- Sweden

- /

- Electrical

- /

- OM:HELIO

Need To Know: This Analyst Just Made A Substantial Cut To Their Heliospectra AB (publ) (STO:HELIO) Estimates

Today is shaping up negative for Heliospectra AB (publ) (STO:HELIO) shareholders, with the covering analyst delivering a substantial negative revision to this year's forecasts. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analyst has soured majorly on the business.

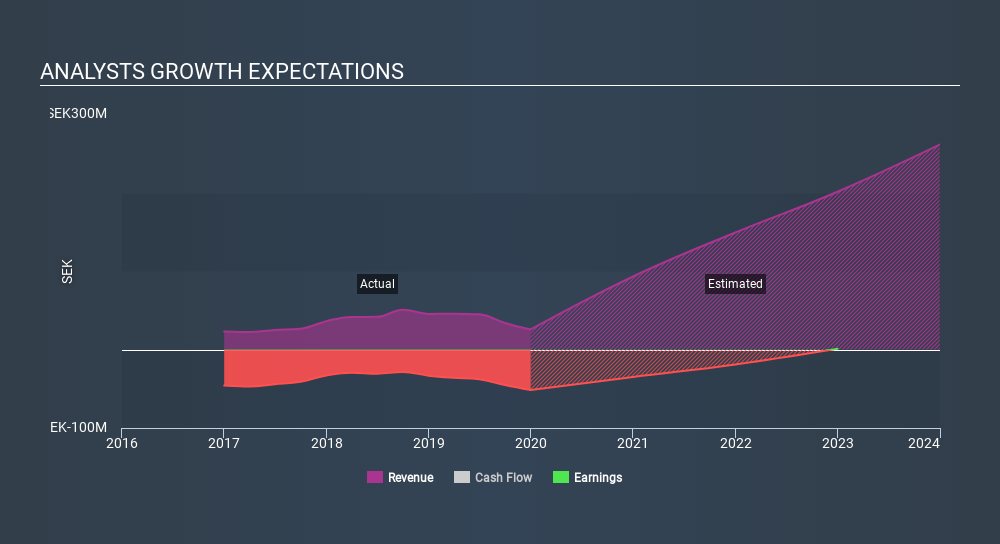

After this downgrade, Heliospectra's solo analyst is now forecasting revenues of kr93m in 2020. This would be a substantial 264% improvement in sales compared to the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 49% to kr0.62. Yet before this consensus update, the analyst had been forecasting revenues of kr115m and losses of kr0.56 per share in 2020. So there's been quite a change-up of views after the recent consensus updates, with the analyst making a serious cut to their revenue forecasts while also expecting losses per share to increase.

Check out our latest analysis for Heliospectra

Of course, another way to look at these forecasts is to place them into context against the industry itself. The analyst is definitely expecting Heliospectra's growth to accelerate, with the forecast 264% growth ranking favourably alongside historical growth of 32% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 28% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Heliospectra is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away is that the analyst increased their loss per share estimates for this year. While the analyst did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. After a cut like that, investors could be forgiven for thinking the analyst is a lot more bearish on Heliospectra, and a few readers might choose to steer clear of the stock.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2023, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OM:HELIO

Heliospectra

Provides smart LED light technology and light control systems for greenhouse and controlled plant growth environments worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives