How Investors May Respond To Electrolux Professional (OM:EPRO B) Boosting Sustainability With Mimbly Partnership and Production Shift

Reviewed by Sasha Jovanovic

- In early November 2025, Electrolux Professional announced a partnership with Mimbly to co-develop water-saving, microplastic-filtering solutions, unveiled new sustainable laundry and food products, and revealed plans to relocate cooking production from Switzerland to Italy for greater efficiency.

- This series of initiatives highlights Electrolux Professional's push toward sustainability-driven innovation, operational streamlining, and preparation for evolving regulatory standards in its industry.

- We'll examine how the Mimbly partnership for microplastic filtration reshapes Electrolux Professional's investment narrative and sustainability focus.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Electrolux Professional Investment Narrative Recap

To back Electrolux Professional, you need conviction in its ability to turn sustainability-focused product development and operational streamlining into stronger margins, even as cost pressures and regional sales concentration weigh on results. The latest partnership with Mimbly and sustainability-themed launches support the long-term business catalyst of eco-friendly innovation, but meaningful near-term impact on net margins or volatility in European demand remains limited for now.

The most relevant announcement is the new laundry platform, scheduled for 2026, designed to improve customer productivity through energy, water, and detergent savings; this aligns with the demand drivers behind Electrolux Professional’s collaboration with Mimbly and shows how sustainability and operational performance are core to product pipelines and earnings catalysts.

However, contrasting these promising developments is the ongoing risk of elevated R&D and operational costs potentially outpacing growth, which investors should be aware of if...

Read the full narrative on Electrolux Professional (it's free!)

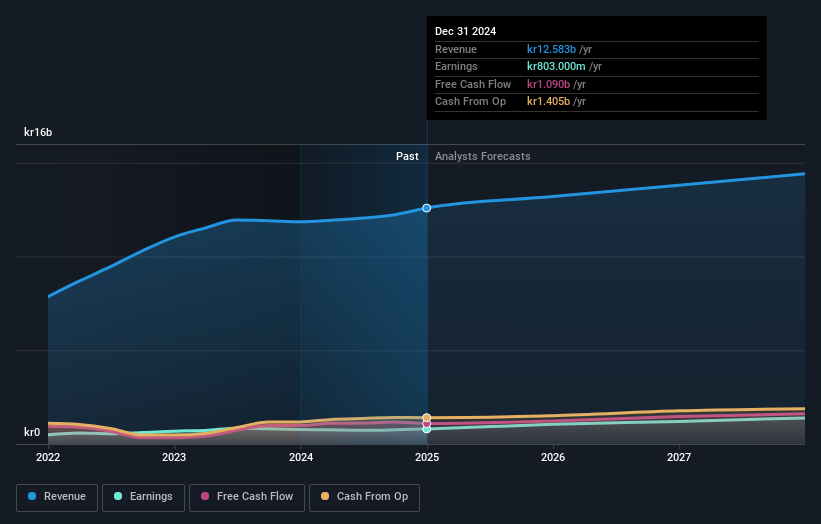

Electrolux Professional's outlook anticipates SEK14.2 billion in revenue and SEK1.4 billion in earnings by 2028. This scenario assumes a 4.2% annual revenue growth rate and a SEK582 million increase in earnings from the current SEK818 million.

Uncover how Electrolux Professional's forecasts yield a SEK75.00 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members’ fair value estimates for Electrolux Professional range widely from SEK 75 to SEK 109.68, across just 2 perspectives. With sustainability-focused products rolling out but cost headwinds persisting, these varying views remind you to compare multiple analyses before forming your outlook.

Explore 2 other fair value estimates on Electrolux Professional - why the stock might be worth as much as 65% more than the current price!

Build Your Own Electrolux Professional Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Electrolux Professional research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Electrolux Professional research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Electrolux Professional's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electrolux Professional might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EPRO B

Electrolux Professional

Provides food service, beverage, and laundry products and solutions to restaurants, hotels, healthcare, educational, and other service facilities.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives