- Sweden

- /

- Electrical

- /

- OM:HTRO

Hexatronic Group (OM:HTRO) Margin Miss Challenges Bullish Narratives Despite Strong Long-Term Growth Forecast

Reviewed by Simply Wall St

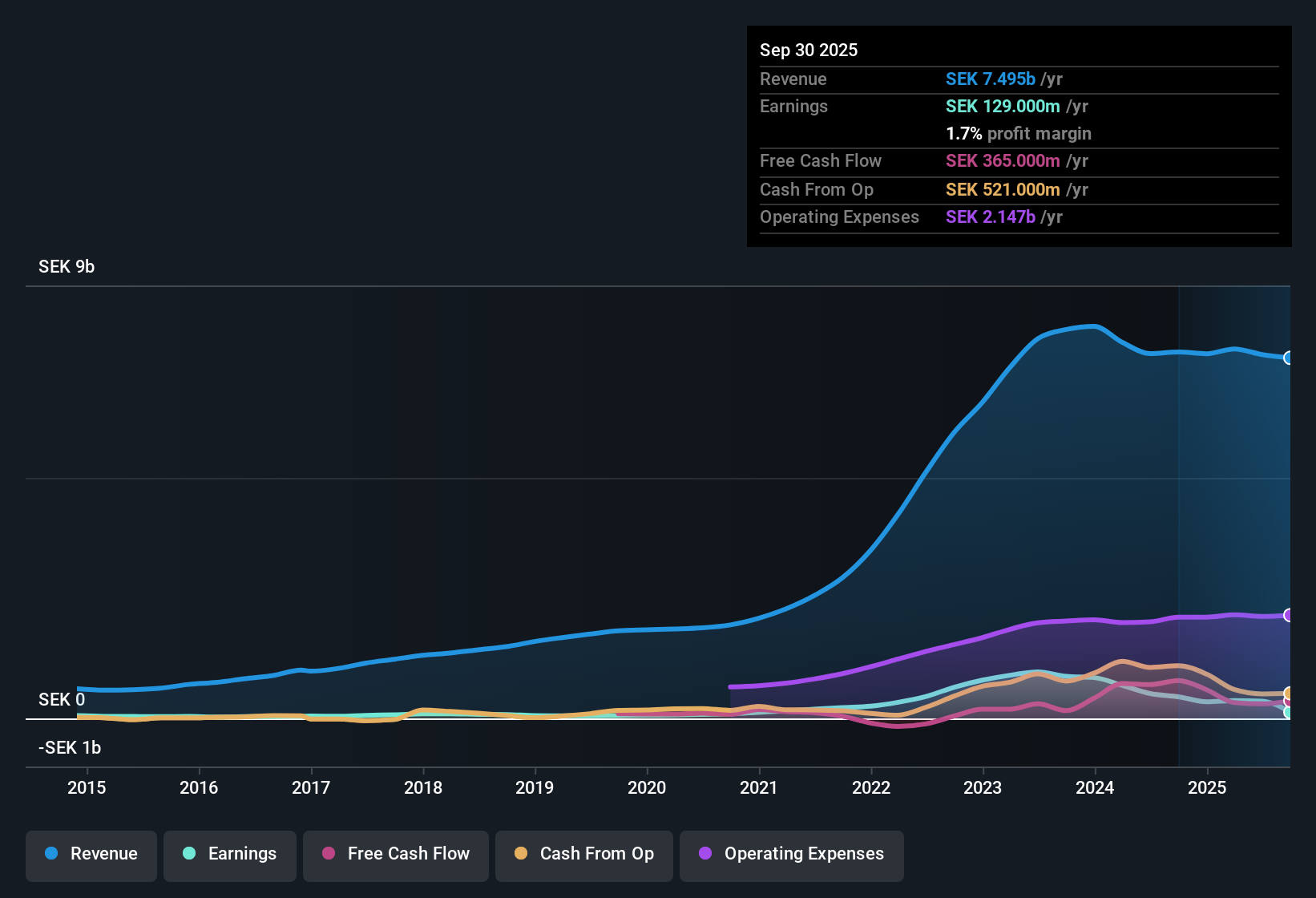

Hexatronic Group (OM:HTRO) is forecasting earnings growth of 17.8% per year, well ahead of the Swedish market average at 12.6%. Revenue is projected to grow 4.2% annually, edging out the local market’s 3.9%, but the company’s net profit margin slipped to 4.7% from 6.8% last year and recent earnings growth has turned negative. This follows a strong 18.3% annualized pace over the previous five years.

See our full analysis for Hexatronic Group.Next, let’s see how the latest results compare to the prevailing narratives around Hexatronic. Sometimes the numbers match the story, and other times they defy expectations.

See what the community is saying about Hexatronic Group

Tariffs, Freight, and Margins Collide

- Freight costs and tariff adjustments have created extra pressure, with the Fiber Solutions segment facing flat growth in Europe and persistent pricing pressure.

- What stands out in the analysts' consensus view is the push-pull between efforts to mitigate U.S. tariffs and the reality of only a 40 basis point boost in EBITA margin.

- Manufacturing fiber optic cable in the U.S. is supposed to improve margins, but increased costs and delays in U.S. infrastructure programs have blunted the positive impact so far.

- Consensus highlights that ongoing freight and inventory challenges could limit the effectiveness of these margin improvement strategies in the near term.

- Analysts’ consensus expects margins to rise from 4.7% today to 5.6% over three years, but cash flow disappointed this quarter due to higher receivables and increased inventory, signaling volatility beneath the surface.

Data Center and Cloud Upside

- The Data Center segment delivered record growth, with sales surging 41% and EBITA climbing 37%, fueled by demand in the rapidly expanding cloud market.

- According to analysts’ consensus, this surge offers material support for a bullish outlook on future earnings.

- The strong performance in Data Center is expected to meaningfully lift overall earnings as cloud-related demand continues to accelerate.

- Consensus underscores the importance of this business area as a long-term growth lever, especially with the potential for acquisitions to diversify and grow revenue streams.

Valuation: Discount to Peers, Margin to Industry

- Trading at SEK22.67, Hexatronic sits well below DCF fair value at 33.30 and below the analyst price target of 25.17, while its Price-To-Earnings ratio of 13.3x is a steep discount to the peer average of 36.2x and the broader industry’s 23.4x.

- The analysts’ consensus narrative points out that, for the share price to align with the price target, Hexatronic must grow earnings to SEK459.8 million by 2028 on a PE ratio of 14.5x, all while overcoming current margin pressure and cash flow volatility.

- With margins expected to improve only gradually, this leaves little room for error if growth or cost controls falter.

- Consensus notes that valuation is compelling versus peers, but execution risks tied to margin recovery are top of mind for investors.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hexatronic Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think there's another way to interpret the results? Craft your own take on Hexatronic’s story in just a few minutes: Do it your way

A great starting point for your Hexatronic Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite Hexatronic’s attractive valuation, margin pressure and volatile cash flow highlight the risk of inconsistent performance and execution uncertainty.

If you’re looking for companies with stronger, more predictable earnings trends, check out stable growth stocks screener (2099 results) that deliver consistency regardless of the market environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hexatronic Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HTRO

Hexatronic Group

Develops, manufactures, markets, and sells fiber communication solutions in Sweden, the United States, Germany, the United Kingdom, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives