Stock Analysis

- Sweden

- /

- Metals and Mining

- /

- OM:SSAB A

FM Mattsson And Two More Top Dividend Stocks On The Swedish Exchange

Reviewed by Simply Wall St

As global markets navigate through a landscape marked by trade tensions and shifts in investment preferences, Sweden's economic stability and mature financial markets offer a compelling backdrop for investors considering dividend stocks. In this context, understanding the attributes of strong dividend-paying companies becomes crucial, especially during times when market volatility and economic indicators suggest a more cautious investment approach.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Betsson (OM:BETS B) | 6.21% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.73% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.87% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.35% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.96% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.25% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.32% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.88% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 3.91% | ★★★★☆☆ |

| SSAB (OM:SSAB A) | 8.85% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top Swedish Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

FM Mattsson (OM:FMM B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FM Mattsson AB (publ) specializes in developing, manufacturing, and selling water taps and related products for bathrooms and kitchens across Sweden, Norway, Denmark, Finland, Benelux, the UK, Germany, and Italy with a market capitalization of SEK 2.07 billion.

Operations: FM Mattsson AB generates SEK 1.12 billion from its operations in the Nordic countries and SEK 783.23 million internationally from the sale of water taps and related products.

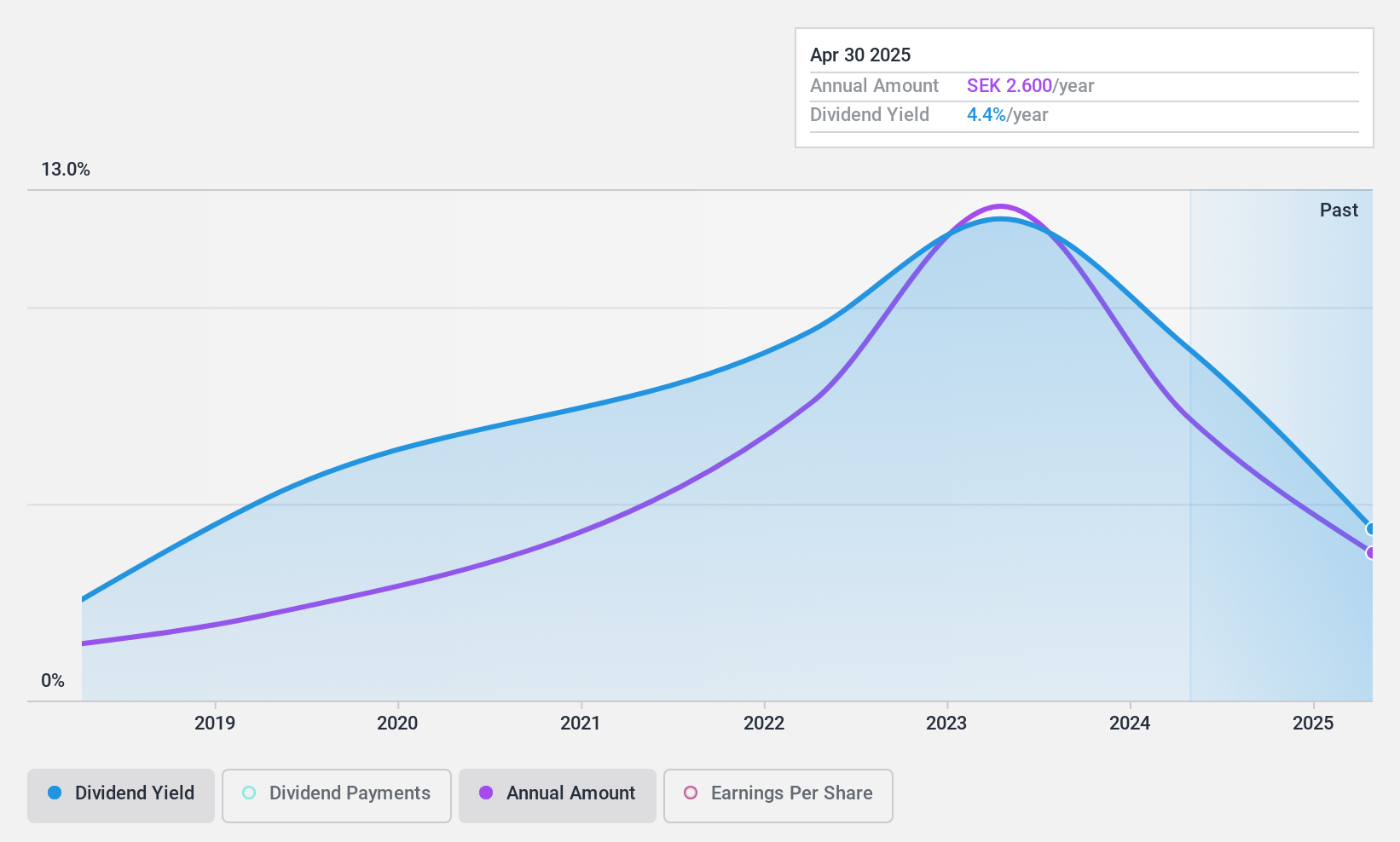

Dividend Yield: 5.1%

FM Mattsson, recently renamed, offers a dividend yield higher than the Swedish market average at 5.11%. Despite a short history of dividend payments—only six years—the dividends are well-supported by both earnings and cash flows, with payout ratios at 86.3% and 49.5%, respectively. However, recent financial results show a decline in net income and sales from the previous year, potentially challenging future dividend growth and sustainability amidst its valuation being significantly below estimated fair value.

- Click here to discover the nuances of FM Mattsson with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of FM Mattsson shares in the market.

Loomis (OM:LOOMIS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Loomis AB operates in providing comprehensive services for the handling, storage, recycling, and distribution of cash and other valuables, with a market capitalization of approximately SEK 22.29 billion.

Operations: Loomis AB generates most of its revenue from operations in Europe and Latin America, totaling SEK 14.32 billion, and the United States of America, with SEK 15.45 billion, alongside a smaller contribution from Loomis Pay at SEK 77 million.

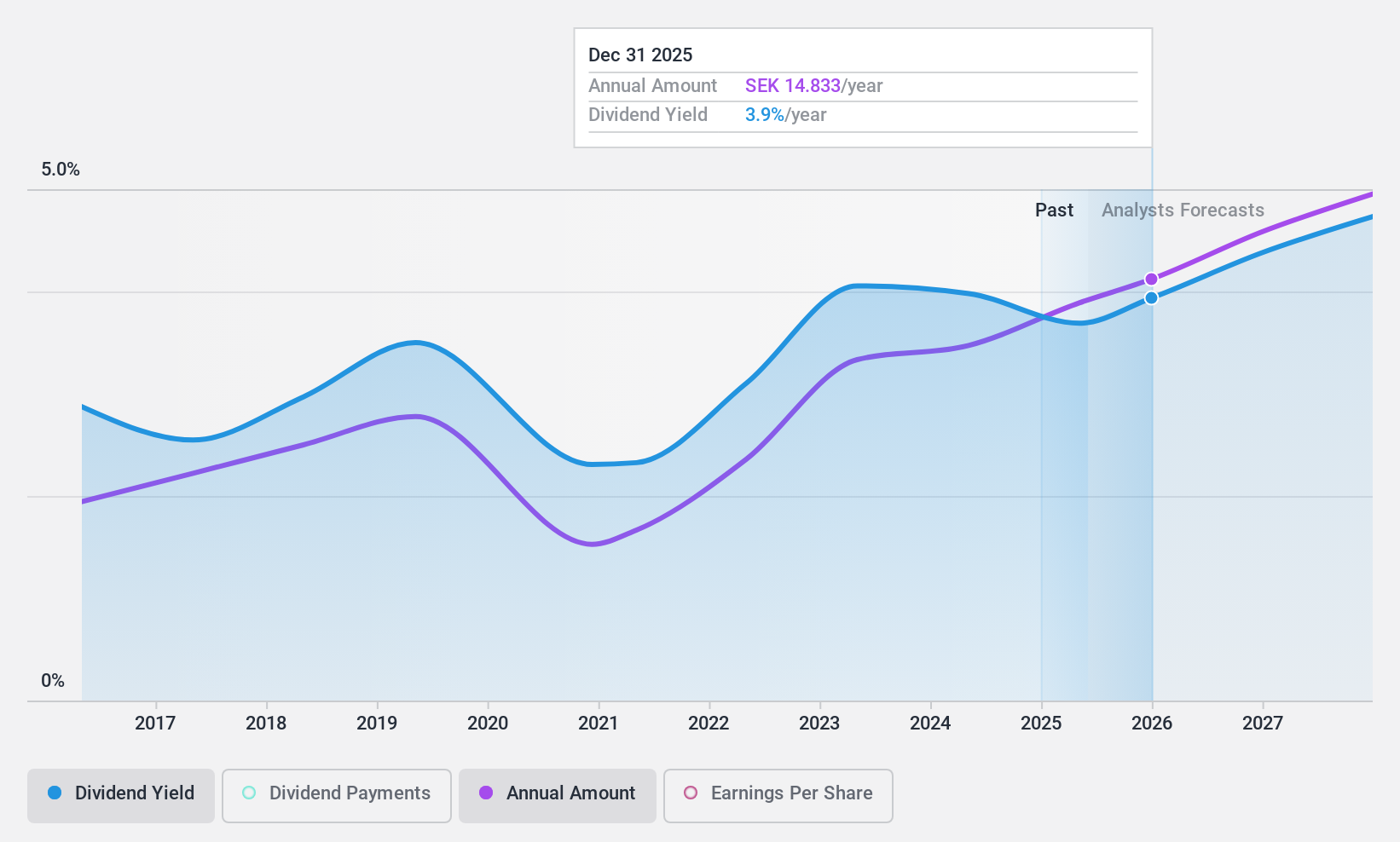

Dividend Yield: 3.9%

Loomis AB, despite a volatile dividend history, declared a SEK 12.50 per share dividend recently, reflecting a commitment to shareholder returns. The company's dividends are sustainably covered by earnings and cash flows with payout ratios of 59.4% and 26.3%, respectively. Recent financials show growth in sales and net income for the first half of 2024, supporting these payments. However, its dividend yield of 3.91% trails behind the top quartile of Swedish dividend stocks at 4.12%.

- Get an in-depth perspective on Loomis' performance by reading our dividend report here.

- Our valuation report unveils the possibility Loomis' shares may be trading at a discount.

SSAB (OM:SSAB A)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SSAB AB (publ) is a global steel producer with operations in Sweden, Finland, Europe, and the United States, boasting a market capitalization of approximately SEK 55.40 billion.

Operations: SSAB AB's revenue is generated through various segments, with SSAB Europe contributing SEK 43.44 billion, SSAB Americas SEK 26.81 billion, SSAB Special Steels SEK 30.49 billion, Tibnor SEK 12.50 billion, and Ruukki Construction SEK 5.41 billion.

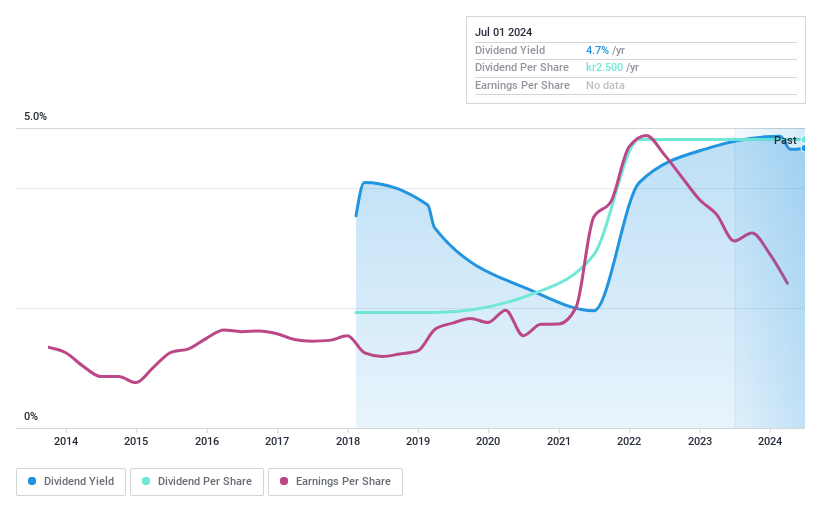

Dividend Yield: 8.8%

SSAB's recent financial performance indicates a downturn, with sales and net income dropping in the first half of 2024 compared to the previous year. Despite this, SSAB maintains a low cash payout ratio of 49.5%, ensuring dividends are well-covered by cash flows. The company's dividend history is short and somewhat volatile, having only initiated payments six years ago. Additionally, earnings are expected to decline over the next three years. However, SSAB trades at a favorable price-to-earnings ratio of 5.4x compared to its Swedish peers and has committed to environmental sustainability through projects like its collaboration with Loimua for district heating and Nordec for fossil-free steel deliveries.

- Take a closer look at SSAB's potential here in our dividend report.

- The analysis detailed in our SSAB valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Reveal the 20 hidden gems among our Top Swedish Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SSAB A

SSAB

Produces and sells steel products in Sweden, Finland, Rest of Europe, the United States, and internationally.

Flawless balance sheet average dividend payer.