- Sweden

- /

- Construction

- /

- OM:FG

Even With A 25% Surge, Cautious Investors Are Not Rewarding Fasadgruppen Group AB (publ)'s (STO:FG) Performance Completely

Fasadgruppen Group AB (publ) (STO:FG) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 37% in the last twelve months.

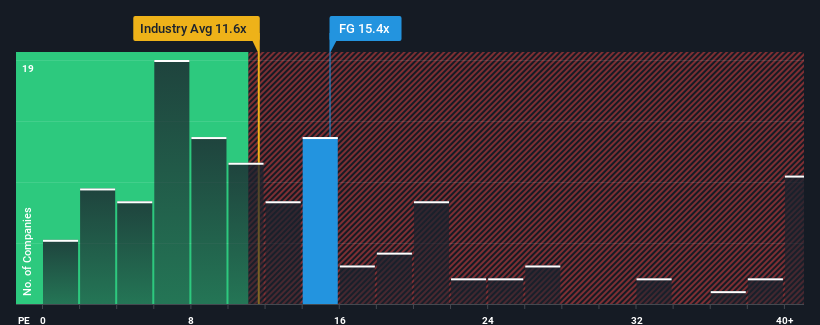

In spite of the firm bounce in price, Fasadgruppen Group may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 15.4x, since almost half of all companies in Sweden have P/E ratios greater than 22x and even P/E's higher than 39x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Fasadgruppen Group hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Fasadgruppen Group

How Is Fasadgruppen Group's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Fasadgruppen Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 41% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 25% over the next year. Meanwhile, the rest of the market is forecast to expand by 24%, which is not materially different.

In light of this, it's peculiar that Fasadgruppen Group's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Fasadgruppen Group's P/E?

Despite Fasadgruppen Group's shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Fasadgruppen Group's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It is also worth noting that we have found 3 warning signs for Fasadgruppen Group that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:FG

Fasadgruppen Group

Operates as a service provider of facades in Sweden, Denmark, Norway, and Finland.

Undervalued with moderate growth potential.

Market Insights

Community Narratives