Epiroc (OM:EPI A) Margin Slip Raises Questions on Premium Valuation Versus Growth Outlook

Reviewed by Simply Wall St

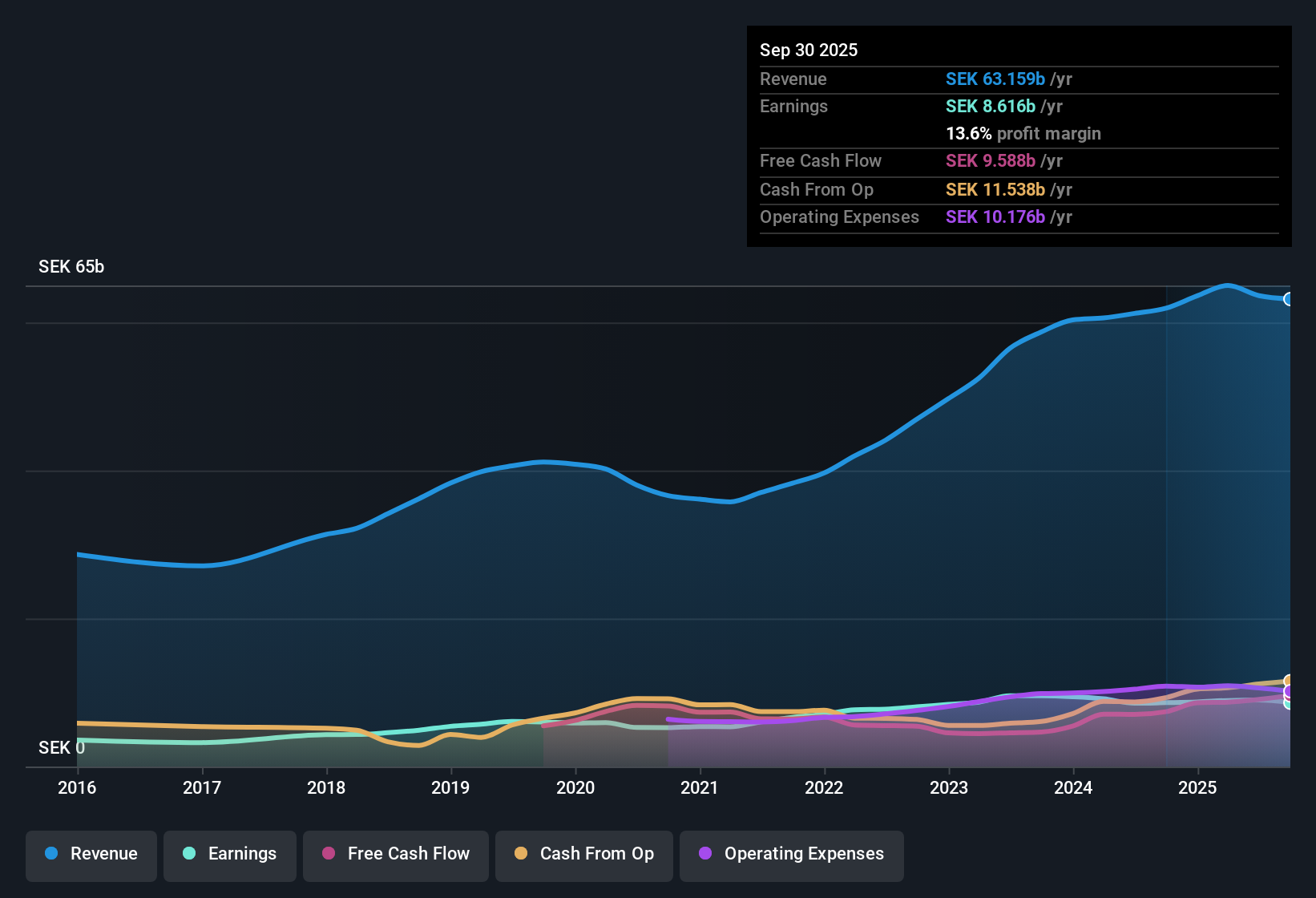

Epiroc (OM:EPI A) delivered mixed earnings, with forecasts pointing to 8.57% annual EPS growth and revenue expected to rise 4.8% per year, ahead of the Swedish market’s 3.7% revenue forecast. However, net profit margins slipped to 13.6% from 13.9% a year ago, and the company posted negative earnings growth over the past 12 months, breaking a streak of 9.7% average annual EPS growth over the previous five years. While projected growth hints at underlying business momentum, profit growth is set to lag the Swedish market average and investors are likely to weigh high-quality earnings against recent margin compression.

See our full analysis for Epiroc.The next step is to see how these numbers compare to what the wider market and community narrative suggest. Some views may hold up while others face new questions.

See what the community is saying about Epiroc

Margins Rebound Projected Despite Recent Slip

- Analysts expect profit margins to increase from 14.1% today to 15.6% in three years, hinting at a recovery after the recent slip to 13.6% reported in the latest results.

- According to the analysts' consensus narrative, efficiency moves like consolidation and back-office integration are projected to support this margin improvement.

- However, gradual restructuring means some of these gains may take time to fully materialize, as margins are recovering more slowly than the five-year average trends might suggest.

- Consensus also points out that a high aftermarket share, representing 67% of group revenue, should provide more stable, high-margin recurring income that underpins the margin rebound story.

- The recent results give fresh evidence to the consensus outlook, so discover how analysts are weighing ongoing margin recovery in their full breakdown. 📊 Read the full Epiroc Consensus Narrative.

Premium Valuation Persists Versus Industry

- Epiroc trades on a Price-To-Earnings ratio of 28.6x, notably above the Swedish Machinery industry average of 24.3x. The current share price of 203.80 is roughly 0.4% above the 203.04 DCF fair value analysts calculate.

- Consensus narrative highlights that the analyst price target stands at 210.18, just a 3.1% premium to the current share price.

- This suggests that while the stock commands a premium, analysts are not anticipating much short-term upside unless earnings outpace current projections.

- Consensus also notes that to justify buying at today’s levels, investors need to believe in Epiroc’s ability to grow recurring, high-margin revenues and lift margins toward that mid-teens target.

Heavy Mining Exposure Remains a Double-Edged Sword

- Epiroc derives a large percentage of its business from mining, with recurring revenues now accounting for 67% of group sales. This links performance directly to commodity cycles and mining sector health.

- Analysts' consensus view highlights both upside and risk:

- Rising demand for electrified and autonomous mining gear is supporting order growth and service revenues.

- However, heavy reliance on mining and commodity prices exposes the business to risks from weaker activity in construction, resource nationalism, and shifting global demand.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Epiroc on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Viewed the data from a new angle? Share your perspective and shape a narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Epiroc.

See What Else Is Out There

Epiroc’s margin recovery is trailing its historical pace, recent earnings growth was negative, and its premium valuation may be hard to justify without steadier performance.

If you’re looking for companies that consistently post steady growth and can weather economic shifts, start with our stable growth stocks screener (2112 results) for dependable performers built for all cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Epiroc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EPI A

Epiroc

Develops and produces equipment for use in surface and underground applications in North America, Europe, South America, Europe, Africa, the Middle East, Asia, Australia, and India.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives