Stock Analysis

Swedish Exchange Stocks That Could Be Priced Below Their Estimated Worth In July 2024

Reviewed by Simply Wall St

As Sweden's market navigates through a period of economic recalibration, with neighboring European indices reflecting a mix of cautious optimism and underlying concerns, investors might find potential in stocks that appear undervalued. Understanding which stocks are priced below their estimated worth could offer attractive opportunities, especially in a landscape where discerning value is paramount amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Björn Borg (OM:BORG) | SEK55.60 | SEK104.56 | 46.8% |

| Paradox Interactive (OM:PDX) | SEK138.00 | SEK252.73 | 45.4% |

| Biotage (OM:BIOT) | SEK160.10 | SEK314.08 | 49% |

| Nordic Waterproofing Holding (OM:NWG) | SEK160.60 | SEK305.71 | 47.5% |

| Lindab International (OM:LIAB) | SEK228.60 | SEK422.44 | 45.9% |

| RaySearch Laboratories (OM:RAY B) | SEK143.40 | SEK281.40 | 49% |

| Stille (OM:STIL) | SEK215.00 | SEK391.26 | 45% |

| Flexion Mobile (OM:FLEXM) | SEK8.76 | SEK15.87 | 44.8% |

| Image Systems (OM:IS) | SEK1.44 | SEK2.81 | 48.8% |

| Nordisk Bergteknik (OM:NORB B) | SEK17.60 | SEK32.46 | 45.8% |

Underneath we present a selection of stocks filtered out by our screen

Addnode Group (OM:ANOD B)

Overview: Addnode Group AB provides software and services for design, construction, product data information, project collaboration, and facility management across Sweden, Nordic countries, the US, the UK, Germany, and other international markets with a market capitalization of approximately SEK 16.68 billion.

Operations: The company generates revenue through three primary segments: Design Management (SEK 4.70 billion), Product Lifecycle Management (SEK 1.91 billion), and Process Management, which includes Content Management (SEK 1.29 billion).

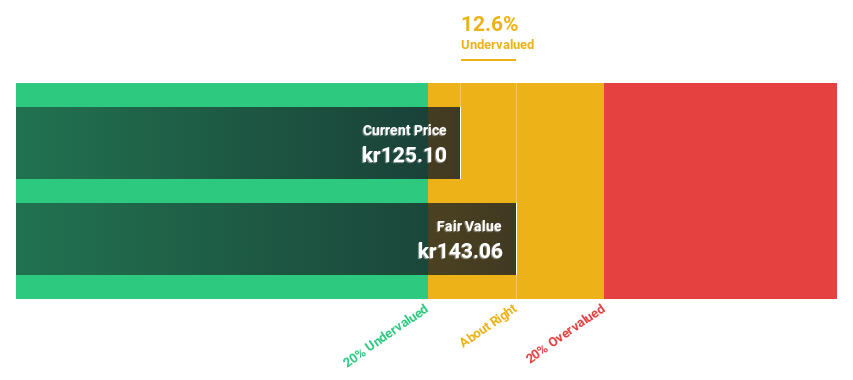

Estimated Discount To Fair Value: 10.9%

Addnode Group, priced at SEK 127.5, is trading 10.9% below our fair value estimate of SEK 143.07, indicating potential undervaluation based on discounted cash flow analysis. Despite a decrease in profit margins from last year (3.8% down from 5.5%), the company is expected to see robust earnings growth of 21.4% annually over the next three years, outpacing the Swedish market's forecast of 13.8%. Revenue growth projections also remain strong at an annual rate of 8.8%, significantly higher than the broader market's expectation of 1.7%.

- Our comprehensive growth report raises the possibility that Addnode Group is poised for substantial financial growth.

- Get an in-depth perspective on Addnode Group's balance sheet by reading our health report here.

Husqvarna (OM:HUSQ B)

Overview: Husqvarna AB, a company based in Sweden, specializes in manufacturing and distributing outdoor power products, watering products, and lawn care equipment, with a market capitalization of approximately SEK 49.51 billion.

Operations: The company's revenue is primarily derived from three segments: Gardena at SEK 13.06 billion, Husqvarna Construction at SEK 8.23 billion, and Husqvarna Forest & Garden at SEK 29.38 billion.

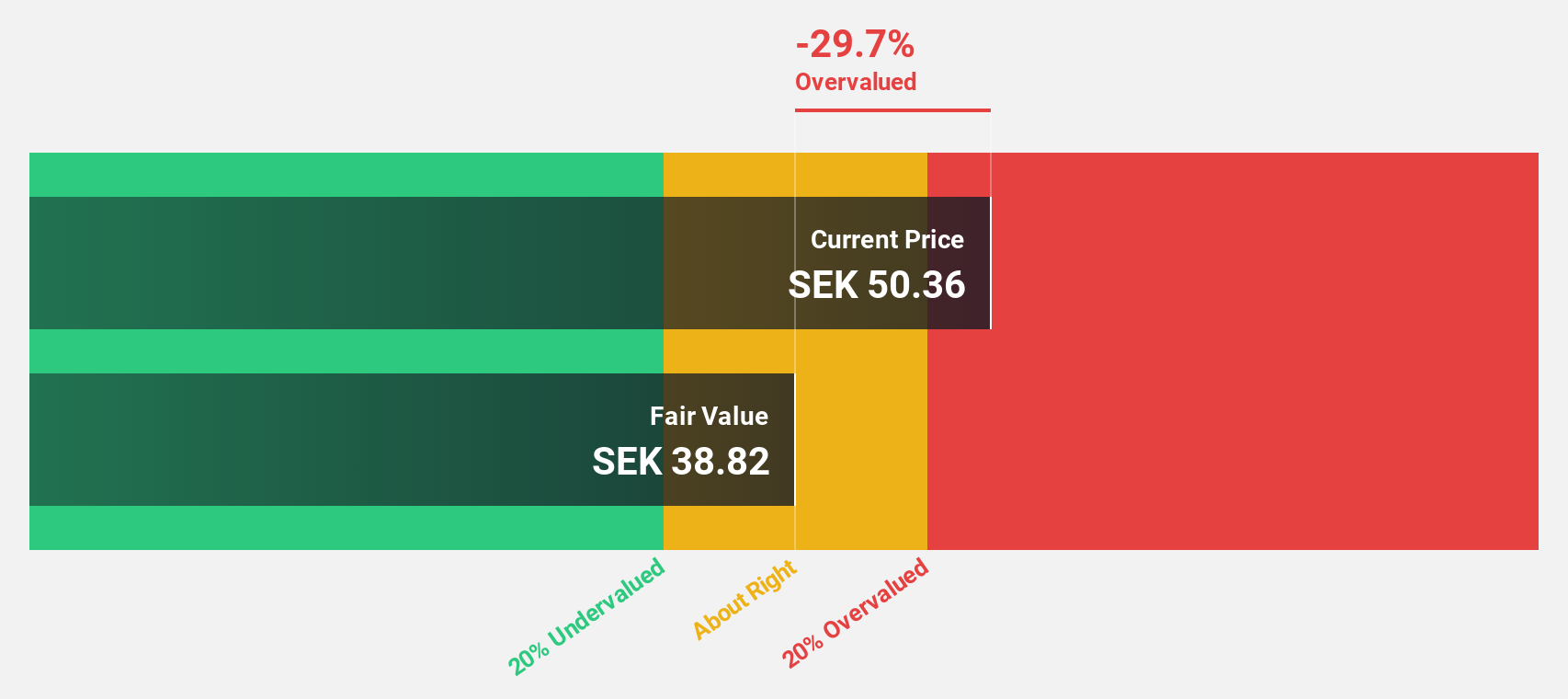

Estimated Discount To Fair Value: 39.3%

Husqvarna, with a current price of SEK 85.3, is identified as trading below its fair value estimate of SEK 140.58, reflecting a significant undervaluation based on discounted cash flow analysis. Despite recent executive changes and a dip in Q1 earnings to SEK 1,322 million from SEK 1,653 million year-over-year, the company's earnings are expected to grow by an impressive average of 24.69% annually over the next three years. However, its dividend coverage is weak and it carries a high level of debt.

- The growth report we've compiled suggests that Husqvarna's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Husqvarna's balance sheet health report.

Sweco (OM:SWEC B)

Overview: Sweco AB (publ), a global provider of architecture and engineering consultancy services, has a market capitalization of approximately SEK 53.47 billion.

Operations: Sweco's revenue is primarily generated through its operations in Sweden (SEK 8.52 billion), followed by Belgium (SEK 3.92 billion), Norway (SEK 3.39 billion), Finland (SEK 3.67 billion), Denmark (SEK 2.98 billion), the Netherlands (SEk 2.89 billion), and Germany & Central Europe (SEk 2.62 billion).

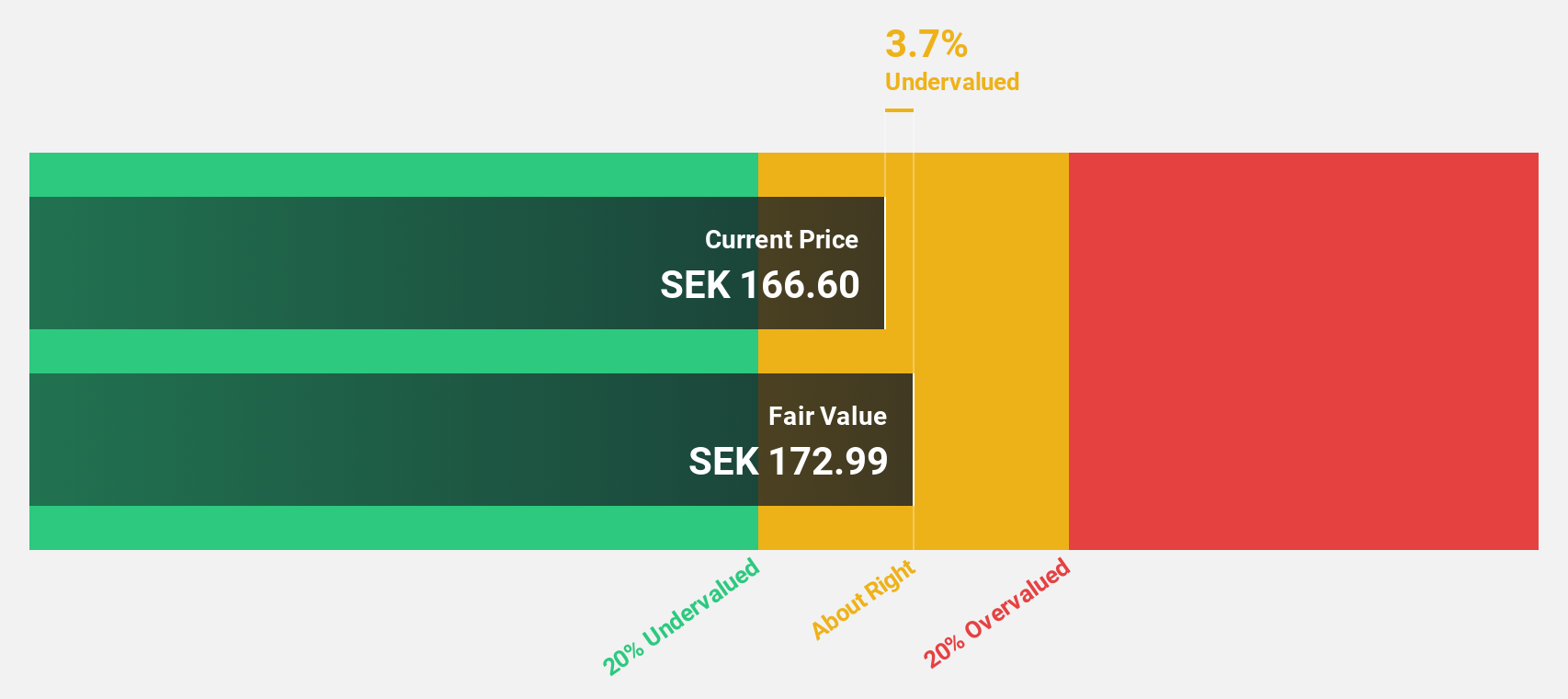

Estimated Discount To Fair Value: 30.9%

Sweco, priced at SEK 149.4, is evaluated as significantly undervalued with a fair value estimate of SEK 216.16 based on discounted cash flow analysis. Recent strategic alliances, such as the design partnership for VoltH2's new hydrogen plant in Delfzijl, underscore its robust engagement in large-scale infrastructure projects supporting sustainable energy solutions. Despite a slight dip in Q1 earnings to SEK 558 million from SEK 625 million year-over-year and an unstable dividend track record, Sweco is forecasted to experience revenue growth of 5.3% annually and earnings growth of 16.41% per year, outpacing the Swedish market's average.

- Insights from our recent growth report point to a promising forecast for Sweco's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Sweco.

Next Steps

- Investigate our full lineup of 44 Undervalued Swedish Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Addnode Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ANOD B

Addnode Group

Offers software and services for the design, construction, product data information, project collaboration, and facility management in Sweden, Nordic countries, the United States, the United Kingdom, Germany, and internationally.

High growth potential with excellent balance sheet.