As global markets navigate through a period of mixed economic signals and varying regional performances, Sweden's market offers a unique landscape for investors seeking stability through dividend stocks. Amidst this backdrop, understanding the fundamentals of solid dividend-paying stocks becomes crucial, particularly in an environment where conservative investment strategies could be beneficial.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Zinzino (OM:ZZ B) | 4.30% | ★★★★★★ |

| Betsson (OM:BETS B) | 5.59% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 4.65% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.56% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.43% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.55% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.99% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.41% | ★★★★★☆ |

| Bilia (OM:BILI A) | 4.60% | ★★★★☆☆ |

| Husqvarna (OM:HUSQ B) | 3.49% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

BioGaia (OM:BIOG B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BioGaia AB, a healthcare company based in Sweden, specializes in probiotic products with a market capitalization of approximately SEK 12.43 billion.

Operations: BioGaia AB generates its revenue primarily through two segments: Pediatrics at SEK 999.84 million and Adult Health at SEK 293.44 million.

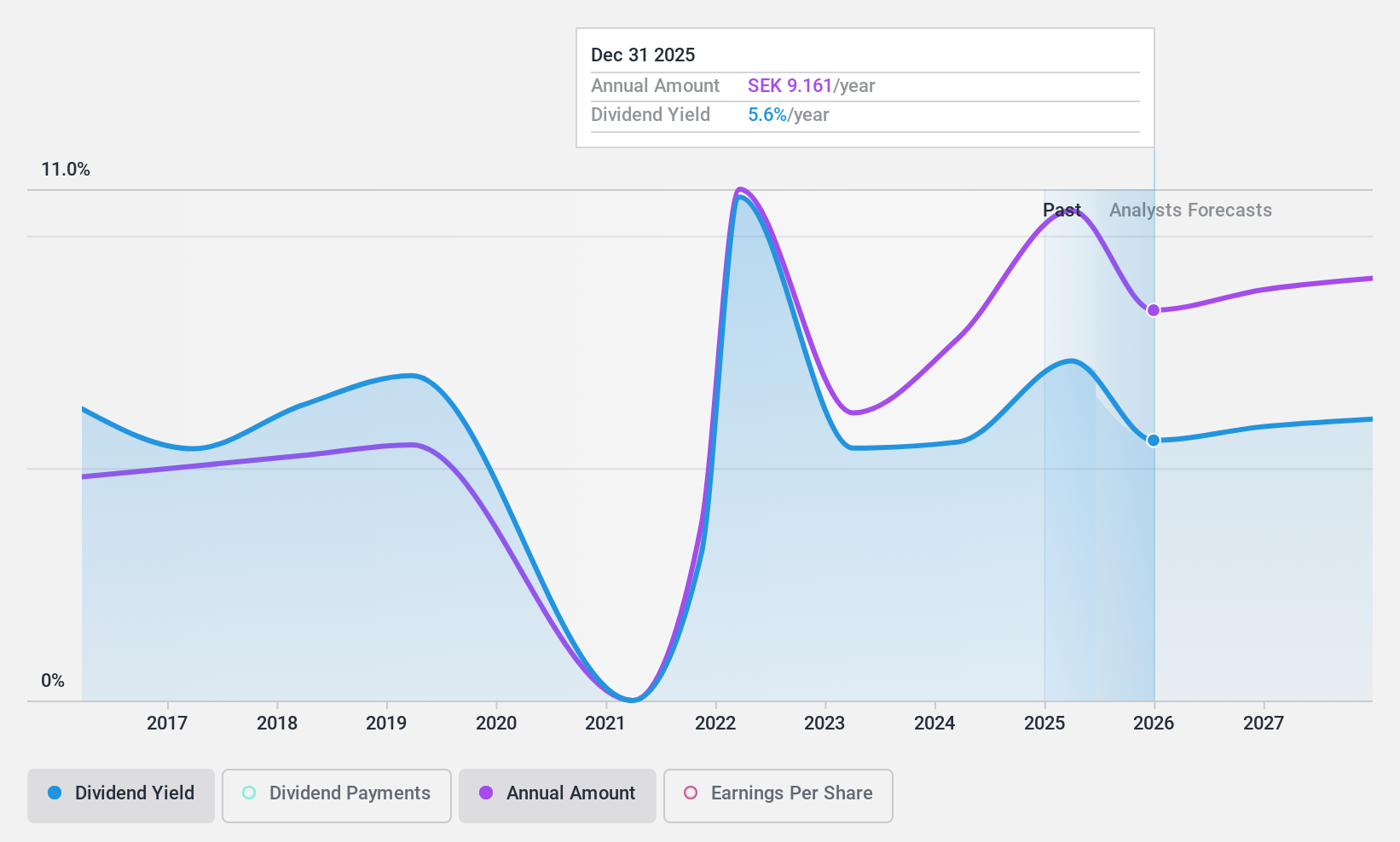

Dividend Yield: 5.6%

BioGaia's dividend yield of 5.61% ranks in the top 25% in Sweden, but its sustainability is questionable with a cash payout ratio of 215.5%, indicating dividends are not well covered by cash flows. Although dividends have increased over the past decade, payments have been volatile and unreliable. Recent expansion into Australia and New Zealand could bolster market presence but has yet to impact financial stability or dividend coverage directly, as evidenced by recent earnings showing modest growth.

- Navigate through the intricacies of BioGaia with our comprehensive dividend report here.

- The analysis detailed in our BioGaia valuation report hints at an inflated share price compared to its estimated value.

HEXPOL (OM:HPOL B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HEXPOL AB (publ) specializes in the development, manufacturing, and sale of polymer compounds and engineered products across Sweden, Europe, the Americas, and Asia, with a market capitalization of approximately SEK 40.16 billion.

Operations: HEXPOL AB generates SEK 20.48 billion from its Compounding segment and SEK 1.59 billion from its Engineered Products division.

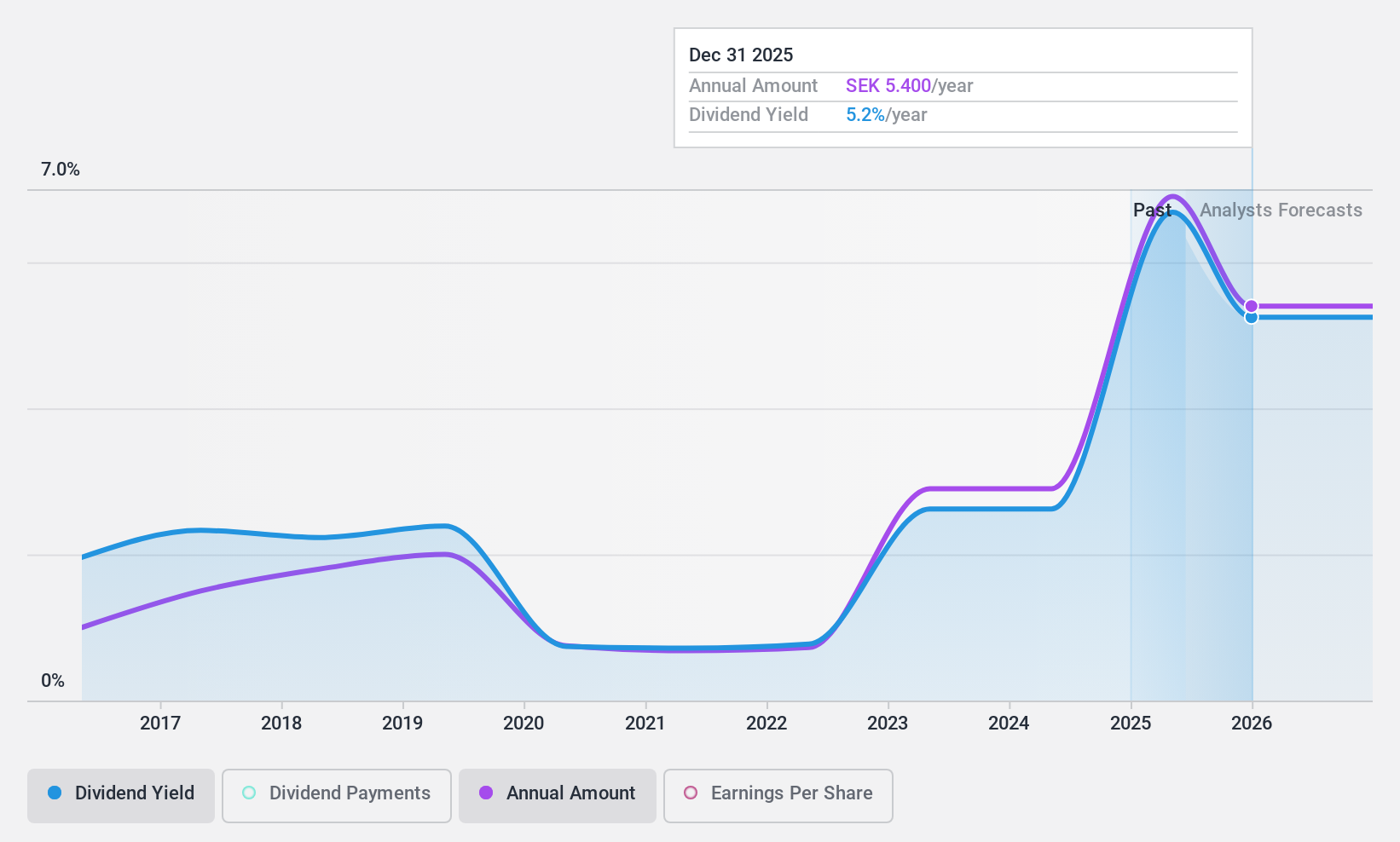

Dividend Yield: 3.4%

HEXPOL AB, under new leadership with CEO Klas Dahlberg since July 2024, maintains a stable dividend history with a recent increase to SEK 6.00 per share as of April 2024. Despite its lower yield of 3.43% compared to Sweden's top dividend payers, the company's dividends are well-supported by both earnings and cash flows, each covering approximately 54%. The firm is actively pursuing acquisitions to potentially enhance future growth and shareholder returns.

- Dive into the specifics of HEXPOL here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that HEXPOL is trading behind its estimated value.

Skandinaviska Enskilda Banken (OM:SEB A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Skandinaviska Enskilda Banken AB (publ), commonly known as SEB, is a Swedish financial services group offering corporate, retail, investment, and private banking services with a market capitalization of approximately SEK 315.27 billion.

Operations: Skandinaviska Enskilda Banken AB generates revenue across several segments, with SEK 31.98 billion from Large Corporates & Financial Institutions, SEK 25.42 billion from Corporate & Private Customers (excluding Private Wealth Management & Family Office), SEK 13.55 billion from Baltic operations, SEK 4.46 billion from Private Wealth Management & Family Office, SEK 3.75 billion from Life insurance services, and SEK 3.16 billion in Investment Management.

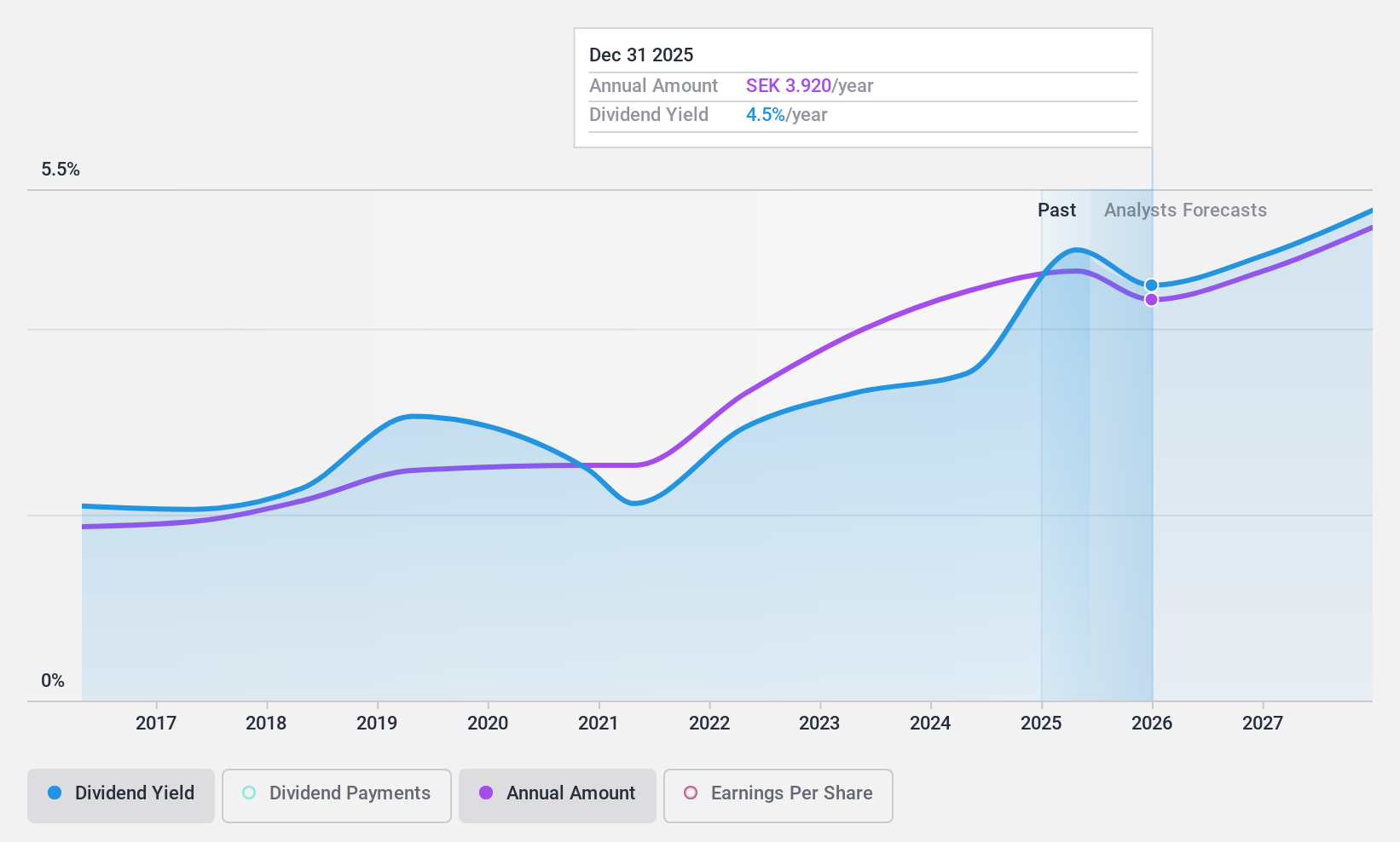

Dividend Yield: 5.6%

Skandinaviska Enskilda Banken AB, while trading at 49.4% below its estimated fair value, offers a dividend yield higher than the Swedish market average. However, its dividends have shown volatility over the past decade despite recent growth and a payout ratio of 46.3%, suggesting reasonable coverage by earnings. Recent financials show an increase in net interest income and net income in Q1 2024, indicating some level of earnings stability which supports ongoing dividend payments.

- Get an in-depth perspective on Skandinaviska Enskilda Banken's performance by reading our dividend report here.

- Our valuation report unveils the possibility Skandinaviska Enskilda Banken's shares may be trading at a premium.

Make It Happen

- Take a closer look at our Top Dividend Stocks list of 22 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SEB A

Skandinaviska Enskilda Banken

Provides corporate, retail, investment, and private banking services.

Excellent balance sheet established dividend payer.