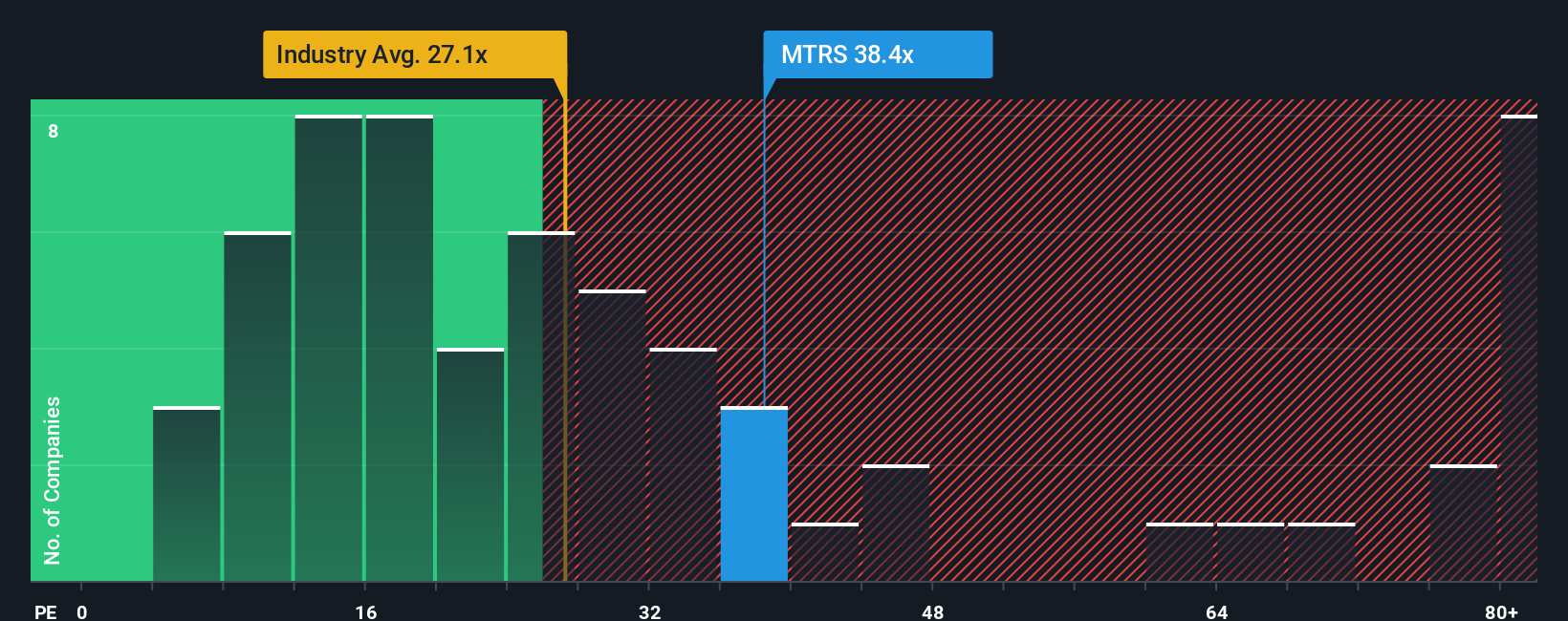

On earnings, Munters trades on a rich 39.7x ratio, well above the European Building industry at 23.5x and peers at 24.2x. Our fair ratio of 45.8x suggests there may still be some headroom. Is this a quality premium, or a narrow margin for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Munters Group Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view in under three minutes using Do it your way.

A great starting point for your Munters Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Use the Simply Wall Street Screener now to uncover fresh opportunities beyond Munters, so you never look back wishing you had acted sooner.

- Capture early momentum by scanning these 3632 penny stocks with strong financials that already show resilient financials instead of fragile hype.

- Position yourself for the next wave of innovation by checking these 24 AI penny stocks that link real revenue growth to artificial intelligence tailwinds.

- Lock in potential value upside by targeting these 910 undervalued stocks based on cash flows where strong cash flows are not yet fully reflected in market prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MTRS

Munters Group

Provides climate solutions in the Americas, Europe, the Middle East, Africa, and Asia.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion