engcon (OM:ENGCON B): Assessing Valuation Following Q3 2025 Earnings and Nine-Month Profit Growth

Reviewed by Simply Wall St

engcon (OM:ENGCON B) released its third quarter and nine-month results. Sales held steady at SEK 415 million for the quarter, while sales and net income have both increased over the first nine months of 2025 compared to last year.

See our latest analysis for engcon.

After a choppy start to the year, engcon’s 1-day and 1-week share price returns of 3% and 6%, respectively, suggest some momentum is building since the latest results. Still, the year-to-date share price return remains down 24%, and over the past twelve months, total shareholder return stands at -34%. That said, long-term holders have seen a 39% total return over three years, so while short-term swings are top of mind, the bigger picture remains nuanced.

If the recent earnings results have you rethinking your strategy, now is a perfect time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With annual revenue and net income trending upward, but share prices still lagging behind analyst targets, the key question is whether engcon’s recent growth is undervalued by the market or if all the future gains are already priced in.

Most Popular Narrative: 14.1% Undervalued

With the most widely followed narrative setting a fair value 14.1% above the last close, expectations are for more upside than the market has currently priced in. This valuation reflects optimism about engcon's growth prospects as it expands globally and leverages industry trends.

Rapidly increasing unit volumes and deeper market penetration in Europe (especially Germany and the Netherlands) through the introduction of entry-level and mid-tier tiltrotator products are setting the stage for higher future sales growth. Initial adoption creates a pathway to upselling the full, higher-margin engcon ecosystem, which could drive both revenue and future net margin expansion as the installed base grows.

Want to know what powers this bullish outlook? The narrative hinges on aggressive international growth and the bold anticipation of premium profits, hinting at dramatic changes ahead. Curious what specific trends and financial expectations drive this gap in fair value? Click to learn more.

Result: Fair Value of $94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressure from entry-level products and currency headwinds could quickly dampen the company’s outlook if trends worsen.

Find out about the key risks to this engcon narrative.

Another View: Are Shares Priced Too High?

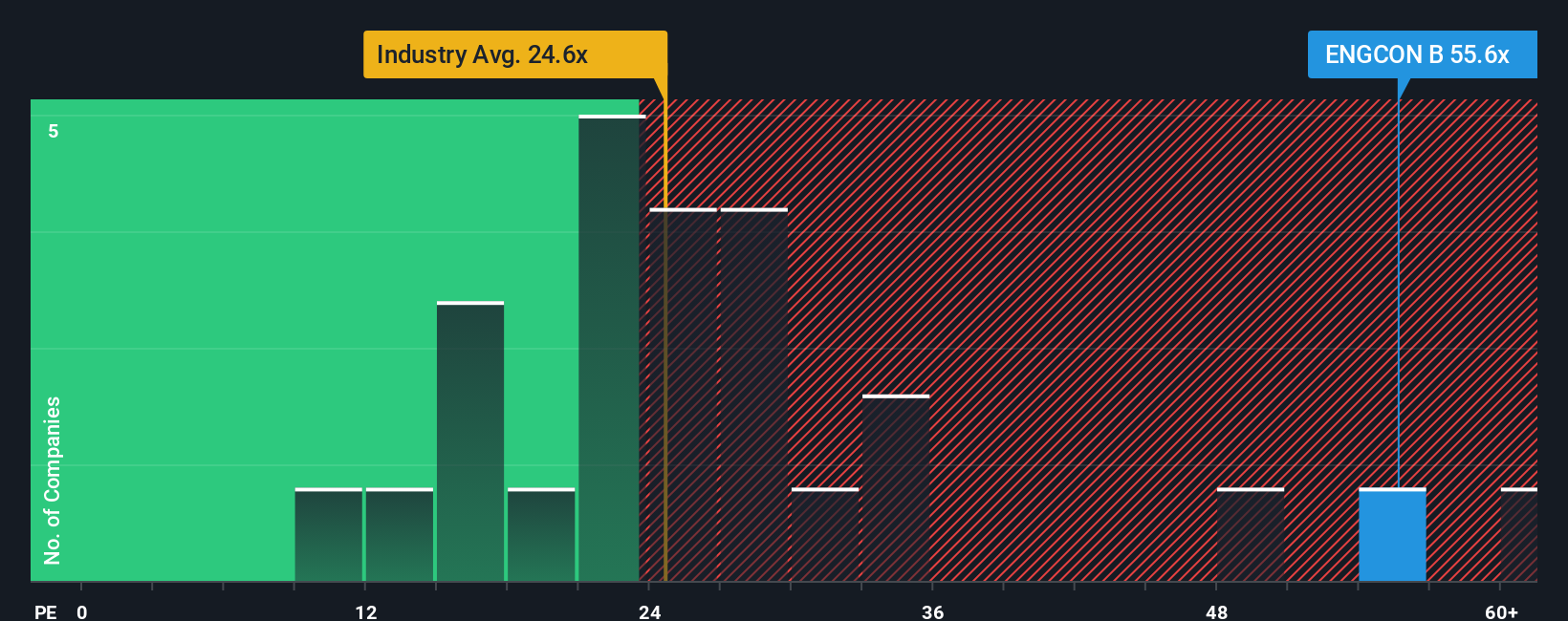

Looking at valuation from another angle, engcon’s current price-to-earnings ratio stands at 55x, which is more than double the Swedish Machinery industry average of 24.4x and notably higher than the fair ratio of 36.5x. This gap suggests the market is placing a significant premium on future growth. Does this add risk or hint at untapped potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own engcon Narrative

If you see things differently or want to dig into the details yourself, it only takes a few minutes to craft your own perspective. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding engcon.

Looking for more investment ideas?

Smart investors never limit themselves to one opportunity. Find your next big winner by checking out these unique sectors and strategies. Act now before others spot them.

- Unlock high growth potential by jumping into these 26 AI penny stocks, which are poised to transform entire industries with artificial intelligence breakthroughs.

- Maximize your income potential with these 21 dividend stocks with yields > 3%, which consistently deliver strong yields and offer the stability savvy investors seek.

- Stay ahead of market trends by pursuing these 855 undervalued stocks based on cash flows, which are still flying under the radar and may be ripe for strong returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ENGCON B

engcon

Engages in the design, production, and sale of excavator tools in Sweden, Denmark, Norway, Finland, rest of Europe, North and South America, Japan, South Korea, Australia, New Zealand, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives