- Saudi Arabia

- /

- Telecom Services and Carriers

- /

- SASE:7040

Etihad Atheeb Telecommunication Company (TADAWUL:7040) Soars 29% But It's A Story Of Risk Vs Reward

The Etihad Atheeb Telecommunication Company (TADAWUL:7040) share price has done very well over the last month, posting an excellent gain of 29%. Looking back a bit further, it's encouraging to see the stock is up 42% in the last year.

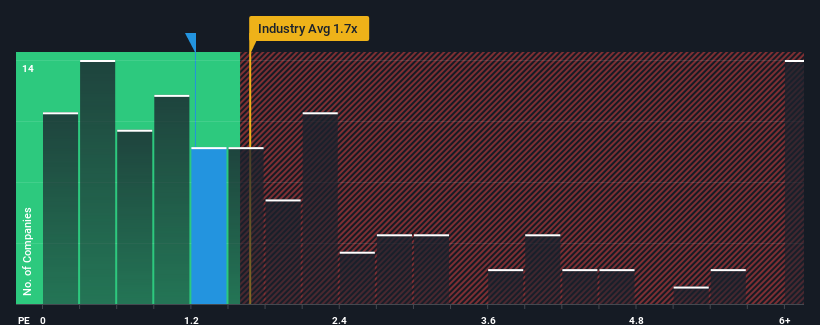

Even after such a large jump in price, it's still not a stretch to say that Etihad Atheeb Telecommunication's price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" compared to the Telecom industry in Saudi Arabia, where the median P/S ratio is around 1.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Etihad Atheeb Telecommunication

What Does Etihad Atheeb Telecommunication's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Etihad Atheeb Telecommunication has been doing very well. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Etihad Atheeb Telecommunication will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Etihad Atheeb Telecommunication would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 72% last year. The strong recent performance means it was also able to grow revenue by 57% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 5.5%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Etihad Atheeb Telecommunication is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Etihad Atheeb Telecommunication's P/S

Its shares have lifted substantially and now Etihad Atheeb Telecommunication's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To our surprise, Etihad Atheeb Telecommunication revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

You need to take note of risks, for example - Etihad Atheeb Telecommunication has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Etihad Atheeb Telecommunication might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:7040

Etihad Atheeb Telecommunication

Provides telecommunication products and services for individuals and businesses in the Kingdom of Saudi Arabia and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success