Stock Analysis

- Sweden

- /

- Auto Components

- /

- OM:BULTEN

Bulten's (STO:BULTEN) Solid Earnings Have Been Accounted For Conservatively

Bulten AB (publ)'s (STO:BULTEN) recent earnings report didn't offer any surprises, with the shares unchanged over the last week. Our analysis suggests that shareholders might be missing some positive underlying factors in the earnings report.

View our latest analysis for Bulten

Zooming In On Bulten's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

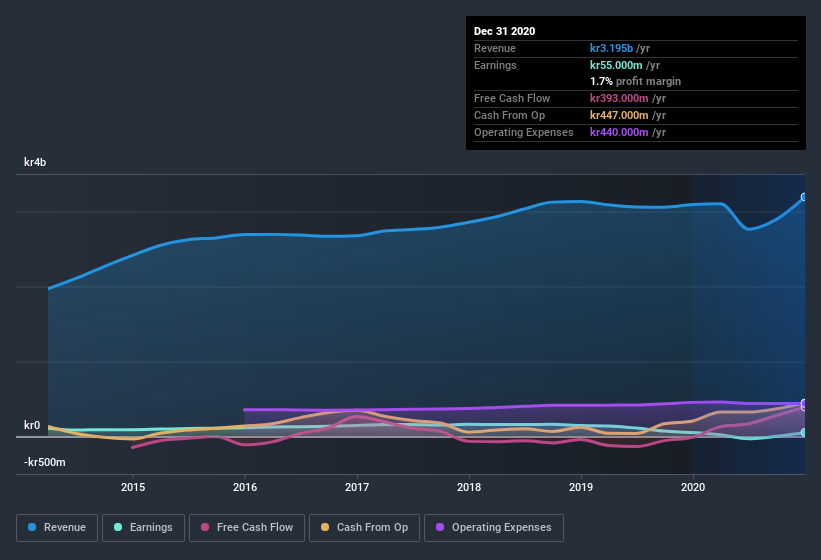

For the year to December 2020, Bulten had an accrual ratio of -0.20. That indicates that its free cash flow quite significantly exceeded its statutory profit. To wit, it produced free cash flow of kr393m during the period, dwarfing its reported profit of kr55.0m. Given that Bulten had negative free cash flow in the prior corresponding period, the trailing twelve month resul of kr393m would seem to be a step in the right direction. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Bulten issued 5.0% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Bulten's EPS by clicking here.

A Look At The Impact Of Bulten's Dilution on Its Earnings Per Share (EPS).

Unfortunately, Bulten's profit is down 66% per year over three years. The good news is that profit was up 4.4% in the last twelve months. On the other hand, earnings per share are pretty much flat, over the last twelve months. And so, you can see quite clearly that dilution is influencing shareholder earnings.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if Bulten can grow EPS persistently. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Bulten's Profit Performance

At the end of the day, Bulten is diluting shareholders which will dampen earnings per share growth, but its accrual ratio showed it can back up its profits with free cash flow. Considering all the aforementioned, we'd venture that Bulten's profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. So while earnings quality is important, it's equally important to consider the risks facing Bulten at this point in time. For example - Bulten has 2 warning signs we think you should be aware of.

Our examination of Bulten has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Bulten, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Bulten is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:BULTEN

Bulten

Manufactures and distributes fasteners and related services and solutions for light vehicles, heavy commercial vehicles, automotive suppliers, consumer electronics, and other industries in Sweden, Poland, Germany, the United Kingdom, rest of Europe, the United States, China, Taiwan, and internationally.

Excellent balance sheet average dividend payer.