- Sweden

- /

- Aerospace & Defense

- /

- OM:GOMX

Market Might Still Lack Some Conviction On GomSpace Group AB (publ) (STO:GOMX) Even After 45% Share Price Boost

GomSpace Group AB (publ) (STO:GOMX) shares have continued their recent momentum with a 45% gain in the last month alone. The annual gain comes to 134% following the latest surge, making investors sit up and take notice.

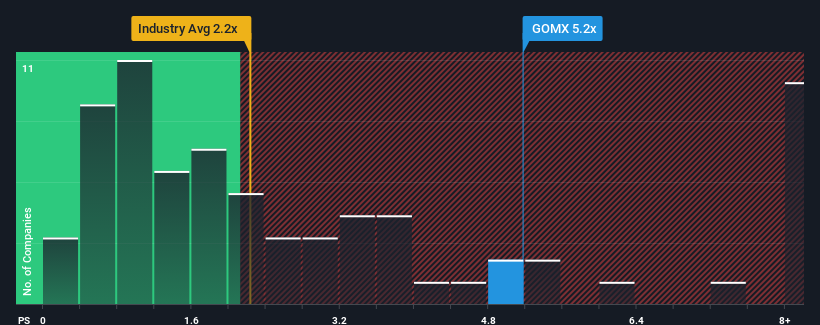

Even after such a large jump in price, it would still be understandable if you think GomSpace Group is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 5.2x, considering almost half the companies in Sweden's Aerospace & Defense industry have P/S ratios above 7x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for GomSpace Group

What Does GomSpace Group's P/S Mean For Shareholders?

Recent times haven't been great for GomSpace Group as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on GomSpace Group.Is There Any Revenue Growth Forecasted For GomSpace Group?

There's an inherent assumption that a company should underperform the industry for P/S ratios like GomSpace Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 8.1%. Revenue has also lifted 20% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 29% per annum during the coming three years according to the lone analyst following the company. With the industry only predicted to deliver 14% per annum, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that GomSpace Group's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does GomSpace Group's P/S Mean For Investors?

GomSpace Group's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at GomSpace Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 1 warning sign for GomSpace Group that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:GOMX

GomSpace Group

Through its subsidiaries, manufactures and sells nanosatellites and components, and turnkey solutions for satellites in Denmark, Sweden, France, rest of Europe, the United States, Asia, and internationally.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026