A Look at Swedbank (OM:SWED A) Valuation Following Q3 Earnings Decline

Reviewed by Simply Wall St

Swedbank (OM:SWED A) has just released its third quarter earnings, revealing that both net interest income and net income fell compared to the same period last year. This update is expected to shape investor expectations going forward.

See our latest analysis for Swedbank.

Despite the modest reaction to its latest quarterly results, Swedbank’s share price has climbed nearly 32% year-to-date. Its total shareholder return over the past twelve months sits at an impressive 46%. The recent price momentum suggests that, even with softer earnings, the market remains confident in the bank’s long-term potential and improving risk-reward profile.

If you’re interested in finding more opportunities beyond the big Nordic banks, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading near recent highs and analyst targets suggesting a slight downside, investors must now consider whether Swedbank is undervalued after its latest earnings or if the market is already pricing in future growth.

Most Popular Narrative: 4% Overvalued

Swedbank's last close at SEK289.6 now sits above its fair value according to the latest widely followed narrative, which places fair value at SEK278.33. This subtle gap highlights shifting expectations as analysts have become only cautiously more optimistic.

The frequency and consistency of positive target adjustments from major institutions such as Citi and JPMorgan suggest a broadly improved outlook among key market participants. However, despite higher price targets, several analysts have maintained Neutral or Underweight ratings. This indicates lingering caution about near-term execution risks or market conditions.

Want to know which surprising factor drove analysts to edge their targets higher, despite divided outlooks? The narrative’s numbers are built on a major margin shift and a headline earnings assumption. See what stands behind the fair value calculation and whether new optimism is really justified.

Result: Fair Value of $278.33 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant digital adoption or resilient mortgage growth in Swedbank’s core markets could quickly challenge this current and more conservative outlook.

Find out about the key risks to this Swedbank narrative.

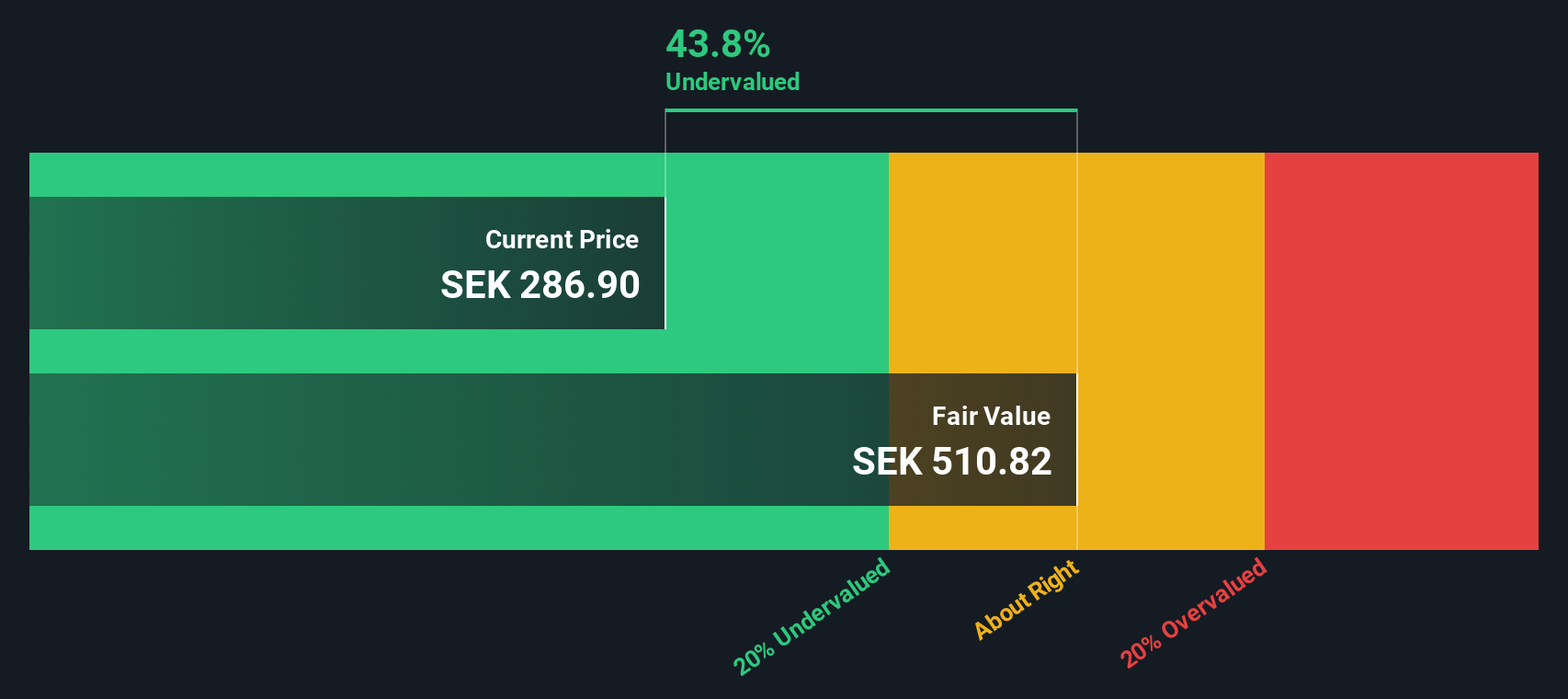

Another View: Discounted Cash Flow Tells a Different Story

While the fair value narrative uses future profits and market targets to judge Swedbank as overvalued, our SWS DCF model tells a very different story. On this basis, Swedbank appears to be trading far below its intrinsic value, suggesting a possible opportunity the market is overlooking. Which scenario will play out for investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Swedbank Narrative

If you see things differently or want to dig into the numbers yourself, you can develop your own perspective on Swedbank in just a few minutes, and Do it your way.

A great starting point for your Swedbank research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Serious investors don’t just wait for headlines; they seize the edge by analyzing hand-picked investments with standout potential. Don’t miss your chance to do the same.

- Supercharge your passive income by checking out these 21 dividend stocks with yields > 3%, designed for high-yield seekers targeting reliable stocks paying over 3%.

- Ride the surging wave of technological innovation and unlock potential with these 26 AI penny stocks, focusing on businesses at the forefront of the artificial intelligence revolution.

- Get ahead of the crowd and search for hidden gems among these 3578 penny stocks with strong financials with strong financials and massive growth upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SWED A

Swedbank

Provides various banking products and services to private and corporate customers in Sweden, Estonia, Latvia, Lithuania, Norway, the United States, Finland, Denmark, Luxembourg, and China.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives