- Sweden

- /

- Aerospace & Defense

- /

- OM:IVSO

A Fresh Look at Invisio (OM:IVSO) Valuation After Q3 Earnings Disappoint

Reviewed by Simply Wall St

Invisio (OM:IVSO) released its third quarter earnings, showing both a drop in sales and a shift from last year’s profit to a net loss. This is a key update for investors tracking the stock’s performance.

See our latest analysis for Invisio.

After the earnings miss, Invisio’s share price took a notable hit over the past week. However, the year-to-date share price return still stands at a healthy 13%. Looking at a longer period, patient investors have enjoyed an impressive 3-year total shareholder return of 95%, highlighting strong long-term momentum even as recent trading has turned volatile.

If Invisio’s rollercoaster has piqued your interest, now’s a smart time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With Invisio’s shares still trading below analyst price targets and carrying a notable intrinsic discount, the big question is whether investors are overlooking future growth or if the current price already reflects all that potential.

Most Popular Narrative: 13.8% Undervalued

Invisio's most popular narrative places its fair value notably above the current share price, suggesting potential upside if the projections hold. The market is digesting new earnings expectations and just-revised financial forecasts, making this narrative particularly timely.

Ongoing soldier modernization and digitization programs are fueling demand for integrated communication and hearing protection systems. Invisio's rapid pace of product innovation (for example, the X7 in-ear headset, Intercom Link, and recent UltraLYNX acquisition) positions the company to capture a larger share of upcoming multi-year upgrade cycles, supporting future revenue expansion and margin stability.

Curious what big financial bets analysts are banking on for that fair value target? It’s all about bold growth assumptions and soaring margins. These are numbers you wouldn’t expect for a defense electronics supplier. Want to see the ambitious scenario behind the optimism? Dive in and uncover the core levers powering this narrative’s upside.

Result: Fair Value of $351.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Invisio’s growth story faces two ongoing risks: unpredictable order timing and rising competition. Both factors could challenge the upbeat narrative.

Find out about the key risks to this Invisio narrative.

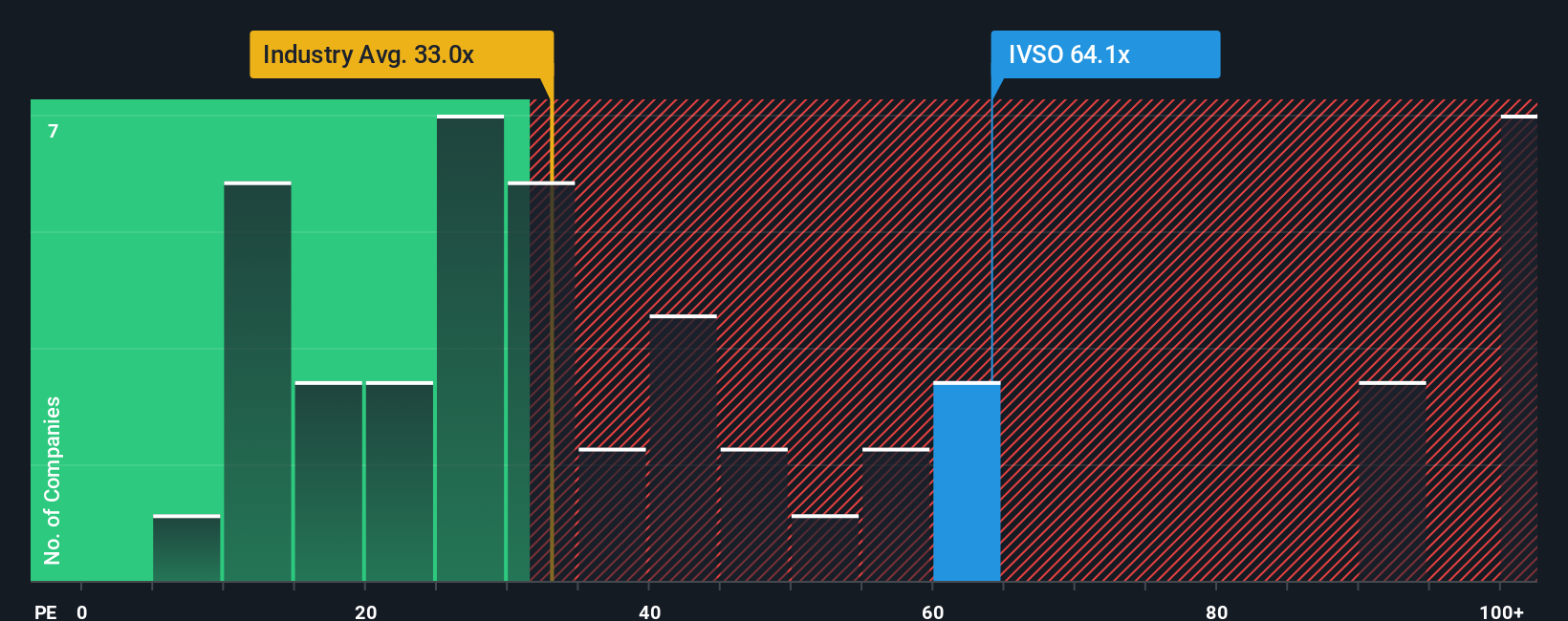

Another View: Market Multiples Raise Caution

While the popular narrative leans on future growth, looking at valuation multiples tells a more sobering story. Invisio trades at a price-to-earnings ratio of 66.7x, which stands well above the European industry average of 34.5x and even its own fair ratio of 47x. This suggests investors are paying a hefty premium, so is the market already betting on best-case growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Invisio Narrative

If you want a different perspective or simply enjoy digging through the numbers yourself, it's easy to assemble your own thesis in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Invisio.

Looking for more investment ideas?

Handpick your next opportunity from a world of smart investment angles. The right screener can help you uncover winners that most investors overlook. Don’t miss your chance to stay ahead of the curve.

- Spot fresh value opportunities by checking out these 839 undervalued stocks based on cash flows where cash flow potential could translate into real portfolio gains.

- Capture growth trends as artificial intelligence transforms industries with these 26 AI penny stocks and see which companies are at the forefront of this revolution.

- Grow your yield with confidence by scanning these 22 dividend stocks with yields > 3% featuring stocks offering attractive returns above the market average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:IVSO

Invisio

Develops and sells communication and hearing protection systems for professionals in the defense, law enforcement, and security sectors in Sweden, the United Kingdom, Denmark, rest of Europe, the United States, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives