- Sweden

- /

- Aerospace & Defense

- /

- OM:MILDEF

Investors Appear Satisfied With MilDef Group AB (publ)'s (STO:MILDEF) Prospects As Shares Rocket 27%

Despite an already strong run, MilDef Group AB (publ) (STO:MILDEF) shares have been powering on, with a gain of 27% in the last thirty days. This latest share price bounce rounds out a remarkable 319% gain over the last twelve months.

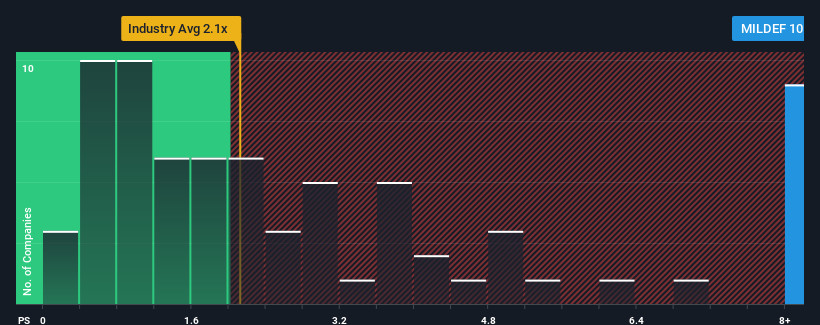

Since its price has surged higher, MilDef Group may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 10.4x, since almost half of all companies in the Aerospace & Defense industry in Sweden have P/S ratios under 6.8x and even P/S lower than 3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Our free stock report includes 3 warning signs investors should be aware of before investing in MilDef Group. Read for free now.Check out our latest analysis for MilDef Group

What Does MilDef Group's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, MilDef Group has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think MilDef Group's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, MilDef Group would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 4.3% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 156% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 44% per year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 19% each year, which is noticeably less attractive.

With this in mind, it's not hard to understand why MilDef Group's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in MilDef Group have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of MilDef Group's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with MilDef Group, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on MilDef Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:MILDEF

MilDef Group

Develops, manufactures, and sells rugged IT solutions in Sweden, Norway, Finland, Denmark, the United Kingdom, Germany, Switzerland, the United States, Australia, and internationally.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives