Volvo Cars (OM:VOLCAR B) Net Margin Falls to 0.1%, Testing Bullish Recovery Expectations

Reviewed by Simply Wall St

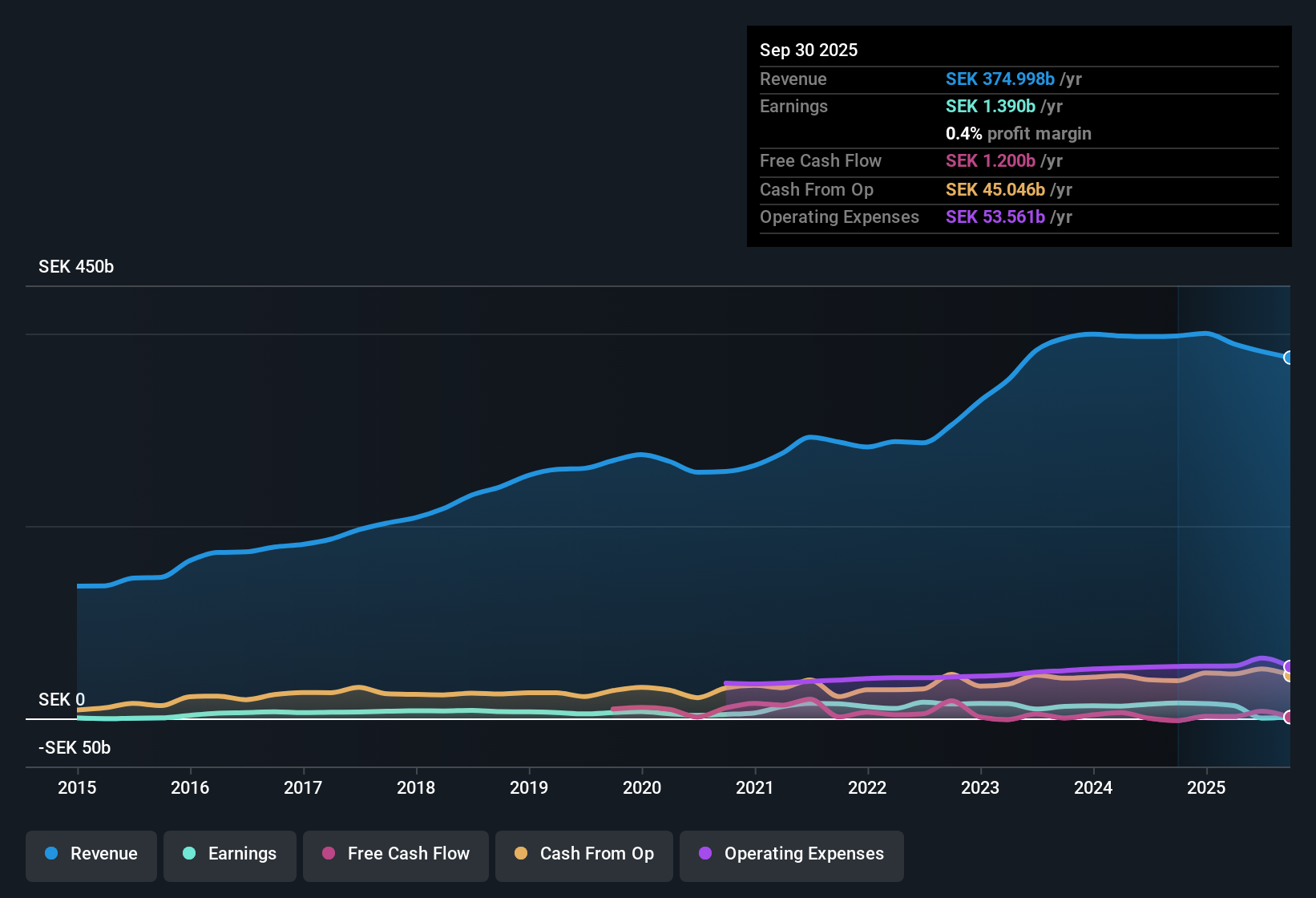

Volvo Car AB (publ.) (OM:VOLCAR B) reported net profit margins of 0.1% for the recent period, a sharp decrease from last year’s 3.7%. While the company experienced negative earnings growth over the past year, five-year average annual earnings growth stands at 2.2%. Looking ahead, consensus forecasts point to a robust 47.1% annual earnings growth and 5.1% revenue growth, both outpacing the wider Swedish market. The current share price of SEK31.41 is well below the estimated fair value of SEK61.47. Value indicators versus peers remain attractive despite recent margin compression and short-term instability in the stock price.

See our full analysis for Volvo Car AB (publ.).Next, we will see how these earnings numbers compare with prevailing narratives in the market, examining whether the results challenge or confirm long-held investor views.

See what the community is saying about Volvo Car AB (publ.)

Margin Pressures Persist Despite Turnaround Program

- Net profit margins fell sharply to 0.1%, down from 3.7% in the prior year. Earnings per share are expected to grow to SEK 6.87 by 2028 from their current low base.

- According to analysts' consensus, profit margins are forecast to rebound to 4.3% within three years. Ongoing trade barriers and higher localization costs continue to cap profitability and cash flow growth.

- Intense EV sector competition and rising Chinese tariffs are driving up operating costs and suppressing free cash flow. These factors reinforce concerns over earnings stabilization.

- Aggressive cost control measures, including Volvo’s SEK 18 billion program, are already supporting a structural reset in the cost base. If sustained, these efforts could improve margins and speed the return to positive cash flow.

Curious how earnings compression and the pivot to margin recovery are shaping the overall Volvo Car AB narrative in the analyst community? 📊 Read the full Volvo Car AB (publ.) Consensus Narrative.

Valuation Gap to DCF Fair Value Remains Wide

- The current share price is SEK31.41 and a DCF fair value is calculated at SEK61.47. This valuation disconnect underscores room for upside, far surpassing both the 0.2x price-to-sales ratio and equity sector benchmarks.

- Analysts' consensus view underscores that although analysts on average target SEK19.97 per share, which is 16.1% below the current market price, they believe the stock's discount to fair value only holds if Volvo delivers on ambitious earnings and margin expansion targets by 2028.

- Consensus expects earnings of SEK17.7 billion in 2028 (versus SEK403 million today) but also cautions that this outcome requires sharper cost cuts, successful EV localizations, and steady top-line growth to close the wide valuation gap.

- The notable divergence between DCF fair value and the analyst target price highlights persistent skepticism about execution. Absolute valuation multiples remain very favorable relative to peers and industry.

Chinese Market Exposure: Key Driver and Source of Volatility

- Looming exposure to the Chinese market in both sales and production is a double-edged sword, delivering growth but amplifying risks from local policy and tariffs.

- Analysts' consensus view cautions that Volvo’s reliance on the Chinese market introduces volatility, with ongoing geopolitical frictions and regulatory uncertainty pressuring both margins and revenue growth.

- Rising trade barriers and shifting local policies have triggered production moves and asset impairments, directly impacting current net profit margins and suppressing free cash flow.

- Consensus still sees expansion in China and the U.S. as long-term upside catalysts, but only if Volvo successfully localizes manufacturing and adapts its supply chain faster than rivals.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Volvo Car AB (publ.) on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? In just a few minutes, you can capture your viewpoint and contribute to the story yourself. Do it your way

A great starting point for your Volvo Car AB (publ.) research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Volvo Car AB (publ.)’s earnings remain pressured by thin margins, volatile free cash flow, and persistent uncertainty over profit stabilization in a challenging sector.

If you want to prioritize steadier earnings and revenue, search with stable growth stocks screener (2088 results) and discover companies offering more consistent growth no matter the economic climate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VOLCAR B

Volvo Car AB (publ.)

Designs, develops, manufactures, markets, and sells cars in Sweden and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives