Volvo Cars (OM:VOLCAR B): Assessing Valuation Following Blowout Q3 Profits and Share Price Surge

Reviewed by Simply Wall St

Volvo Car AB (publ.) (OM:VOLCAR B) stock jumped more than 30% to its highest level in 15 months after the company reported third-quarter profits that exceeded expectations, driven by rapid cost-cutting and operational improvements.

See our latest analysis for Volvo Car AB (publ.).

Volvo Car AB (publ.)’s recent surge reflects more than just a strong quarter. The stock’s remarkable 47% share price return in the past week is part of a broader rebound, with year-to-date gains of 34%. This momentum is increasing as investors respond to operational improvements, significant progress in electric vehicle launches, and new milestones in both China and the US. While the one-year total shareholder return of 34% is encouraging, current enthusiasm is also about a renewed sense of growth potential as the company strengthens its place in the evolving global auto market.

If Volvo’s turnaround and burst of momentum have you thinking bigger, now’s a smart time to explore what’s happening across the sector with See the full list for free.

But with such a sharp rally on the back of strong results, investors now face the classic dilemma: has Volvo’s recent outperformance left room for more upside, or is the market already pricing in the company’s growth ambitions?

Most Popular Narrative: 75% Overvalued

At SEK18.14 per share, the fair value estimate lands far below Volvo Car AB (publ.)'s last close of SEK31.7. This means the stock is seen as trading well above its calculated worth according to the most followed narrative. This gap draws attention to serious questions about the pace of future growth and the likelihood that current optimism has run ahead of near-term fundamentals.

Ongoing geopolitical instability and regulatory uncertainty around emissions standards necessitate costly compliance investments and supply chain adaptations. These could further strain net margins and delay earnings improvement. Elevated investment needs for electrification, new technologies, and capacity expansions are suppressing free cash flow and delaying the timeline to return to sustainable cash generation, heightening risks to earnings and capital allocation.

Want to know what’s driving this sky-high valuation call? The narrative hinges on critical earnings shifts and surprisingly bold long-term financial targets. Wonder which forecasts shaped this controversial fair value? Dive in to uncover the factors behind the headlines.

Result: Fair Value of $18.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, successful ramp-up of local EV production or stronger than expected cost-cutting could rapidly boost margins and challenge concerns about near-term earnings growth.

Find out about the key risks to this Volvo Car AB (publ.) narrative.

Another View: Is DCF Pointing to Deep Value?

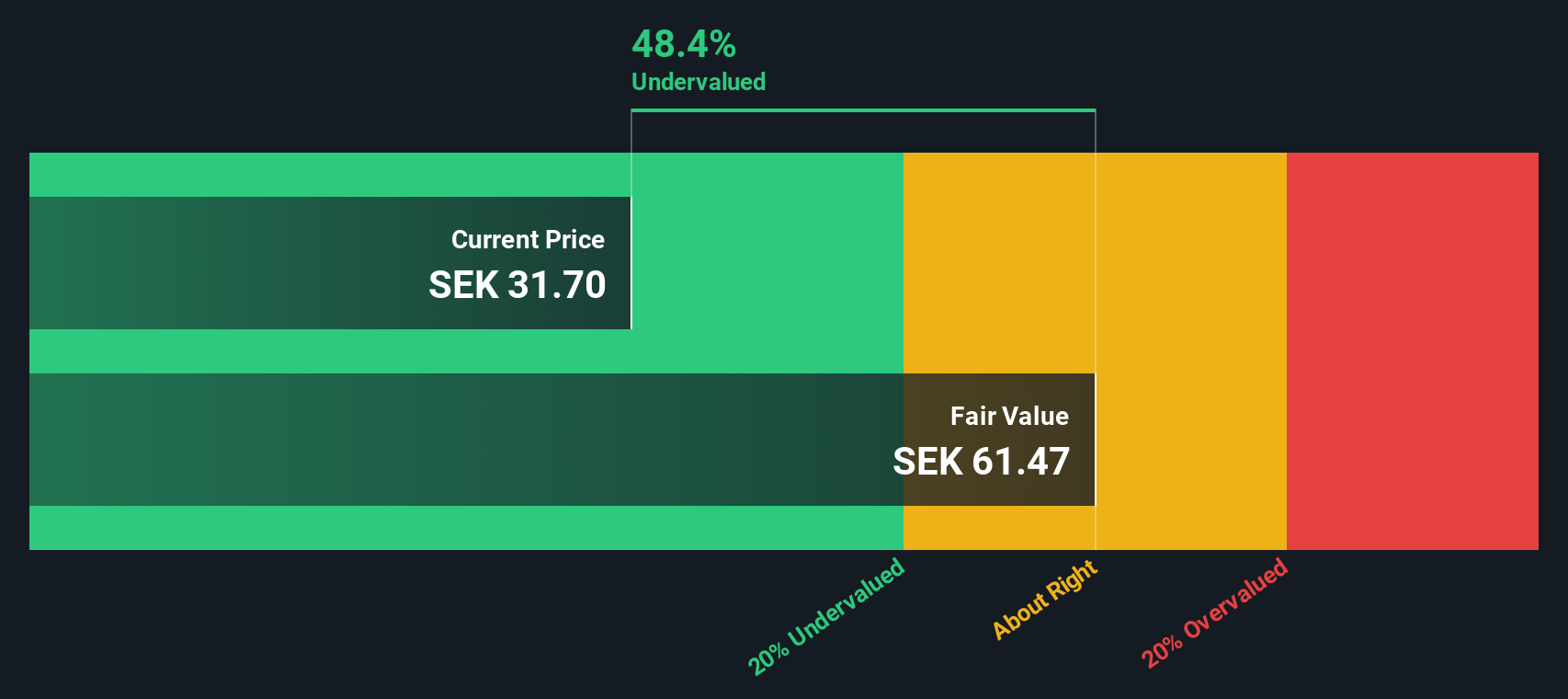

While the popular narrative says Volvo Car AB (publ.) is overvalued, our SWS DCF model comes to a starkly different conclusion. This model values the stock at SEK61.47, which is nearly double the current share price. Could this mean the market is missing substantial long-term potential, or is it pricing in risks the model overlooks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Volvo Car AB (publ.) for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Volvo Car AB (publ.) Narrative

If you have a different perspective or want to dig into the numbers on your own terms, you can quickly shape your own insights right now: Do it your way

A great starting point for your Volvo Car AB (publ.) research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Investing Moves?

Seize your next opportunity using Simply Wall Street’s screeners, which pinpoint stocks with breakout potential, high yields, and exposure to tomorrow’s megatrends, tailored just for you.

- Unlock the upside of fast movers by checking out these 3567 penny stocks with strong financials. These are building momentum with strong financials and potential for outsized returns.

- Boost your growth portfolio by targeting these 877 undervalued stocks based on cash flows. These offer rare bargains based on their solid cash flows.

- Tap into the healthcare revolution by viewing these 33 healthcare AI stocks, which is helping to transform medicine through artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VOLCAR B

Volvo Car AB (publ.)

Designs, develops, manufactures, markets, and sells cars in Sweden and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives