As European markets continue to show resilience, with the STOXX Europe 600 Index and major stock indexes experiencing gains, investors are increasingly focused on identifying growth opportunities within this robust economic landscape. In this context, companies with strong insider ownership often stand out as promising candidates, as they can indicate confidence in the company's future prospects and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 43.9% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.4% |

| Magnora (OB:MGN) | 10.4% | 75.4% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 85% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 49.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 51.4% |

We'll examine a selection from our screener results.

Bonesupport Holding (OM:BONEX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bonesupport Holding AB is an orthobiologics company that develops and sells injectable bio-ceramic bone graft substitutes globally, with a market cap of SEK14.81 billion.

Operations: The company's revenue primarily comes from its Pharmaceuticals segment, which generated SEK1.12 billion.

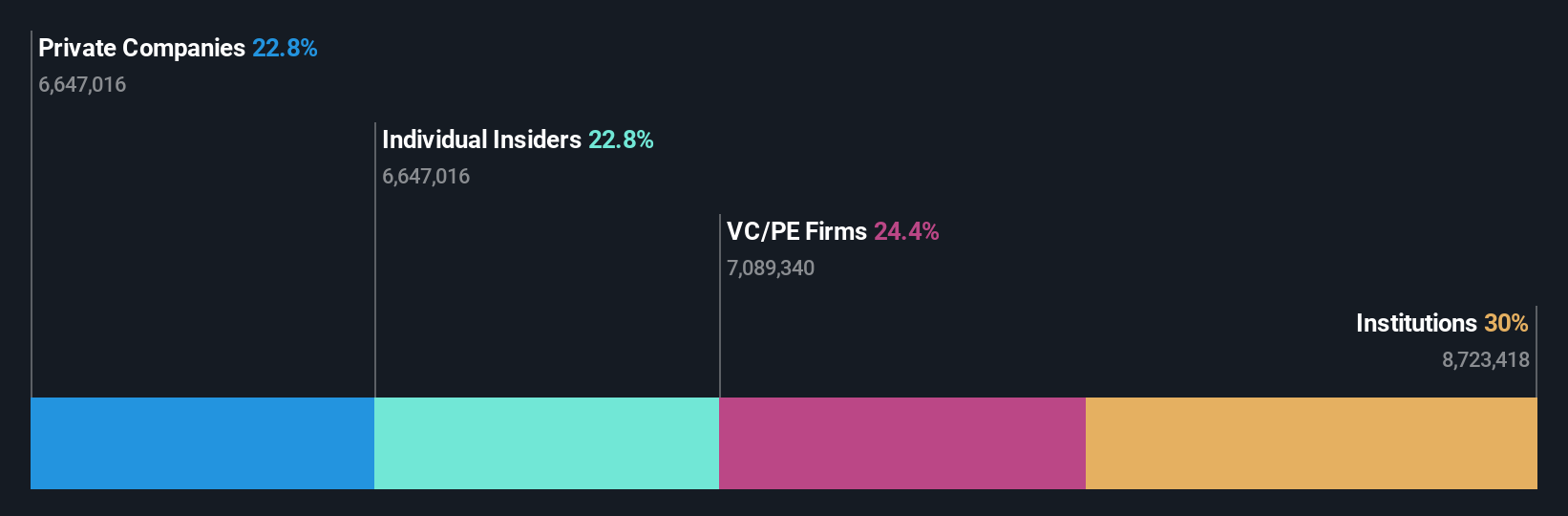

Insider Ownership: 10.4%

Revenue Growth Forecast: 27.8% p.a.

Bonesupport Holding shows strong growth potential with substantial insider ownership, evidenced by its impressive earnings results. For Q3 2025, sales increased to SEK 294.14 million from SEK 237.5 million year-over-year, while net income rose to SEK 34.51 million from SEK 30.57 million. The company forecasts robust revenue and earnings growth of over 20% annually, outpacing the Swedish market significantly. Recent clinical study success further bolsters its innovative edge in the medical field.

- Click to explore a detailed breakdown of our findings in Bonesupport Holding's earnings growth report.

- Upon reviewing our latest valuation report, Bonesupport Holding's share price might be too pessimistic.

CTT Systems (OM:CTT)

Simply Wall St Growth Rating: ★★★★★★

Overview: CTT Systems AB (publ) specializes in providing humidity control systems for aircraft across Sweden, Denmark, France, the United States, and internationally, with a market cap of SEK2.36 billion.

Operations: The company's revenue is primarily derived from its Aerospace & Defense segment, amounting to SEK291.20 million.

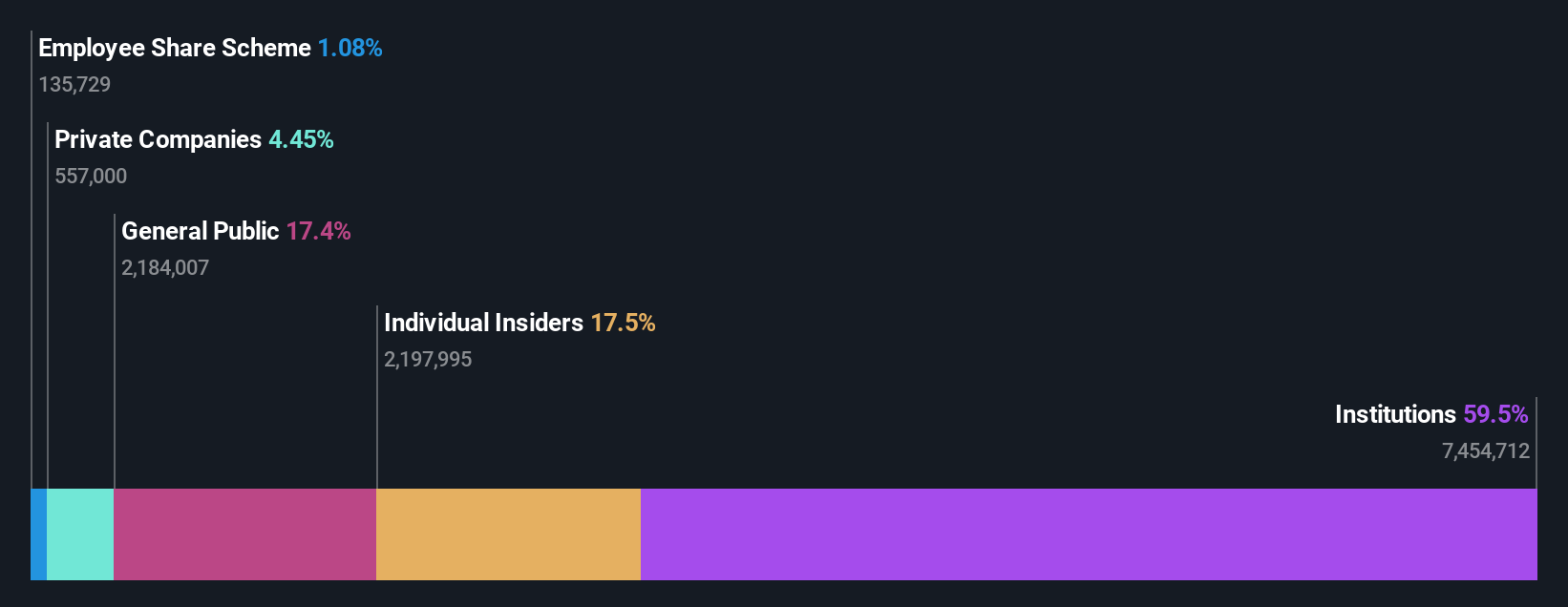

Insider Ownership: 17.5%

Revenue Growth Forecast: 25.2% p.a.

CTT Systems demonstrates growth potential with substantial insider ownership, highlighted by its forecasted earnings growth of 52% annually, surpassing the Swedish market. Despite a decline in profit margins from 29.5% to 19.6%, revenue is expected to grow at 25.2% per year, outpacing the market significantly. The company recently reported Q3 sales of SEK 74 million and net income of SEK 14.4 million, indicating steady performance despite challenges in sustaining dividend coverage through earnings or cash flow.

- Get an in-depth perspective on CTT Systems' performance by reading our analyst estimates report here.

- The analysis detailed in our CTT Systems valuation report hints at an deflated share price compared to its estimated value.

Shoper (WSE:SHO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shoper S.A. offers Software as a Service solutions for e-commerce in Poland, with a market cap of PLN1.52 billion.

Operations: The company generates revenue through its Solutions segment, which accounts for PLN163.88 million, and its Subscriptions segment, contributing PLN44.03 million.

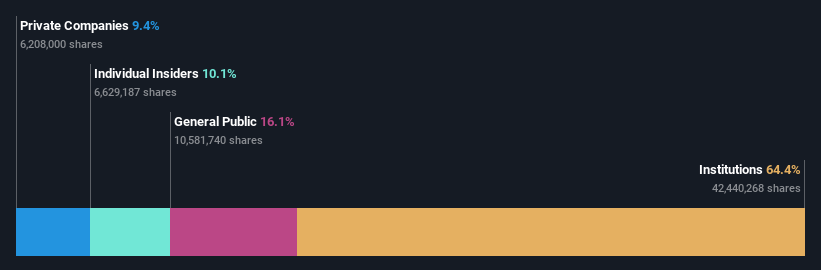

Insider Ownership: 22.5%

Revenue Growth Forecast: 14.9% p.a.

Shoper's growth trajectory is underscored by its high insider ownership and substantial earnings growth, forecasted at 21.7% annually, which outpaces the Polish market. Despite revenue growth projections of 14.9% per year being below 20%, they still exceed market averages. Recent inclusion in the S&P Global BMI Index highlights its growing prominence. The company reported a half-year revenue increase to PLN 105.4 million and net income of PLN 19.1 million, reflecting robust performance amidst competitive pressures.

- Click here to discover the nuances of Shoper with our detailed analytical future growth report.

- Our valuation report here indicates Shoper may be overvalued.

Taking Advantage

- Access the full spectrum of 189 Fast Growing European Companies With High Insider Ownership by clicking on this link.

- Seeking Other Investments? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SHO

Shoper

Provides Software as a Service solutions for e-commerce in Poland.

Outstanding track record with high growth potential.

Market Insights

Community Narratives