- Taiwan

- /

- Real Estate

- /

- TWSE:2539

Three Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets respond to easing inflation and robust bank earnings, major U.S. stock indexes have rebounded, with small-cap indices like the S&P MidCap 400 experiencing notable gains. In this dynamic environment, investors often seek out stocks with strong fundamentals and growth potential that remain under the radar, presenting opportunities for those looking beyond the usual market leaders.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Ve Wong | 11.84% | 0.61% | 3.56% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Commercial Bank International P.S.C | 0.33% | 5.59% | 28.69% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

AQ Group (OM:AQ)

Simply Wall St Value Rating: ★★★★★★

Overview: AQ Group AB (publ) manufactures and sells components and systems for industrial customers across Sweden, other European countries, and internationally, with a market cap of approximately SEK15.12 billion.

Operations: AQ Group generates revenue primarily from its System and Component segments, with SEK1.59 billion from Systems and SEK7.81 billion from Components. The net profit margin is not specified in the provided data, so further details on profitability trends are unavailable.

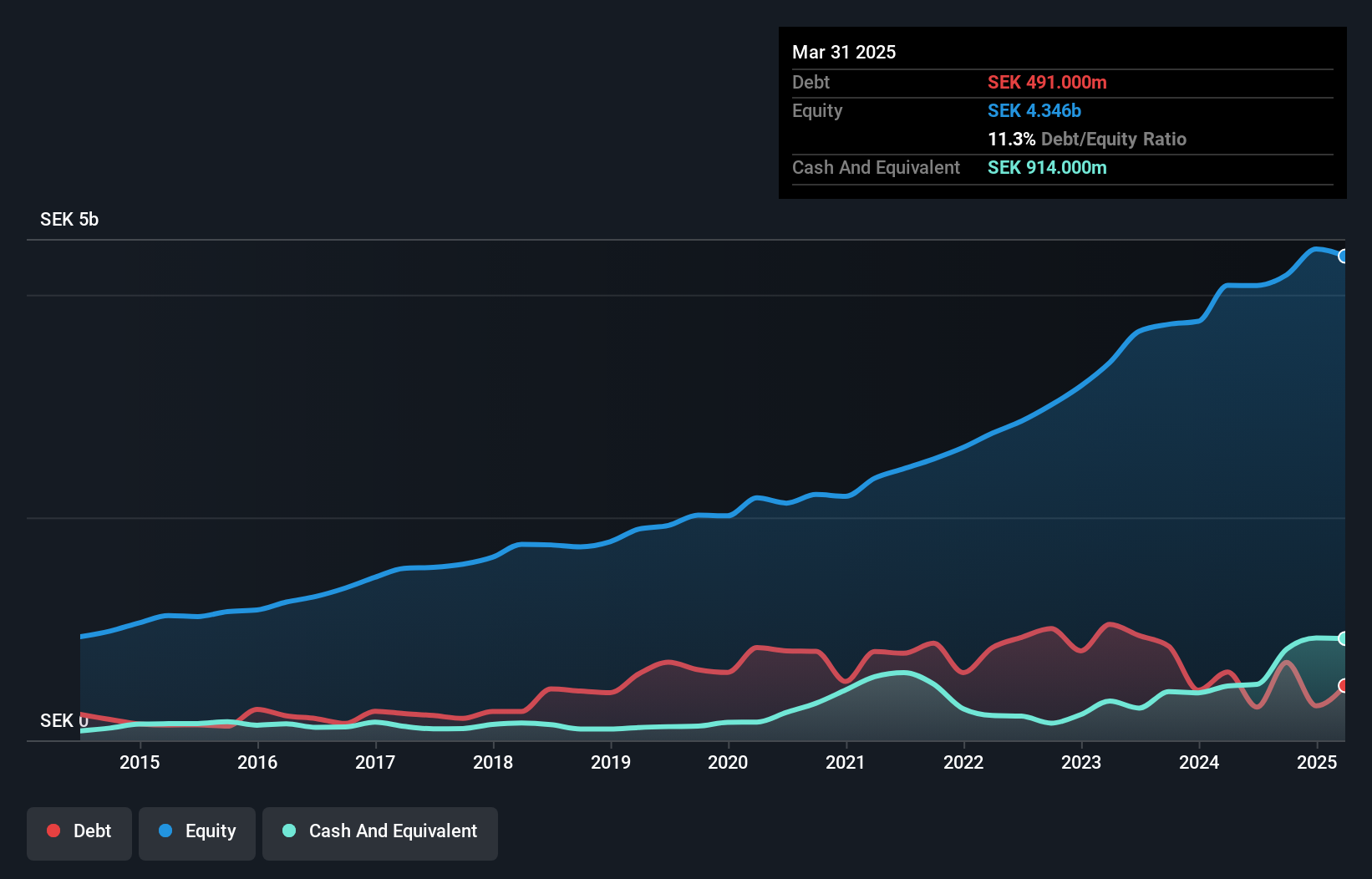

AQ Group, a nimble player in the electrical industry, shows promise with its price-to-earnings ratio of 23.5x, slightly below the industry average. The company boasts high-quality earnings and has managed to reduce its debt-to-equity ratio from 31.4% to 16.8% over five years, indicating prudent financial management. AQ's interest payments are comfortably covered by EBIT at 26.7x, reflecting strong operational efficiency. Despite significant insider selling recently, AQ remains financially sound with more cash than total debt and free cash flow positivity. Earnings growth outpaced the industry's negative trend last year and is projected to grow annually by 7%.

- Click here to discover the nuances of AQ Group with our detailed analytical health report.

Assess AQ Group's past performance with our detailed historical performance reports.

Shenzhen Newway Photomask Making (SHSE:688401)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Newway Photomask Making Co., Ltd is a lithography company involved in the design, development, and production of mask products in China with a market cap of CN¥5.06 billion.

Operations: Shenzhen Newway generates revenue primarily from its electronic components and parts segment, totaling CN¥793.19 million.

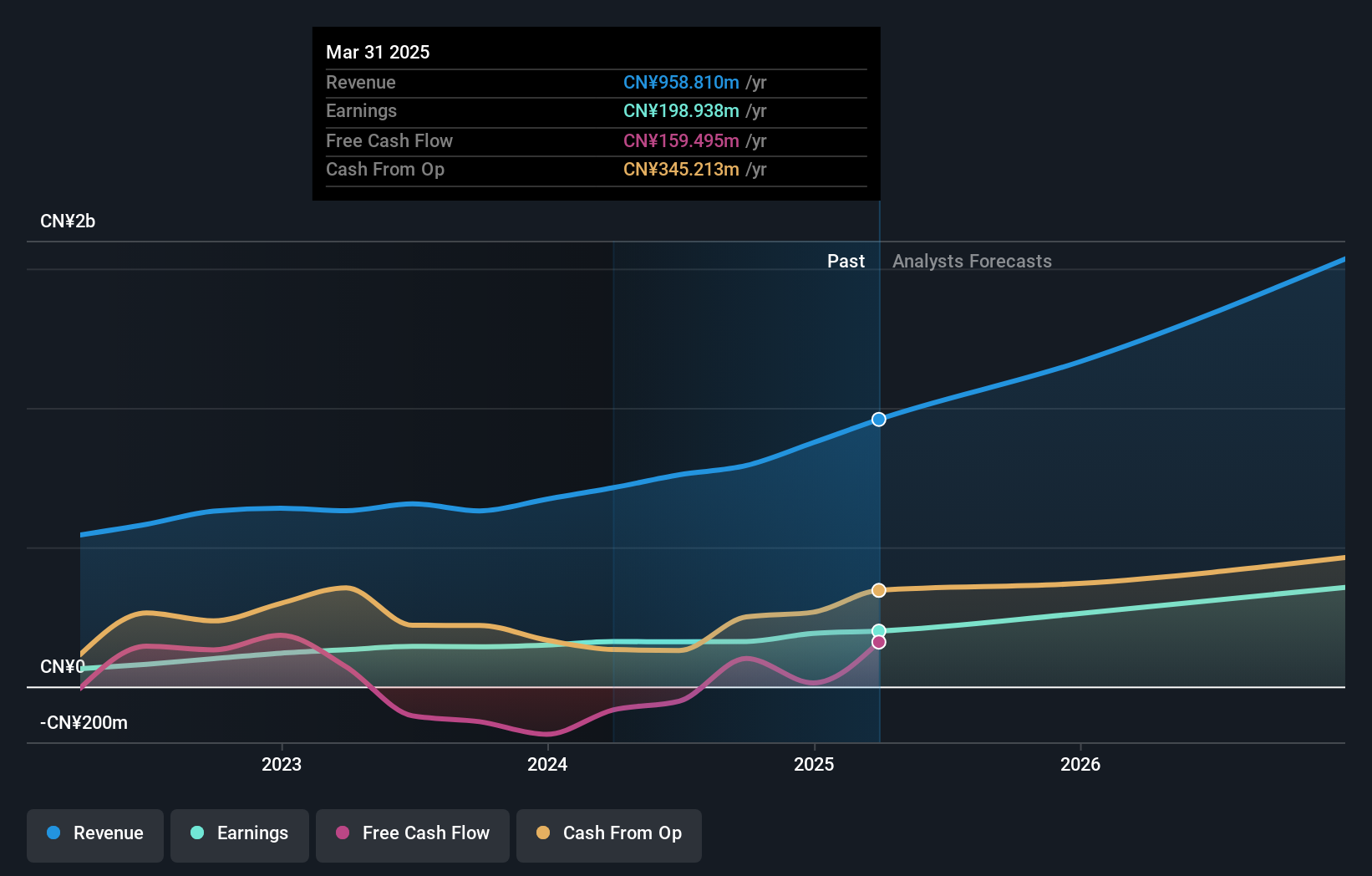

Shenzhen Newway Photomask Making, a small yet promising player in the photomask industry, showcases notable financial strides. Over the past year, earnings increased by 13%, outpacing the electronic industry's growth of 2.3%. The firm's price-to-earnings ratio stands at 31.3x, slightly below China's market average of 34.8x, suggesting it trades at a favorable value relative to peers. With a net debt to equity ratio reduced from 129% to an impressive 48% over five years and interest payments well-covered by EBIT at 19.5x, financial health appears robust. Recent buybacks amounting to CNY 50.66 million further highlight management's confidence in its prospects.

Sakura DevelopmentLtd (TWSE:2539)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sakura Development Co., Ltd specializes in the sale and lease of residential properties, primarily in the Zhongzhangtou area of Taiwan, with a market cap of NT$52.30 billion.

Operations: Sakura Development generates revenue through the sale and lease of residential properties in Taiwan. The company's market capitalization is NT$52.30 billion, reflecting its scale in the real estate sector.

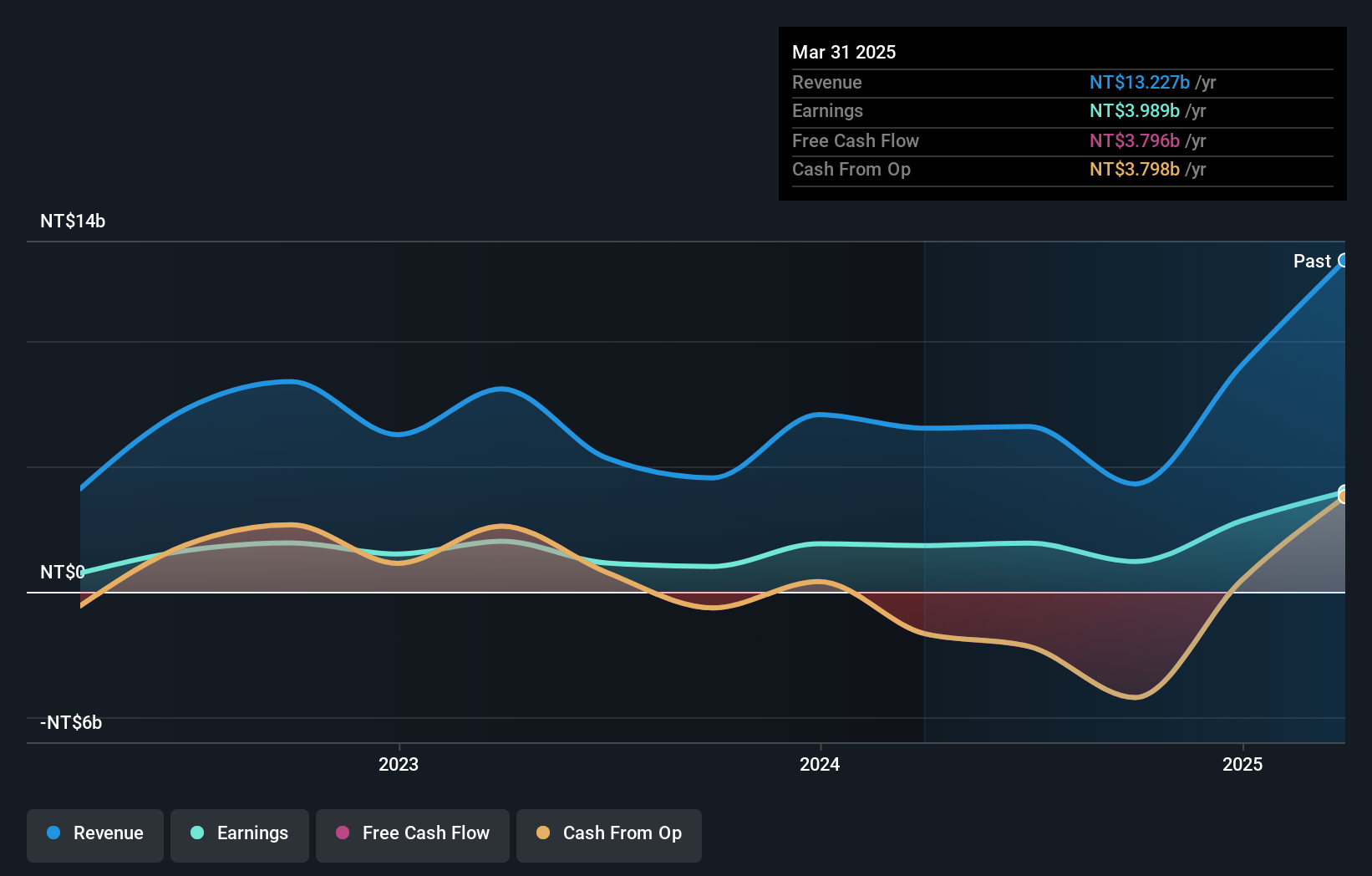

Sakura Development Ltd. has been making strategic moves in the real estate sector with recent land acquisitions in Taiwan, totaling over TWD 1.47 billion. Despite these expansions, the company faced challenges last year, reporting a net loss of TWD 139 million for Q3 compared to a net income of TWD 593 million the previous year. Over five years, earnings have grown at an annual rate of 9.8%, yet their debt-to-equity ratio remains high at around 106%. The company's focus on growth seems evident through its investments but balancing this with financial stability may be key moving forward.

- Unlock comprehensive insights into our analysis of Sakura DevelopmentLtd stock in this health report.

Evaluate Sakura DevelopmentLtd's historical performance by accessing our past performance report.

Make It Happen

- Discover the full array of 4655 Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2539

Sakura DevelopmentLtd

Engages in the sale and lease of residential properties with focus on the Zhongzhangtou area in Taiwan.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives