Epiroc (OM:EPI A): Exploring Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

Epiroc (OM:EPI A) shares have caught investor attention with a mix of recent returns, including a dip over the past week after several months of steady growth. There is renewed curiosity about where the stock could head next.

See our latest analysis for Epiroc.

Despite a sharp 9.6% drop in its share price over the past week, Epiroc’s longer-term story is less volatile. Its one-year total shareholder return is holding just below neutral and its three- and five-year total returns show healthy gains. Recent fluctuations hint at shifting market sentiment as investors reassess the company’s growth prospects and perceived risks in a changing industrial landscape.

If short-term moves like these have you searching for broader opportunities, now’s a great time to discover fast growing stocks with high insider ownership

Given Epiroc’s moderate share price discount to analyst targets and solid multi-year returns, the big question is whether investors are being offered a value opportunity here or if future growth is already reflected in the price.

Most Popular Narrative: 3.5% Undervalued

With Epiroc closing at SEK201.2, the most widely followed narrative sets a fair value of SEK208.5. This reflects cautious optimism about the stock's potential upside. The narrative highlights the role of earnings and margin expansion in analyst fair value models, providing a foundation for a deeper exploration of the key factors behind this perspective.

Continued investment in automation and digital features (automation for core drilling rigs, expansion in BEV technology, and a growing connected fleet of approximately 15,000 machines) aligns with the mining sector's shift toward digitalization and productivity. These initiatives are likely to increase long-term recurring revenues from software, data, and aftermarket services, supporting future margin expansion.

Curious what powers the bullish view? The engines behind this call are subtle but potent. They rely on specific assumptions about growth, profitability, and high-margin digital solutions. Which trends and figures are tipping the valuation upward? The full breakdown shows where even small changes could reshape the outlook.

Result: Fair Value of SEK208.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in construction demand or rising supply chain costs could quickly challenge the optimistic outlook that investors have for Epiroc's future growth.

Find out about the key risks to this Epiroc narrative.

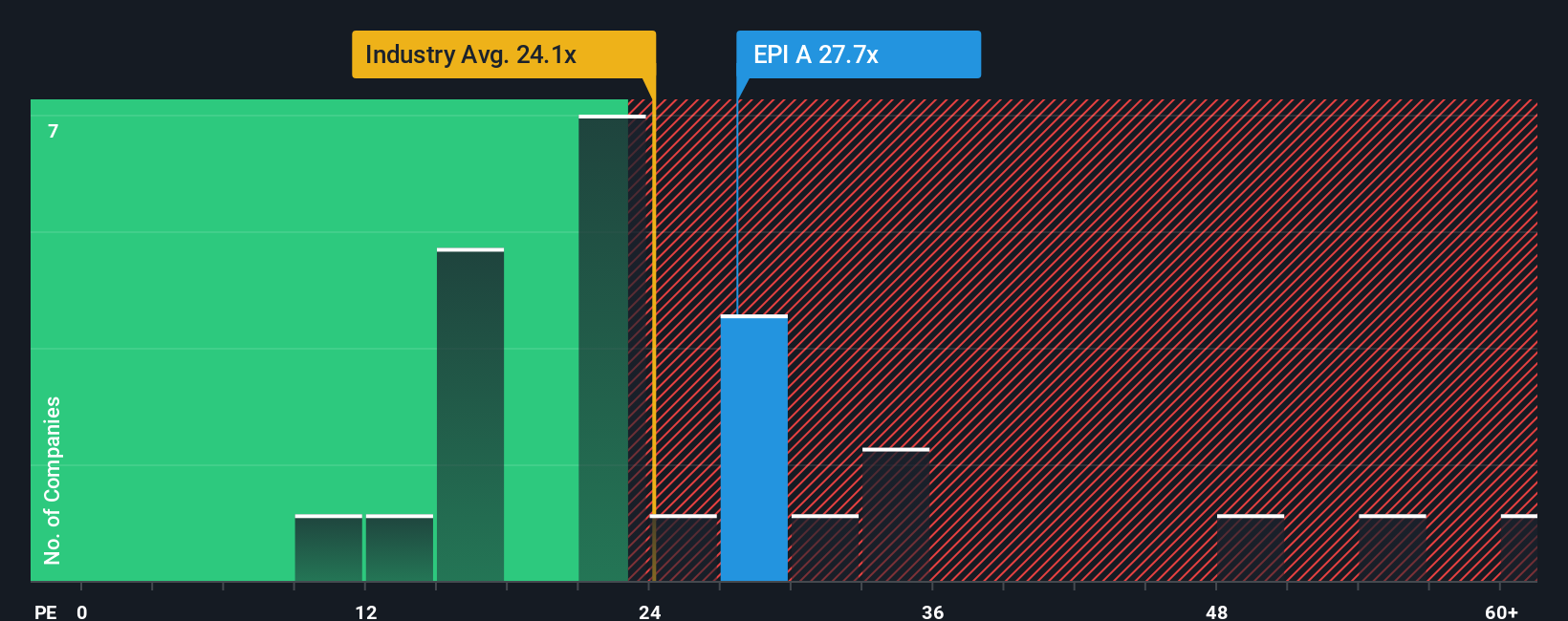

Another Perspective: Market Multiples Tell a Different Story

Looking at market valuation multiples, Epiroc trades at a price-to-earnings ratio of 28.2x, which is higher than both the Swedish Machinery industry average of 24.5x and the fair ratio of 26.5x. This suggests the market is placing a premium on future growth, but also introduces greater valuation risk if growth expectations are not met. Is the market too optimistic, or does this signal untapped upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Epiroc Narrative

If you see the numbers in a different light or want to shape your own view, you can build a fresh Epiroc narrative yourself in under three minutes, Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Epiroc.

Ready for More Investment Ideas?

Smart investors keep their options open. Now is your chance to access exclusive stock picks and fresh opportunities you won’t find in the headlines.

- Supercharge your portfolio with high-yield opportunities by checking out these 22 dividend stocks with yields > 3%, featuring attractive returns and robust fundamentals that stand out in volatile markets.

- Tap into the unlimited growth potential of advanced computing and uncover tomorrow's pioneers through these 28 quantum computing stocks, which is pushing the boundaries of what’s possible.

- Capitalize on rapidly evolving tech by backing these 26 AI penny stocks, positioned to benefit from the next wave of artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Epiroc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EPI A

Epiroc

Develops and produces equipment for use in surface and underground applications in North America, Europe, South America, Europe, Africa, the Middle East, Asia, Australia, and India.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives