Atlas Copco (OM:ATCO A) Is Down 5.6% After Earnings Miss and Margin Pressure Confirmed – What's Changed

Reviewed by Sasha Jovanovic

- Atlas Copco AB (publ) reported its third quarter and nine-month 2025 results, noting sales of SEK41.62 billion and SEK125.56 billion, respectively, both of which declined compared to the same periods a year earlier; net income also fell to SEK6.68 billion for the quarter and SEK19.80 billion for the nine months.

- The reductions in both basic and diluted earnings per share from continuing operations reflect ongoing margin pressures during the period and highlight the impact of lower large-order demand.

- With reduced sales and net income now confirmed, we will explore how this development impacts Atlas Copco's longer-term investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Atlas Copco Investment Narrative Recap

To invest in Atlas Copco, you need to believe in the company’s long-term ability to benefit from industrial automation and recurring service revenues, even as near-term results can fluctuate with order cycles and currency swings. The recent drop in sales, net income, and margins in Q3 2025 highlights that order weakness and margin pressure remain the central risks to the business right now, while the prospect of a recovery in large orders is still unresolved. The latest results do not deliver a decisive blow to the company’s key short-term catalysts, though the ongoing decline in large equipment demand will keep investor focus on when, rather than if, the order book rebounds meaningfully. Among recent company actions, the October 2025 dividend payment of SEK 1.50 per share stands out, arriving in the wake of confirmed earnings pressure. While Atlas Copco has a reputation for maintaining its dividend through earnings cycles, the payout’s sustainability can attract both income-focused and long-term shareholders, especially at a time when margin pressure and order softness test confidence in a near-term recovery. Yet, as headline results reflect, reduced equipment demand remains front of mind for anyone watching short-term catalysts. But, in contrast, investors should be aware that persistent weakness in large-order segments could continue to pressure near-term results...

Read the full narrative on Atlas Copco (it's free!)

Atlas Copco's narrative projects SEK198.7 billion in revenue and SEK33.5 billion in earnings by 2028. This requires 4.7% yearly revenue growth and a SEK5.4 billion earnings increase from SEK28.1 billion today.

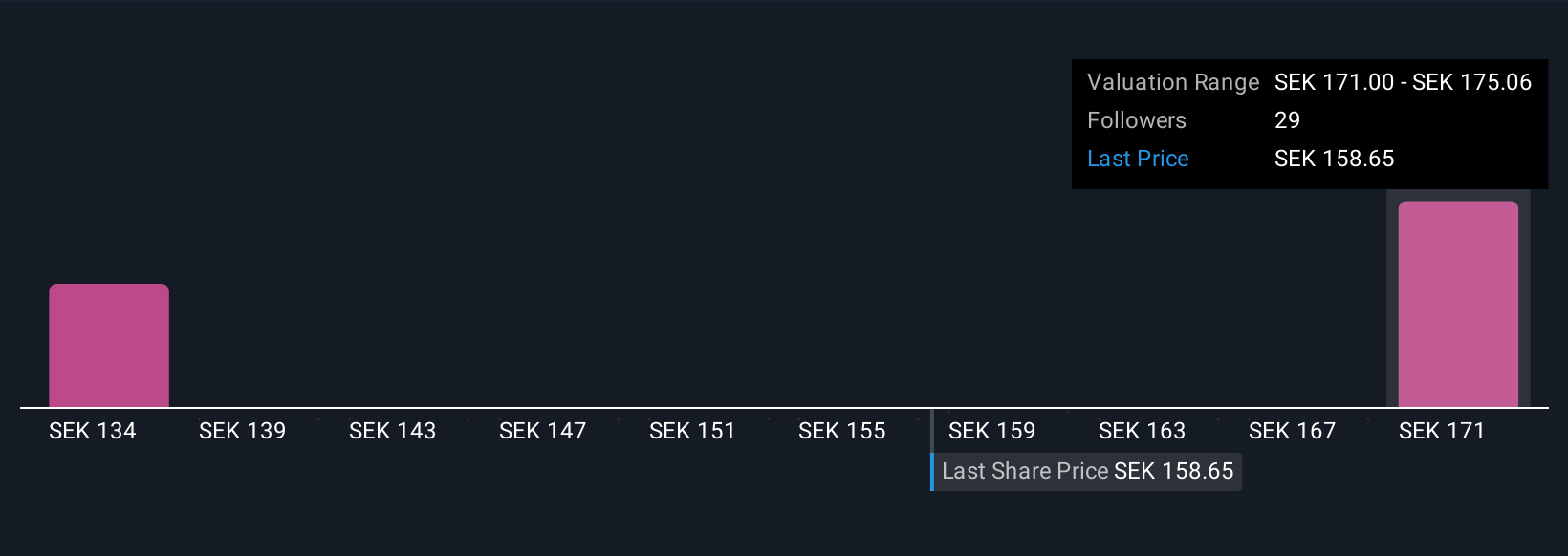

Uncover how Atlas Copco's forecasts yield a SEK175.06 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Fair value estimates for Atlas Copco from four Simply Wall St Community members currently range from SEK133.81 to SEK175.06. With ongoing pressure on large equipment orders, you can see how varied opinions align or contrast with this risk, so explore the full spectrum of forecasts for a broader perspective.

Explore 4 other fair value estimates on Atlas Copco - why the stock might be worth as much as 11% more than the current price!

Build Your Own Atlas Copco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atlas Copco research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Atlas Copco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atlas Copco's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ATCO A

Atlas Copco

Provides compressed air and gas, vacuum, energy, dewatering and industrial pumps, industrial power tools, and assembly and machine vision solutions in North America, South America, Europe, Africa, the Middle East, Asia, and Oceania.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives