- Sweden

- /

- Industrials

- /

- OM:KARNEL B

Karnell Group (OM:KARNEL B) Profit Margin Surges, Reinforcing Bullish Sentiment This Earnings Season

Reviewed by Simply Wall St

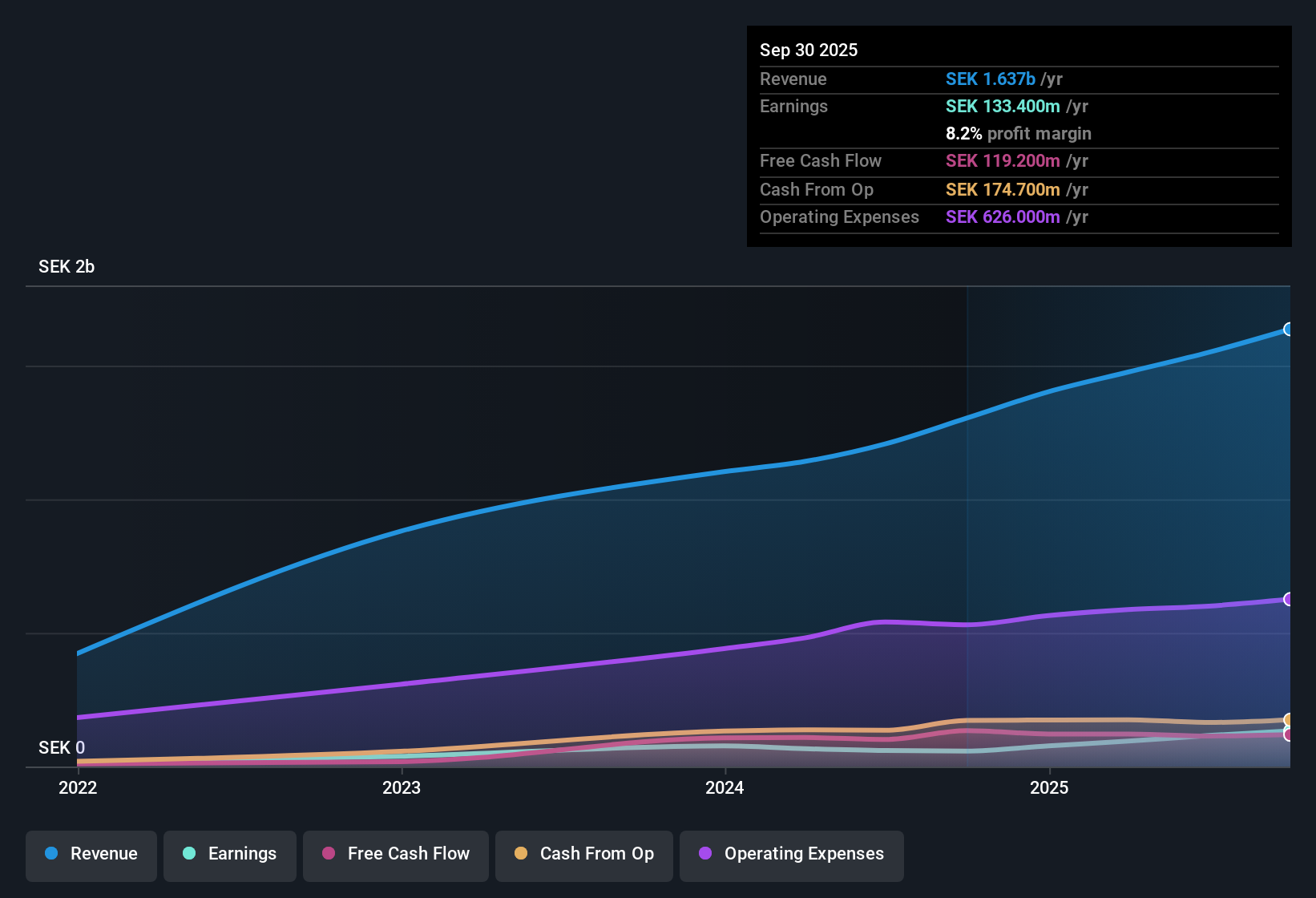

Karnell Group (OM:KARNEL B) posted a net profit margin of 8.2%, up sharply from last year’s 4.5%. The company’s earnings have climbed at an average rate of 36.9% per year over the past five years, with a recent standout growth of 129.6% in the latest period. This surge in profit growth and enhanced margins, coupled with high quality earnings, puts Karnell Group in the spotlight this earnings season as investors weigh how sustainable these trends might be.

See our full analysis for Karnell Group.Next, we’ll see how these headline numbers measure up against the narratives widely discussed in the market. There may be surprises, or some consensus may be reinforced.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Expansion Raises the Bar

- Karnell Group’s profit margin jumped from 4.5% to 8.2% year-on-year, meaning the company is now converting a much larger share of revenue into profit than before.

- The prevailing analysis argues that while such a leap in margin attracts attention, sustaining this pace depends on continued operational efficiency and sector demand.

- On one hand, a margin far above last year’s level signals better cost management or higher-value contracts.

- At the same time, typical margins in the industrials sector fluctuate, so future profit rates may not always mirror this jump.

Five-Year Earnings Growth Outpaces Sector Peers

- Annual earnings growth averaged an impressive 36.9% over the past five years, peaking at 129.6% most recently. This is well above typical industry growth rates.

- The current view highlights that such rapid, high-quality earnings growth strengthens the appeal for growth-minded investors.

- Consistent multi-year expansion stands out, especially against industrial sector averages that are often much lower.

- However, when growth far exceeds long-term averages as in the latest year, investors may scrutinize whether these results can be repeated.

Valuation Premium: Share Price vs. DCF Fair Value

- Karnell’s share price at SEK71 currently trades above its DCF fair value of SEK50.68 and reflects a P/E ratio of 28.2, higher than the sector average of 21.4 but below the direct peer average of 38.8.

- This gap encourages debate over whether the company’s premium price is justified by momentum or signals caution for new buyers.

- The company’s value may appear steep based on broad sector metrics, yet it offers relative appeal versus immediate competitors with even higher valuations.

- Bulls may point to recent earnings strength and margin improvement as reasons to accept a higher valuation, but skeptics will focus on the share price gap with fair value.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Karnell Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Karnell’s elevated share price, now well above its fair value, raises questions about whether future returns can continue outpacing industry averages.

If overpaying is not for you, check out these 836 undervalued stocks based on cash flows to uncover stocks trading at more appealing prices with better value potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karnell Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:KARNEL B

Karnell Group

A private equity firm specializing investments in add-on acquisitions, expansion and small and medium-sized companies.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives