Stock Analysis

- Sweden

- /

- Personal Products

- /

- OM:HUMBLE

H & M Hennes & Mauritz And 2 Other Swedish Stocks Considered Below Estimated Intrinsic Value

Reviewed by Simply Wall St

As European markets grapple with political uncertainty and fluctuating government yields, investors are keenly observing market dynamics for potential opportunities. In this context, exploring undervalued stocks like H & M Hennes & Mauritz in Sweden could offer interesting prospects, especially when considering intrinsic values that may not yet be fully recognized by the broader market.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Björn Borg (OM:BORG) | SEK54.60 | SEK101.88 | 46.4% |

| Boule Diagnostics (OM:BOUL) | SEK10.50 | SEK20.93 | 49.8% |

| Nordic Waterproofing Holding (OM:NWG) | SEK161.60 | SEK296.16 | 45.4% |

| RaySearch Laboratories (OM:RAY B) | SEK141.60 | SEK278.12 | 49.1% |

| Nolato (OM:NOLA B) | SEK59.75 | SEK114.72 | 47.9% |

| Net Insight (OM:NETI B) | SEK5.12 | SEK9.53 | 46.2% |

| MilDef Group (OM:MILDEF) | SEK68.20 | SEK132.74 | 48.6% |

| Humble Group (OM:HUMBLE) | SEK9.775 | SEK19.45 | 49.8% |

| Hexatronic Group (OM:HTRO) | SEK50.98 | SEK99.00 | 48.5% |

| Enea (OM:ENEA) | SEK75.10 | SEK147.75 | 49.2% |

Let's take a closer look at a couple of our picks from the screened companies

H & M Hennes & Mauritz (OM:HM B)

Overview: H & M Hennes & Mauritz AB operates globally, offering clothing, accessories, footwear, cosmetics, home textiles, and homeware for women, men, and children with a market cap of approximately SEK 303.35 billion.

Operations: The company generates SEK 234.83 billion in revenue from its apparel segment.

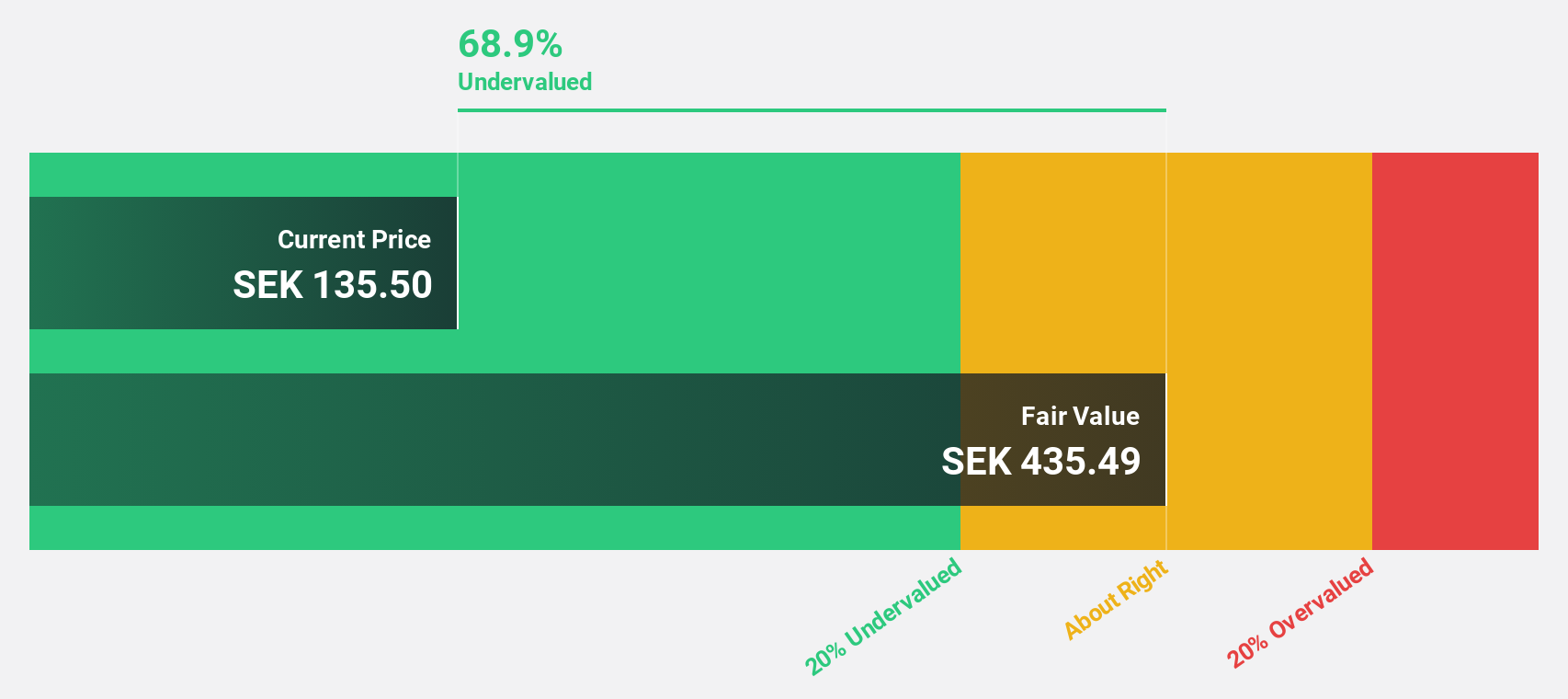

Estimated Discount To Fair Value: 36.7%

H & M Hennes & Mauritz AB, priced at SEK188.35, is considered undervalued with a fair value estimate of SEK297.75, reflecting a significant discount. The company's earnings are expected to grow by 16.9% annually, outpacing the Swedish market forecast of 14.1%. However, its dividend coverage is weak despite recent affirmations of a SEK6.50 per share annual payout. Notably, H&M's revenue growth projection stands at 3.6% yearly, above the national average of 1.9%. Recent elections and dividend affirmations underscore stability in governance and shareholder returns.

- Our expertly prepared growth report on H & M Hennes & Mauritz implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on H & M Hennes & Mauritz's balance sheet by reading our health report here.

Humble Group (OM:HUMBLE)

Overview: Humble Group AB, a company based in Sweden, refines, develops, and distributes fast-moving consumer goods both domestically and internationally, with a market capitalization of approximately SEK 4.34 billion.

Operations: The company's revenue is generated through four primary segments: Future Snacking (SEK 935 million), Sustainable Care (SEK 2.24 billion), Quality Nutrition (SEK 1.51 billion), and Nordic Distribution (SEK 2.62 billion).

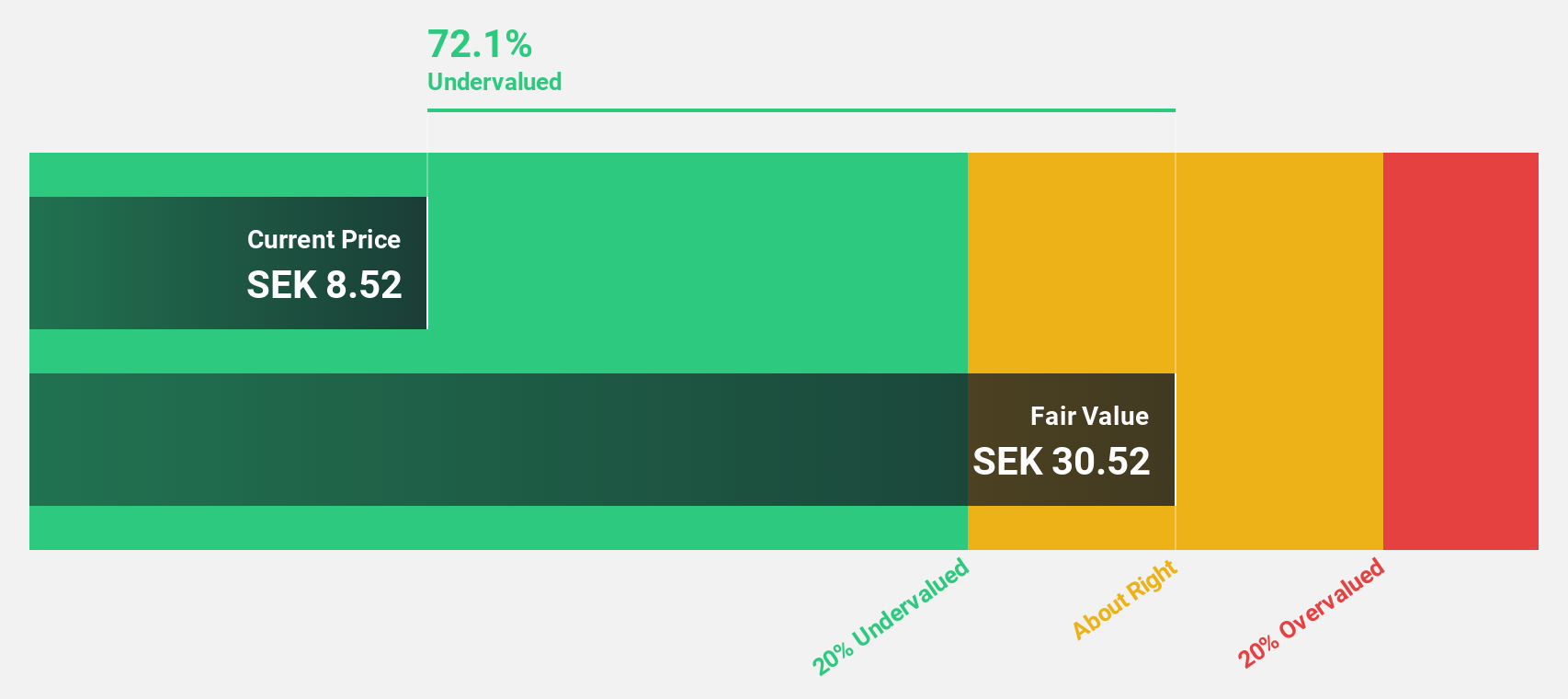

Estimated Discount To Fair Value: 49.8%

Humble Group, with a current price of SEK 9.78, is significantly undervalued based on DCF analysis, suggesting a fair value of SEK 19.45. The company's revenue growth is robust at 12% annually, surpassing the Swedish market average of 1.9%. Although recent earnings show improvement with a net income of SEK 23 million up from a loss last year, concerns include shareholder dilution and modest forecasted Return on Equity at 9.1%.

- The growth report we've compiled suggests that Humble Group's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Humble Group.

Husqvarna (OM:HUSQ B)

Overview: Husqvarna AB (publ) specializes in manufacturing and distributing outdoor power products, watering products, and lawn care equipment, with a market capitalization of approximately SEK 50.22 billion.

Operations: The company's revenue is segmented into Gardena at SEK 13.06 billion, Husqvarna Construction at SEK 8.23 billion, and Husqvarna Forest & Garden at SEK 29.38 billion.

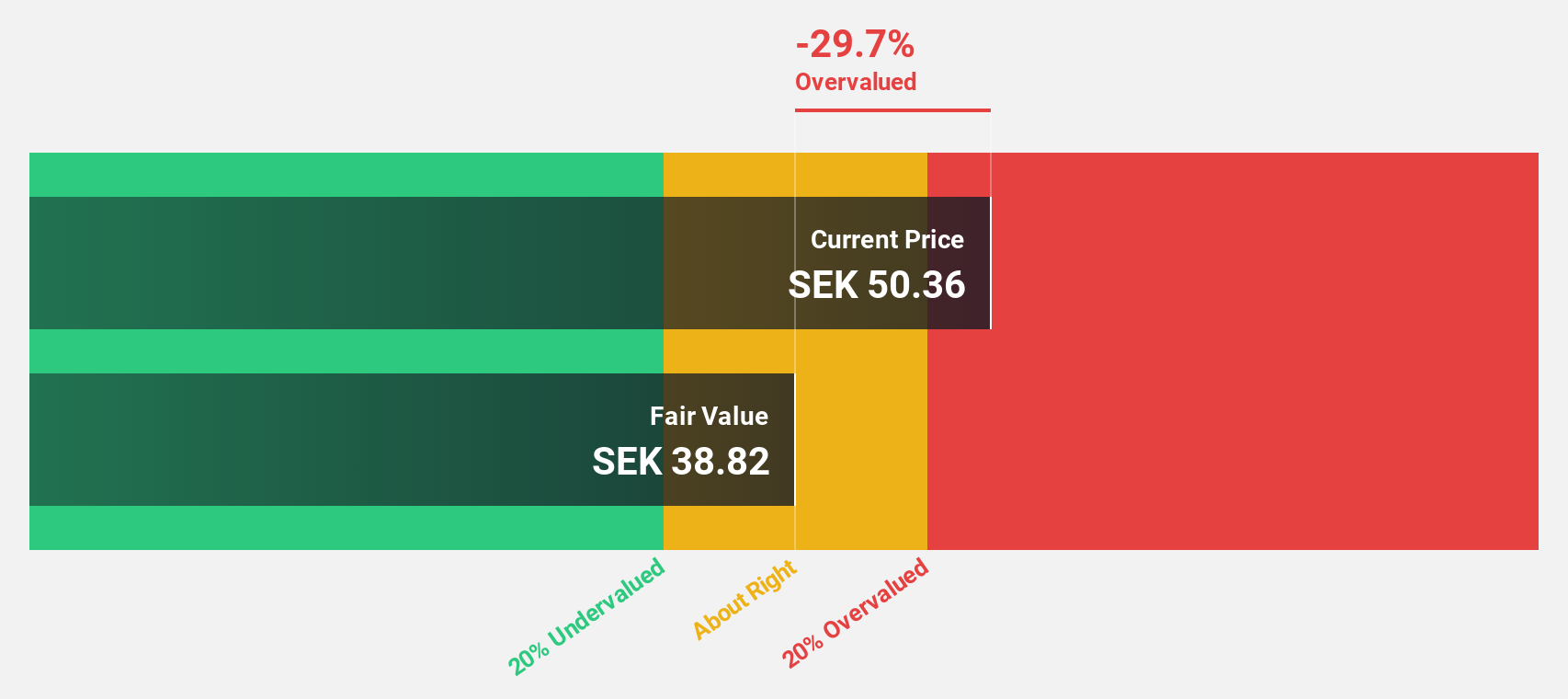

Estimated Discount To Fair Value: 36.9%

Husqvarna, priced at SEK87.96, is trading well below its calculated fair value of SEK139.46, indicating a significant undervaluation based on discounted cash flows. Despite this, the company's revenue growth projection of 3.4% per year slightly outpaces the Swedish market average but remains modest overall. Husqvarna faces challenges such as high debt levels and earnings that are not adequately covering dividends, with recent declines in quarterly sales and net income further complicating its financial outlook.

- Upon reviewing our latest growth report, Husqvarna's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Husqvarna with our detailed financial health report.

Make It Happen

- Click this link to deep-dive into the 47 companies within our Undervalued Swedish Stocks Based On Cash Flows screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Humble Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HUMBLE

Humble Group

Humble Group AB (publ) refines, develops, and distributes fast-moving consumer products in Sweden and internationally.

Undervalued with excellent balance sheet.