Take Care Before Jumping Onto Ecoclime Group AB (publ) (STO:ECC B) Even Though It's 25% Cheaper

To the annoyance of some shareholders, Ecoclime Group AB (publ) (STO:ECC B) shares are down a considerable 25% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 30% in that time.

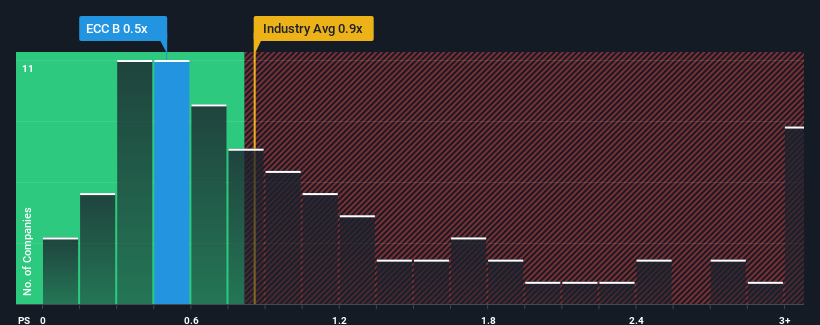

Since its price has dipped substantially, when close to half the companies operating in Sweden's Building industry have price-to-sales ratios (or "P/S") above 1.2x, you may consider Ecoclime Group as an enticing stock to check out with its 0.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Ecoclime Group

What Does Ecoclime Group's P/S Mean For Shareholders?

Ecoclime Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ecoclime Group.How Is Ecoclime Group's Revenue Growth Trending?

In order to justify its P/S ratio, Ecoclime Group would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 27% last year. The latest three year period has also seen an excellent 106% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 14% per year as estimated by the dual analysts watching the company. With the industry only predicted to deliver 5.9% each year, the company is positioned for a stronger revenue result.

With this information, we find it odd that Ecoclime Group is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The southerly movements of Ecoclime Group's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Ecoclime Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you take the next step, you should know about the 1 warning sign for Ecoclime Group that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Ecoclime Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:ECC B

Ecoclime Group

Provides solutions for extraction, recycling, storage, and distribution of thermal energy in properties in Sweden.

Flawless balance sheet with low risk.

Market Insights

Community Narratives