Lindab International (OM:LIAB): Evaluating Valuation After Q3 Profit Surge and Acquisition Momentum

Reviewed by Simply Wall St

Lindab International (OM:LIAB) just released its third quarter and nine-month results. The company reported a considerable jump in net income and earnings per share, even though sales dipped slightly year-over-year. The results highlight improving profitability and strong operational momentum.

See our latest analysis for Lindab International.

Lindab International’s momentum is picking up, with its share price rebounding 15.5% over the past month after a muted start to the year. While recent earnings and the completed Ventia acquisition have stirred interest, the stock’s 1-year total return of 4.7% is modest compared to its impressive 111% total return over three years. This suggests long-term shareholders have been well rewarded as the business has executed on growth and capital allocation strategies.

If the company’s expanding acquisition pipeline caught your attention, consider broadening your search and see what else is out there with fast growing stocks with high insider ownership

With shares rallying recently and profitability hitting new highs, the key question for investors is whether Lindab International is undervalued at current levels, or if the market already reflects its growth prospects. Could there still be a buying opportunity?

Most Popular Narrative: 2.7% Undervalued

With Lindab International’s narrative fair value set at SEK234 and the last closing price at SEK227.6, the consensus view implies modest upside. The market appears to be catching up with forecasts built around growth in green building trends and key European acquisitions.

Stricter energy efficiency and indoor air quality regulations across Europe are anticipated to boost adoption of advanced ventilation systems, directly increasing demand for Lindab's higher-margin products and positively impacting future earnings. Recent acquisitions in core European ventilation markets (Poland and U.K.) expand Lindab's presence and scale, improving operational leverage and setting the stage for both organic and inorganic revenue growth as market activity recovers.

Want to see which bold projections are driving analyst optimism? The foundation of this valuation involves earnings leaps and a future profit multiple that rivals much bigger players. What is the real story behind this seemingly modest premium? Unlock the figures pushing this fair value up.

Result: Fair Value of SEK234 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in construction demand or further negative currency movements could challenge Lindab International's earnings outlook and limit share price upside.

Find out about the key risks to this Lindab International narrative.

Another View: Market Multiples Point to Lofty Valuation

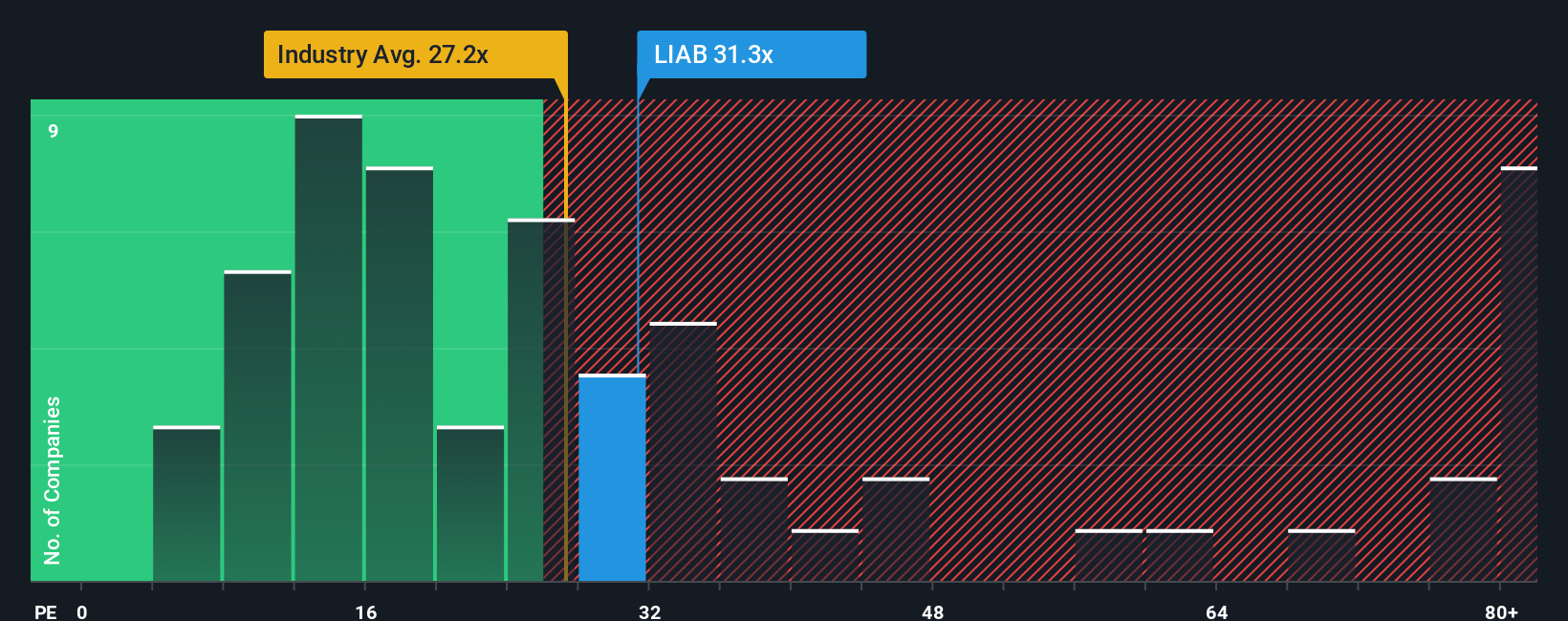

While fair value models suggest Lindab International is undervalued, market price-to-earnings tells a different story. The shares trade at 32.1 times earnings, noticeably higher than both the European building industry at 27.3 times and a fair ratio of 29.4. This means investors are paying a premium, which raises the risk that the stock’s price could move closer to average if expectations slip. Which perspective is right for the near term?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lindab International Narrative

If you’d rather examine the numbers and look beyond the consensus, you can shape your own view of Lindab International in just a few minutes with Do it your way

A great starting point for your Lindab International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Level up your investing toolkit by hunting for standout opportunities you might otherwise overlook. These unique investment spaces are buzzing right now. See what you could be missing out on:

- Grow your portfolio’s passive income stream by tapping into these 22 dividend stocks with yields > 3% offering yields above 3% and proven financial stability.

- Ride the wave of artificial intelligence breakthroughs as you evaluate leading-edge opportunities among these 26 AI penny stocks poised for rapid growth.

- Seize attractive value opportunities by analyzing these 835 undervalued stocks based on cash flows that the market may be overlooking based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LIAB

Lindab International

Manufactures and sells products and solutions for ventilation systems in Sweden, Denmark, Germany, France, the United Kingdom, Norway, Ireland, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives