Why Did Norion Bank (OM:NORION) Surge 10% After Strong Q3 Results and Share Buyback Completion?

Reviewed by Sasha Jovanovic

- Norion Bank AB reported third quarter 2025 results, highlighting year-over-year growth in net interest income to SEK 832 million and net income to SEK 340 million, alongside the completion of its NOK 500 million share buyback program covering 3.92% of shares.

- This combination of stronger financial results and a completed buyback initiative reflects the company's efforts to enhance shareholder value and operational efficiency.

- We'll explore how Norion Bank's earnings growth and capital return via share repurchases shape its current investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Norion Bank's Investment Narrative?

To be on board with Norion Bank as a shareholder, you’re essentially buying into a story of steady, if not spectacular, earnings growth while the company works to reward investors through direct capital returns. The recent completion of a nearly 4% share buyback, paired with improved third quarter earnings, sends a signal that management is focused on both operational strength and shareholder value creation. In the short term, catalysts remain tied to ongoing earnings delivery and further capital allocation decisions, as the business continues to outpace many industry peers in key valuation metrics. With the new buyback now reflected in the share count and recent price appreciation factored in, there is little evidence that risk factors, such as the high level of bad loans or modest return on equity, have fundamentally shifted since prior analysis. However, for anyone considering exposure, monitoring how credit risks evolve from here is still essential.

In contrast, the bank’s level of bad loans could surprise some investors, details ahead.

Exploring Other Perspectives

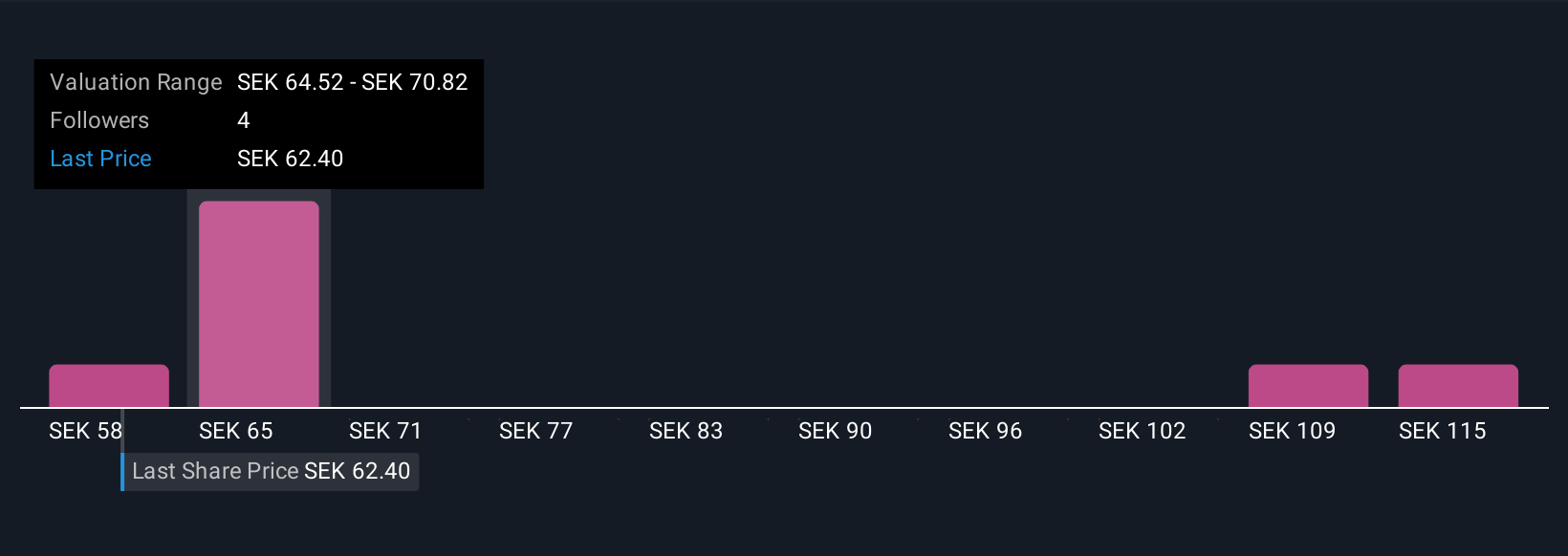

Explore 4 other fair value estimates on Norion Bank - why the stock might be worth 14% less than the current price!

Build Your Own Norion Bank Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Norion Bank research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Norion Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Norion Bank's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norion Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NORION

Norion Bank

Provides financial solutions for medium-sized corporates and real estate companies, merchants, and private individuals in Sweden, Germany, Norway, Denmark, Finland, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives