Volvo Car AB (OM:VOLCAR B) Surges 47.1% After Profit Jump and Electric Hybrid Expansion—What's Changed

Reviewed by Sasha Jovanovic

- In October 2025, Volvo Car AB (publ.) reported a sharp increase in quarterly profit fueled by accelerated cost-cutting efforts, alongside the debut of its next-generation long-range hybrid XC70 in China and further expansion of electric and hybrid manufacturing in the US and EU.

- Despite a year-over-year fall in sales volume, the company's swift operational turnaround and strong reception of new electric and hybrid models highlighted Volvo's capacity to adapt to changing market and regulatory demands.

- We'll explore how Volvo's rapid cost reductions and expanding electric lineup could reshape its investment narrative moving forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Volvo Car AB (publ.) Investment Narrative Recap

To own Volvo Car AB (publ.) stock today, you need continued conviction in the company’s ability to turn rapid product innovation and strong operational discipline into sustainable earnings growth. The October 2025 results spotlight faster-than-expected cost reductions and a rebound in quarterly profit, but persistent sales declines remind us the most critical short-term catalyst remains the smooth ramp-up and market acceptance of new electric models, while the biggest immediate risk is ongoing price pressure and sluggish underlying demand, which could threaten revenue momentum if setbacks arise. While these recent headlines mark progress on costs, they do not fundamentally change the importance of successful launches and volume recovery to the broader investment narrative.

Among the latest announcements, the upcoming launch of the fully electric EX60 SUV in January 2026 is especially relevant. As the EX60 targets the largest electric vehicle segment and aims to strengthen Volvo’s position in the mid-size SUV market, its reception and ramp-up will directly influence whether the company’s business transition delivers on volume and margin ambitions, making it a pivotal development to watch for those focused on near-term catalysts.

Yet, with all this optimism, investors should not overlook the potential risk that even with new product success, underlying market growth for EVs may...

Read the full narrative on Volvo Car AB (publ.) (it's free!)

Volvo Car AB (publ.)'s narrative projects SEK 413.0 billion in revenue and SEK 17.7 billion in earnings by 2028. This requires 2.7% yearly revenue growth and an increase in earnings of SEK 17.3 billion from the current SEK 403.0 million.

Uncover how Volvo Car AB (publ.)'s forecasts yield a SEK18.14 fair value, a 43% downside to its current price.

Exploring Other Perspectives

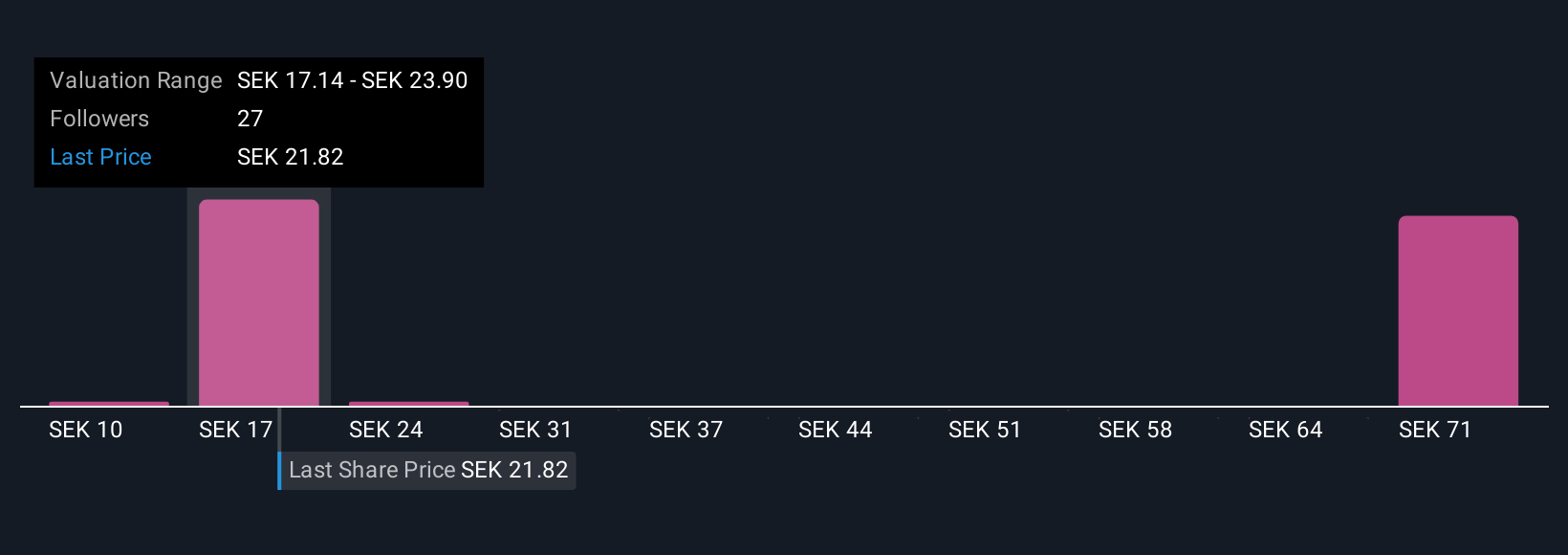

Simply Wall St Community members provided 12 distinct fair value ranges for Volvo Car AB (publ.), stretching from SEK10.38 up to SEK61.47 per share. While community estimates reflect sharp differences, ongoing volume pressure and price competition continue to shape expectations for the company’s trajectory. Explore multiple viewpoints to broaden your analysis.

Explore 12 other fair value estimates on Volvo Car AB (publ.) - why the stock might be worth as much as 94% more than the current price!

Build Your Own Volvo Car AB (publ.) Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Volvo Car AB (publ.) research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Volvo Car AB (publ.) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Volvo Car AB (publ.)'s overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VOLCAR B

Volvo Car AB (publ.)

Designs, develops, manufactures, markets, and sells cars in Sweden and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives