Beijer Alma (OM:BEIA B) Margin Expansion Exceeds Narratives With 8.9% Net Profit Mark

Reviewed by Simply Wall St

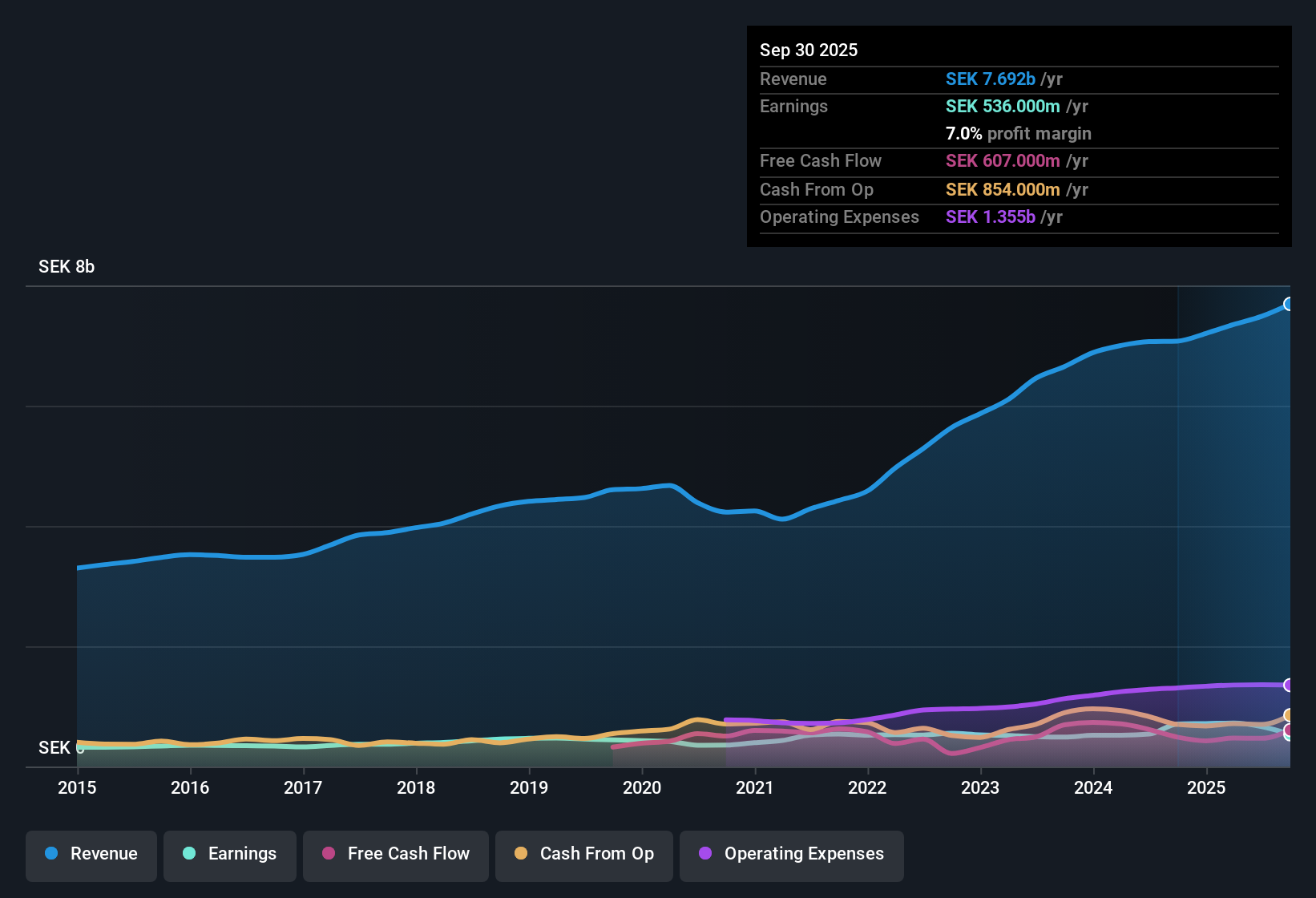

Beijer Alma (OM:BEIA B) posted a net profit margin of 8.9%, up from 7.6% last year, with EPS growth increasing by 23.2% over the past year, more than doubling its five-year average of 9.8% per year. Looking ahead, the company’s earnings are forecast to expand by 20.3% per year and revenue by 4.8% per year, both outperforming Swedish market norms. Momentum is building behind Beijer Alma, with accelerating profit growth and widening margins setting an optimistic tone for investors considering this release.

See our full analysis for Beijer Alma.The next section compares these headline numbers with the dominant market narratives, so you can see which story is prevailing and where the conversation might shift.

See what the community is saying about Beijer Alma

Analyst Margin Targets Rise to 11.9%

- Analysts expect profit margins to increase from the current 8.9% to 11.9% by 2028, tightening the focus on operational improvements over the next three years.

- According to the analysts' consensus view, productivity gains are predicted to come from automation investments and flexible manufacturing. This view is supported by ongoing expansion into smart manufacturing and sustainability initiatives.

- Expansion into automation, sustainability, and new high-value markets is expected to boost Beijer Alma’s topline as well as drive margin and earnings improvements.

- Order inflows and recent factory expansions, such as in rail springs and bus windows, support the analysts' premise that pricing power and productivity will remain strong.

- Expectations for earnings to reach SEK 1.0 billion by 2028 set a high bar for execution, especially given the 23.2% growth achieved this year and the current trend of margin expansion. Investors will watch to see if operational streamlining can match this outlook.

- Improved productivity and consolidation from cost reduction programs, including factory closures and workforce optimization, are projected to drive these margin enhancements.

- The analysts' forecast highlights the importance of executing these plans effectively to deliver on the ambitious earnings and margin growth targets.

Peer Valuation: Below Fair Value, Premium to Industry

- Beijer Alma’s share price sits at SEK 275.50, which is below its DCF fair value of SEK 325.81 and below the analyst price target of SEK 297.50. The shares still trade at a P/E of 25x, higher than the Swedish Machinery industry average of 23.8x and just below direct peers at 26.4x.

- Consensus narrative notes that, despite the attractive discount to fair value and analyst targets, investors may be paying a modest premium versus the broader sector. This reflects expectations for above-market growth in earnings and revenue.

- Trading below both DCF fair value and analyst consensus price target may attract investors who believe near-term execution risks are manageable.

- The slight premium to sector multiples suggests the market is anticipating Beijer Alma can continue to deliver margin expansion and earnings growth above the industry average.

Cyclical Risk and Acquisition Integration Remain Watchpoints

- Heavily concentrated exposure to cyclical markets like the Nordics and the US, combined with ongoing restructuring issues from the Alcomex acquisition (factory closures and inventory write-downs), could dampen the earnings outlook and delay realization of growth targets.

- Consensus narrative warns that headwinds, such as sluggish demand in mature geographies and slow organic growth in core products, may challenge Beijer Alma’s ability to sustain rapid earnings upgrades.

- Integration struggles shown by the Alcomex experience could mean restructuring costs linger, affecting group net margins and EPS for longer than bulls hope.

- Persistent exposure to traditional product lines in slow-growing markets is a structural hurdle that could limit the effectiveness of expansion and efficiency initiatives.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Beijer Alma on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got your own interpretation of the earnings? Share your take and shape your narrative in just a few minutes by clicking Do it your way.

A great starting point for your Beijer Alma research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Persistent exposure to slow-growing core markets and recent restructuring challenges could limit Beijer Alma’s ability to maintain rapid earnings momentum as forecast.

If you’d prefer companies delivering consistent earnings expansion across cycles, consider stable growth stocks screener (2098 results) that have historically demonstrated resilient, steady growth even when conditions are volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijer Alma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BEIA B

Beijer Alma

Engages in component manufacturing and industrial trading businesses in Sweden, rest of Nordic Region, rest of Europe, North America, Asia, and internationally.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives