Atlas Copco (STO:ATCO A) Will Pay A Larger Dividend Than Last Year At SEK1.50

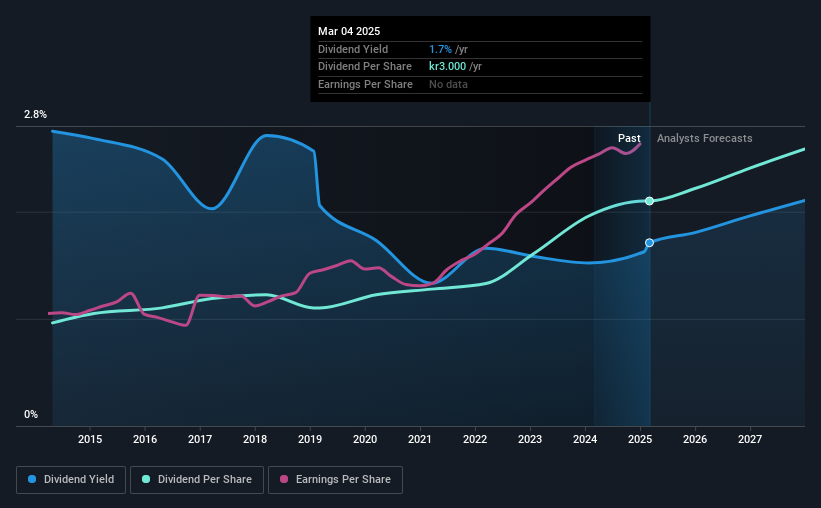

Atlas Copco AB (publ) (STO:ATCO A) will increase its dividend from last year's comparable payment on the 7th of May to SEK1.50. Even though the dividend went up, the yield is still quite low at only 1.7%.

View our latest analysis for Atlas Copco

Atlas Copco's Payment Could Potentially Have Solid Earnings Coverage

Even a low dividend yield can be attractive if it is sustained for years on end. The last dividend was quite easily covered by Atlas Copco's earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

The next year is set to see EPS grow by 20.6%. Assuming the dividend continues along recent trends, we think the payout ratio could be 42% by next year, which is in a pretty sustainable range.

Atlas Copco Has A Solid Track Record

The company has an extended history of paying stable dividends. Since 2015, the annual payment back then was SEK1.38, compared to the most recent full-year payment of SEK3.00. This implies that the company grew its distributions at a yearly rate of about 8.1% over that duration. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. It's encouraging to see that Atlas Copco has been growing its earnings per share at 12% a year over the past five years. Earnings are on the uptrend, and it is only paying a small portion of those earnings to shareholders.

We Really Like Atlas Copco's Dividend

Overall, a dividend increase is always good, and we think that Atlas Copco is a strong income stock thanks to its track record and growing earnings. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All in all, this checks a lot of the boxes we look for when choosing an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 17 analysts we track are forecasting for Atlas Copco for free with public analyst estimates for the company. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ATCO A

Atlas Copco

Provides compressed air and gas, vacuum, energy, dewatering and industrial pumps, industrial power tools, and assembly and machine vision solutions in North America, South America, Europe, Africa, the Middle East, Asia, and Oceania.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026