Stock Analysis

- Sweden

- /

- Healthtech

- /

- OM:SECT B

Swedish Exchange Growth Companies With High Insider Ownership And 22% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate through a landscape marked by trade tensions and shifts in investment preferences, the Swedish stock market presents unique opportunities, particularly among growth companies with high insider ownership. These firms not only benefit from robust revenue growth but also demonstrate a strong alignment of interests between shareholders and management, which is crucial in today's volatile economic environment.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Biovica International (OM:BIOVIC B) | 18.7% | 73.8% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Sileon (OM:SILEON) | 20.3% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Yubico (OM:YUBICO) | 37.5% | 43.8% |

| BioArctic (OM:BIOA B) | 34% | 50.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

Underneath we present a selection of stocks filtered out by our screen.

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EQT AB (publ) is a global private equity firm specializing in private capital and real asset segments, with a market capitalization of approximately SEK 398.31 billion.

Operations: The company generates revenue primarily through its Private Capital and Real Assets segments, with contributions of €1.28 billion and €0.88 billion respectively.

Insider Ownership: 31%

Revenue Growth Forecast: 17.9% p.a.

EQT AB, a Swedish private equity firm, showcases robust insider activity with more shares bought than sold recently, though not in substantial volumes. The company reported a significant increase in earnings and revenue for the first half of 2024, with net income rising to €282 million from €120 million year-over-year. EQT's future looks promising with expected high profit growth and above-market revenue growth rates. However, one-off items have impacted financial results, indicating some earnings quality concerns. Additionally, EQT is actively exploring strategic options such as potential sales or acquisitions which could influence its market position and valuation.

- Get an in-depth perspective on EQT's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report EQT implies its share price may be too high.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of approximately SEK 47.13 billion.

Operations: The company generates revenue primarily from two segments: Imaging IT Solutions at SEK 2.55 billion and Secure Communications at SEK 367.35 million.

Insider Ownership: 30.3%

Revenue Growth Forecast: 14.7% p.a.

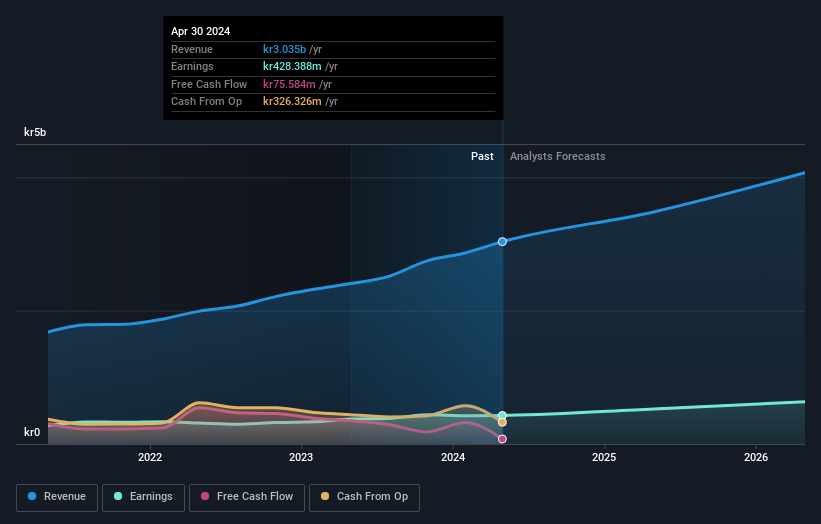

Sectra AB, a Swedish firm with high insider ownership, reported a robust financial performance with SEK 3.04 billion in annual revenue and SEK 428.39 million in net income, reflecting year-over-year growth. Recent expansions include launching a genomic diagnostics module in the US and implementing Sectra One Cloud in Belgium, enhancing operational efficiencies at client hospitals. Despite these advancements, revenue growth is projected below significant levels at 14.7% annually, suggesting moderated future expansion pace compared to market averages.

- Click here to discover the nuances of Sectra with our detailed analytical future growth report.

- The analysis detailed in our Sectra valuation report hints at an inflated share price compared to its estimated value.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services with a market capitalization of SEK 23.08 billion.

Operations: The company generates SEK 1.93 billion from its Security Software & Services segment.

Insider Ownership: 37.5%

Revenue Growth Forecast: 22.9% p.a.

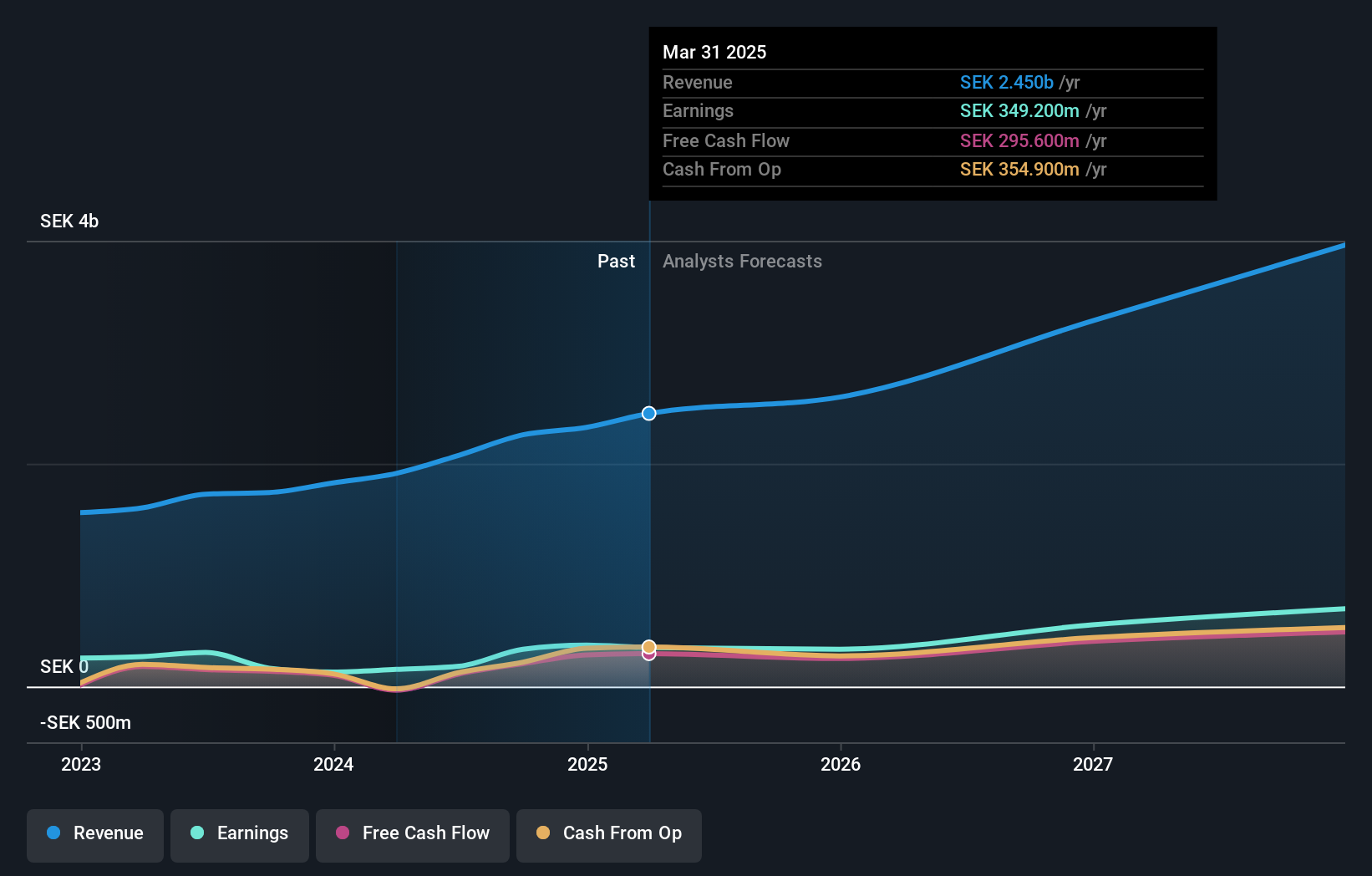

Yubico, a Swedish growth company with high insider ownership, is trading 9.1% below its estimated fair value and has shown promising financial trends with a revenue increase of 19.9% over the past year. Despite substantial insider selling recently, Yubico's earnings are expected to grow significantly at 43.8% annually, outpacing the Swedish market's forecast of 15.3%. However, profit margins have declined from last year’s 16.9% to this year’s 8.6%, and shareholder dilution has occurred over the past year.

- Click to explore a detailed breakdown of our findings in Yubico's earnings growth report.

- The valuation report we've compiled suggests that Yubico's current price could be inflated.

Key Takeaways

- Dive into all 93 of the Fast Growing Swedish Companies With High Insider Ownership we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SECT B

Sectra

Provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe.

Flawless balance sheet with reasonable growth potential.