- United Kingdom

- /

- Professional Services

- /

- LSE:STEM

European Small Caps With Insider Buying That Are Undervalued

Reviewed by Simply Wall St

Amidst renewed concerns over inflated AI stock valuations, European markets have experienced a downturn, with the STOXX Europe 600 Index falling by 2.21%. Despite this challenging environment, small-cap stocks in Europe may present unique opportunities for investors who focus on companies with strong fundamentals and insider buying activity that could signal confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.3x | 0.7x | 44.07% | ★★★★★☆ |

| Foxtons Group | 10.5x | 1.0x | 39.65% | ★★★★★☆ |

| Senior | 23.1x | 0.7x | 32.06% | ★★★★★☆ |

| Eurocell | 16.2x | 0.3x | 40.67% | ★★★★☆☆ |

| Pexip Holding | 30.4x | 4.9x | 28.21% | ★★★☆☆☆ |

| Kendrion | 29.2x | 0.7x | 40.90% | ★★★☆☆☆ |

| Fiskars Oyj Abp | 37.6x | 0.9x | 29.76% | ★★★☆☆☆ |

| Eastnine | 11.8x | 7.5x | 49.03% | ★★★☆☆☆ |

| J D Wetherspoon | 10.9x | 0.3x | -1.44% | ★★★☆☆☆ |

| CVS Group | 45.0x | 1.3x | 27.93% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

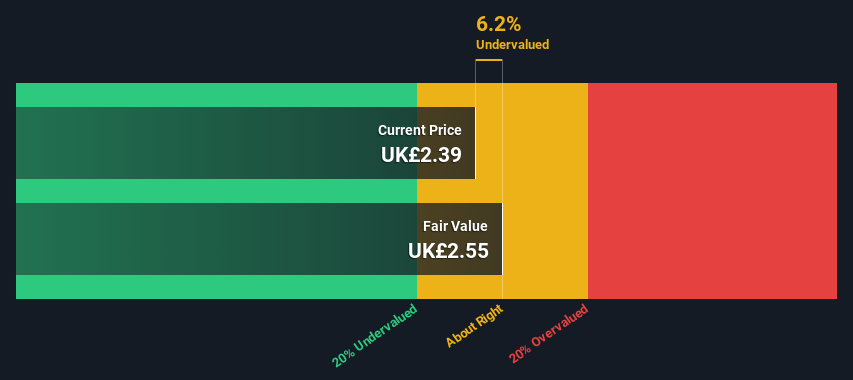

SThree (LSE:STEM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SThree is a global staffing company specializing in science, technology, engineering, and mathematics (STEM) sectors with a market capitalization of approximately £1.14 billion.

Operations: SThree generates revenue primarily from its operations across various regions, with the DACH region contributing significantly. The company's cost of goods sold (COGS) has been increasing over time, impacting its gross profit margin, which was 24.62% in May 2025. Operating expenses are a substantial part of the cost structure and have shown fluctuations, affecting net income margins as well.

PE: 7.2x

SThree, a European staffing company, is navigating a challenging environment with declining earnings projected over the next three years. Despite this, insider confidence remains strong as they have engaged in share purchases recently. The company's Q3 2025 net fees fell to £81.5 million from £92.7 million the previous year, reflecting market pressures. Recent board changes bring seasoned expertise with Rosie Shapland's appointment as an Independent Non-Executive Director, potentially strengthening governance and oversight amidst financial volatility.

- Click here to discover the nuances of SThree with our detailed analytical valuation report.

Evaluate SThree's historical performance by accessing our past performance report.

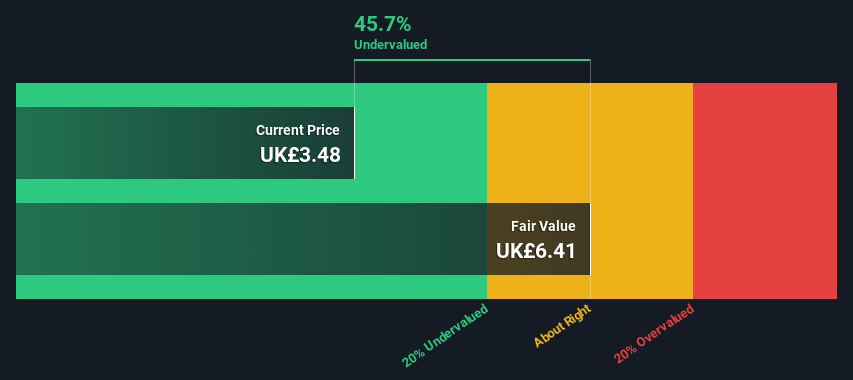

Wilmington (LSE:WIL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Wilmington is a company that provides information, education, and networking services across sectors such as legal, financial services, and health, safety and environment (HSE), with a market cap of £0.27 billion.

Operations: Wilmington derives its revenue primarily from financial services (£67.96 million), legal (£15.14 million), and health, safety, and environment (£16.43 million) segments. The company's cost of goods sold has been a significant expense, impacting its gross profit margin, which has seen fluctuations over time but reached 23.50% by mid-2025. Operating expenses have generally remained low compared to revenue, contributing to varying net income margins across periods analyzed.

PE: 23.2x

Wilmington, a smaller European company, is navigating its financial landscape with strategic changes. They are divesting their U.S. events business to enhance earnings quality, aligning with a digital-first approach. Despite an improved net profit margin from last year, profits fell significantly to £11.56 million from £41.21 million previously due to large one-off items and higher-risk funding sources. Insider confidence remains stable as leadership transitions occur, reflecting ongoing commitment amid evolving market strategies and potential growth opportunities in the digital sector.

- Navigate through the intricacies of Wilmington with our comprehensive valuation report here.

Examine Wilmington's past performance report to understand how it has performed in the past.

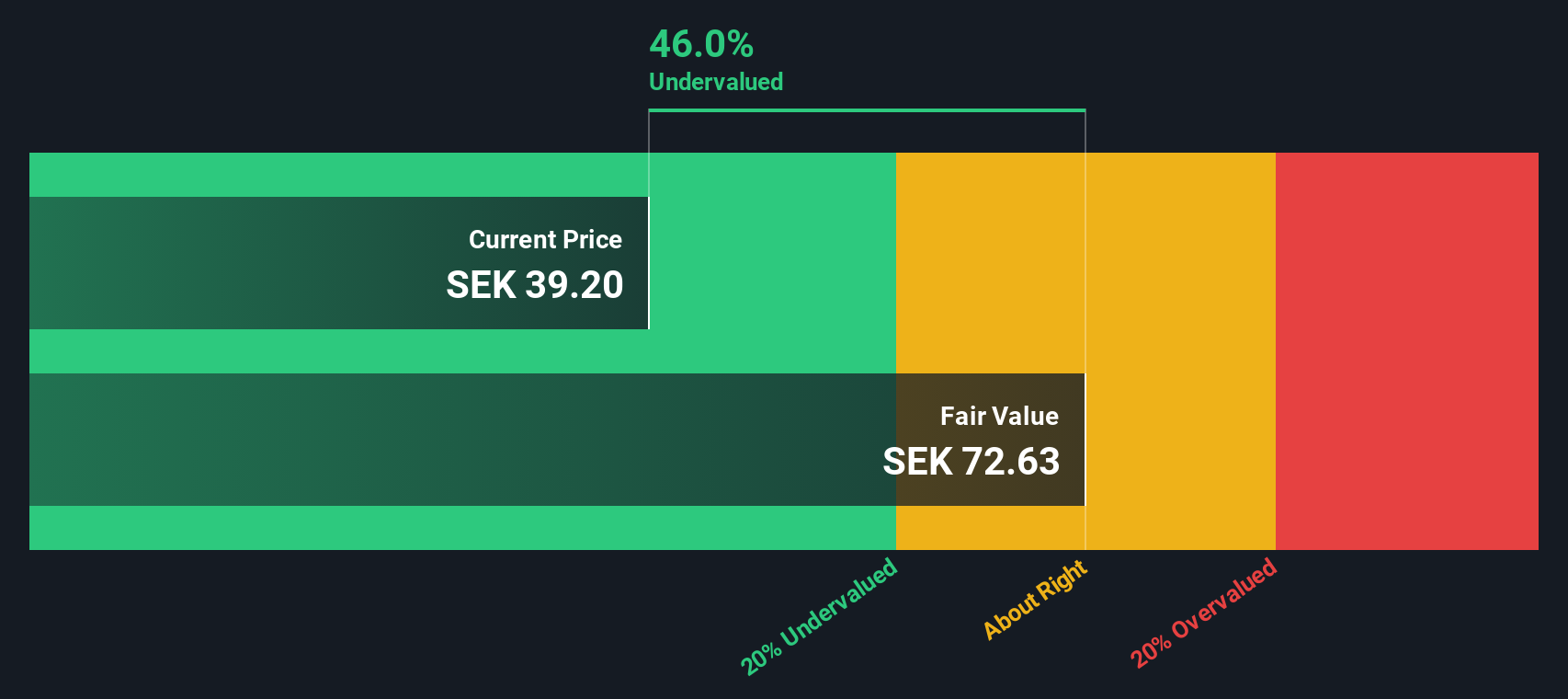

Fagerhult Group (OM:FAG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fagerhult Group operates in the lighting industry, offering a range of products across segments such as Premium, Collection, Professional, Infrastructure, and Smart Solutions with a market capitalization of SEK 9.45 billion.

Operations: The Group generates revenue primarily from its Collection and Premium segments, with Collection contributing SEK 3.63 billion and Premium SEK 2.62 billion. The gross profit margin has shown a notable increase, reaching 39.92% in the most recent period. Operating expenses are largely driven by sales and marketing costs, which amounted to SEK 1.79 billion in the latest quarter.

PE: 28.4x

Fagerhult Group, a European lighting company, is experiencing a growth phase with earnings expected to rise by 33.69% annually. However, its financial stability is challenged as debt isn't well-covered by operating cash flow and all liabilities stem from external borrowing. Recent insider confidence was shown through share purchases in Q3 2025, suggesting optimism about future prospects. Despite improved net income of SEK 85.6 million for Q3 compared to SEK 54 million last year, profit margins have decreased from the previous year’s figures.

- Click to explore a detailed breakdown of our findings in Fagerhult Group's valuation report.

Gain insights into Fagerhult Group's past trends and performance with our Past report.

Seize The Opportunity

- Click here to access our complete index of 71 Undervalued European Small Caps With Insider Buying.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:STEM

SThree

Provides specialist recruitment services in the sciences, technology, engineering, and mathematics markets in the United Kingdom, Austria, Germany, Switzerland, Netherlands, Spain, Belgium, France, the United States, Dubai, Japan, and the United Arab Emirates.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success