Did TF Bank's (OM:TFBANK) Tier 2 Bond Plans and Lending Surge Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- TF Bank recently mandated ABG Sundal Collier to arrange investor meetings for a potential Tier 2 bond issuance of SEK 150 million, aiming to refinance existing bonds and support general corporate purposes, with redemption of the outstanding SEK 100 million Tier 2 bonds contingent on successful funding.

- The company also reported a 20% year-over-year increase in its loan portfolio, driven by expansion in its credit card and ecommerce solutions segments, reflecting broadening demand for its consumer lending products.

- We’ll examine how the strong growth in lending volumes might shape TF Bank’s investment narrative and future business outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is TF Bank's Investment Narrative?

To stay invested in TF Bank, shareholders need confidence in the bank’s ability to sustain rapid loan growth and manage credit risk, even as the bank’s valuation appears rich compared to sector peers. The recent intention to issue SEK 150 million in Tier 2 bonds to refinance existing debt is unlikely to drastically change near-term catalysts, given the planned redemption of SEK 100 million in outstanding bonds is contingent only on successful funding and early regulatory consent is in place. Instead, the most pressing catalysts remain TF Bank’s ambitious expansion in credit cards and ecommerce lending, driving both profit and revenue growth well ahead of market averages. The biggest risks haven’t disappeared though: a relatively high bad loan ratio, and now added complexity from executive changes, could put pressure on earnings quality if credit conditions shift.

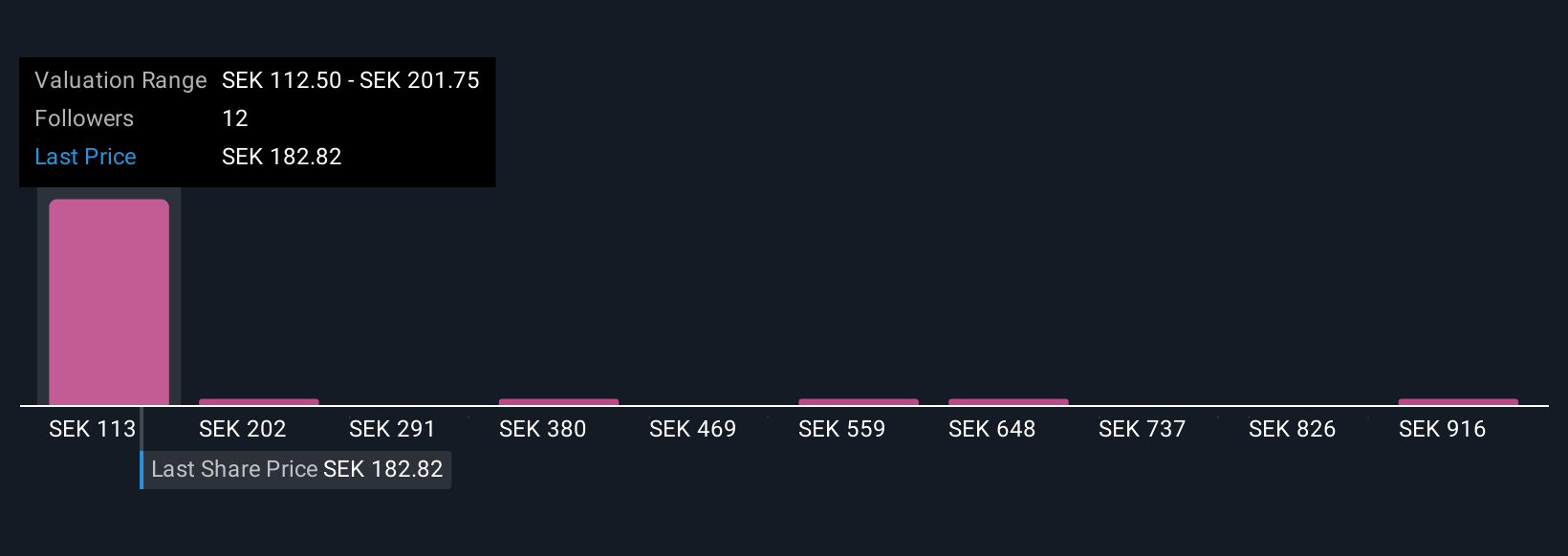

But the high level of bad loans could still surprise some investors. TF Bank's share price has been on the slide but might be up to 47% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 8 other fair value estimates on TF Bank - why the stock might be worth over 5x more than the current price!

Build Your Own TF Bank Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TF Bank research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TF Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TF Bank's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TF Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TFBANK

TF Bank

A digital bank, provides consumer banking services and e-commerce solutions through a proprietary IT platform in Sweden .

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives