- Saudi Arabia

- /

- Wireless Telecom

- /

- SASE:7020

Etihad Etisalat Company's (TADAWUL:7020) Recent Stock Performance Looks Decent- Can Strong Fundamentals Be the Reason?

Most readers would already know that Etihad Etisalat's (TADAWUL:7020) stock increased by 4.6% over the past three months. Given its impressive performance, we decided to study the company's key financial indicators as a company's long-term fundamentals usually dictate market outcomes. Specifically, we decided to study Etihad Etisalat's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for Etihad Etisalat

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Etihad Etisalat is:

14% = ر.س2.6b ÷ ر.س18b (Based on the trailing twelve months to June 2024).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each SAR1 of shareholders' capital it has, the company made SAR0.14 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Etihad Etisalat's Earnings Growth And 14% ROE

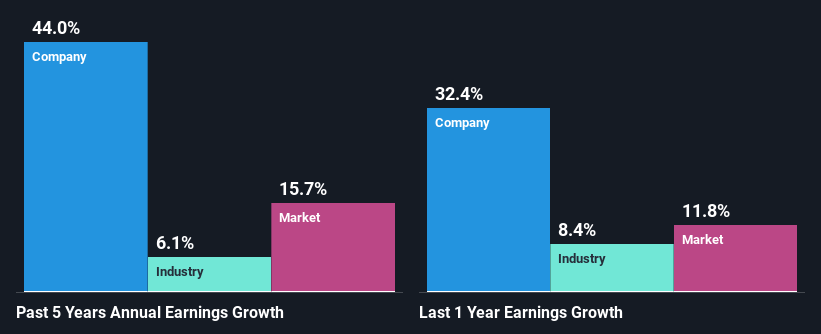

It is hard to argue that Etihad Etisalat's ROE is much good in and of itself. However, when compared to the industry average of 10%, we do feel there's definitely more to the company. Particularly, the substantial 44% net income growth seen by Etihad Etisalat over the past five years is impressive . That being said, the company does have a low ROE to begin with, just that its higher than the industry average. Therefore, the growth in earnings could also be the result of other factors. Such as high earnings retention or an efficient management in place.

Next, on comparing with the industry net income growth, we found that Etihad Etisalat's growth is quite high when compared to the industry average growth of 6.1% in the same period, which is great to see.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. What is 7020 worth today? The intrinsic value infographic in our free research report helps visualize whether 7020 is currently mispriced by the market.

Is Etihad Etisalat Efficiently Re-investing Its Profits?

Etihad Etisalat has a three-year median payout ratio of 48% (where it is retaining 52% of its income) which is not too low or not too high. This suggests that its dividend is well covered, and given the high growth we discussed above, it looks like Etihad Etisalat is reinvesting its earnings efficiently.

Additionally, Etihad Etisalat has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders. Our latest analyst data shows that the future payout ratio of the company is expected to rise to 62% over the next three years. However, the company's ROE is not expected to change by much despite the higher expected payout ratio.

Summary

In total, we are pretty happy with Etihad Etisalat's performance. Specifically, we like that it has been reinvesting a high portion of its profits at a moderate rate of return, resulting in earnings expansion. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Valuation is complex, but we're here to simplify it.

Discover if Etihad Etisalat might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:7020

Etihad Etisalat

Through its subsidiaries, establishes and operates mobile wireless telecommunication and fiber optic networks in the Kingdom of Saudi Arabia.

Undervalued with excellent balance sheet.