Alimak Group (OM:ALIG) Margin Expansion Challenges Bearish Narratives as Annual Profits Improve

Reviewed by Simply Wall St

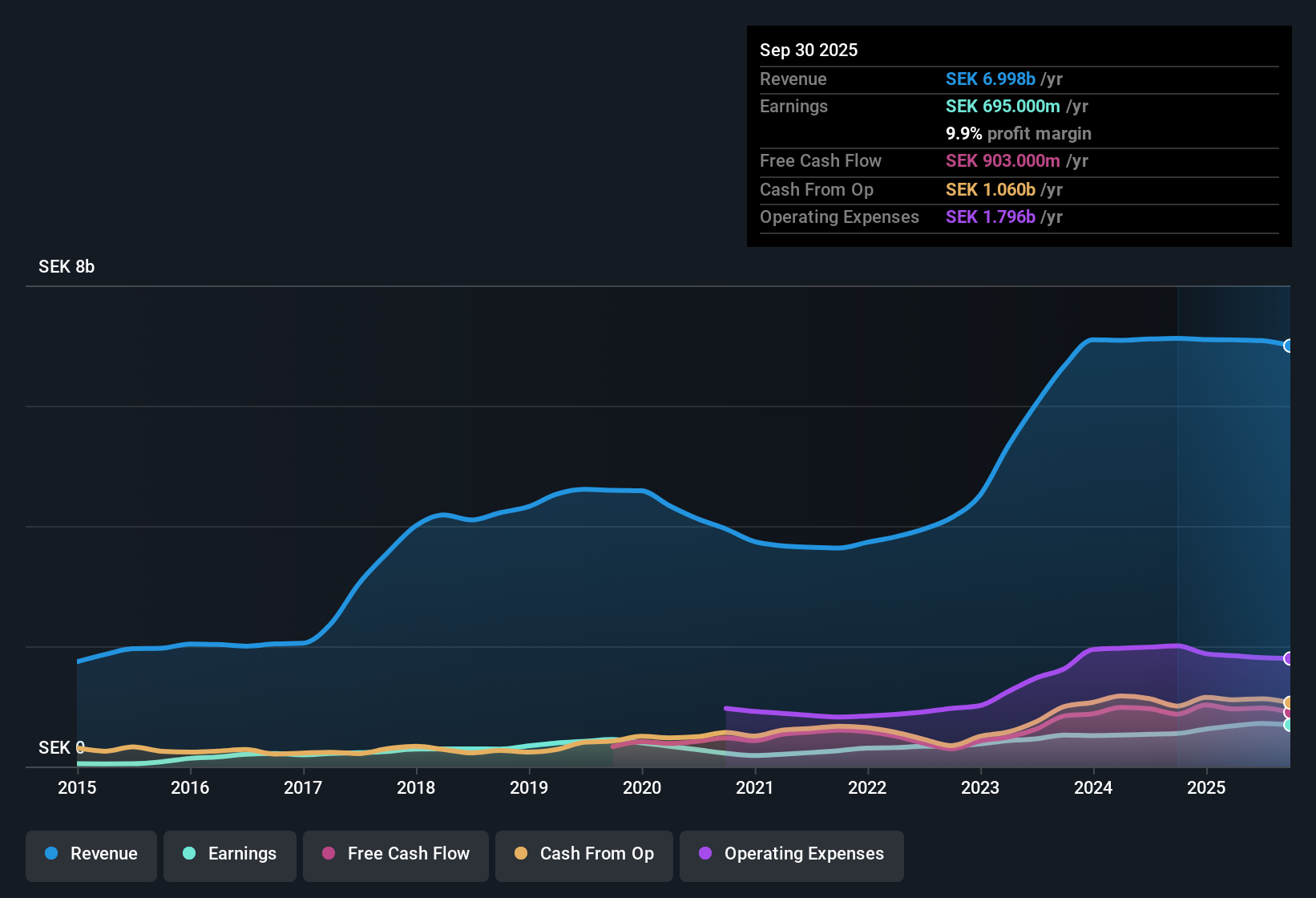

Alimak Group (OM:ALIG) posted annual revenue growth of 4.2%, topping the Swedish market’s 3.6% expectation, while net profit margins strengthened to 10.1% from 7.5% a year prior. EPS growth was robust as well, with earnings increasing 33.6% over the last year, comfortably outpacing the company’s five-year earnings growth trend of 25.9% per year. These solid numbers are driving a positive outlook, although earnings are projected to continue expanding at a slower pace of 11.5% per year going forward, just behind the overall Swedish market.

See our full analysis for Alimak Group.The next section compares these fresh earnings numbers against the current market and community narratives, highlighting where the data reinforces consensus and where it throws a curveball.

See what the community is saying about Alimak Group

Margins Poised for More Gains

- Profit margins are set to climb from 10.1% today to 12.9% over the next three years, according to analyst forecasts. This indicates further improvement in operational efficiency beyond the already strong margin uptick just delivered.

- The analysts' consensus view highlights that ongoing cost efficiency efforts, such as restructuring in Facade Access and a more decentralized divisional structure, are driving fixed costs down. This should pave the way for even higher earnings margins as market demand grows.

- Recent restructuring is aimed directly at divisions with underperformance, linking margin ambitions to tangible operational steps.

- Analysts expect these moves to yield enhanced net profits, with margin expansion seen as a key driver for future upside as efficiency gains are realized.

Consensus sees Alimak’s margin momentum as a durable edge on rivals. See what else they’re factoring into their forecast in the full view. 📊 Read the full Alimak Group Consensus Narrative.

Industry-Leading Valuation Discount

- Alimak trades on a Price-To-Earnings ratio of 21.7x, noticeably below the Swedish Machinery industry’s 23.5x and its peer group at 29.1x. The current share price of SEK147 remains well below its DCF fair value of SEK214.56.

- The analysts' consensus view is that this valuation gap gives the company an extra buffer if industry conditions shift, with continued revenue and earnings growth providing a strong case for the shares to catch up to sector peers.

- Consensus expects that as margins expand and recurring revenues grow, Alimak’s valuation could close the gap versus the wider machinery sector.

- However, analysts caution that lingering profitability challenges in legacy divisions still need to be fully addressed for the market to re-rate the stock.

Analyst Price Target Just Above Market

- The current share price of SEK147 sits about 13.9% below the allowed analyst price target of SEK170.0, highlighting a limited but positive consensus upside based on projected steady growth in earnings and revenue through 2028.

- The analysts' consensus view points out that the modest 8.0% gap between today’s price and target suggests the stock is close to fairly valued, with the bulk of future gains dependent on management’s ability to execute on cost cuts and navigate risks tied to the construction cycle.

- Consensus expects recurring earnings to grow at 11.5% per year going forward. This is a healthy pace, but slightly below the Swedish market, which may temper upside if execution falters.

- Analysts emphasize that ongoing integration of recent acquisitions and addressing low-margin legacy projects are pivotal for the forecasted upside to materialize.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Alimak Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have a different take on these numbers? Share your perspective in just a few minutes and shape your own investment story. Do it your way

A great starting point for your Alimak Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Alimak’s profit margins are improving, lingering challenges in legacy divisions and reliance on cost cuts raise concerns about consistent long-term earnings momentum.

If you want exposure to steadier earnings potential, use our stable growth stocks screener (2090 results) to find companies delivering reliable revenue and profit growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ALIG

Alimak Group

Alimak Group AB (publ) desigs and manufactures vertical access solutions in Europe, Asia, Australia, South and North America, and internationally.

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives