- Saudi Arabia

- /

- Telecom Services and Carriers

- /

- SASE:7010

Investors Appear Satisfied With Saudi Telecom Company's (TADAWUL:7010) Prospects

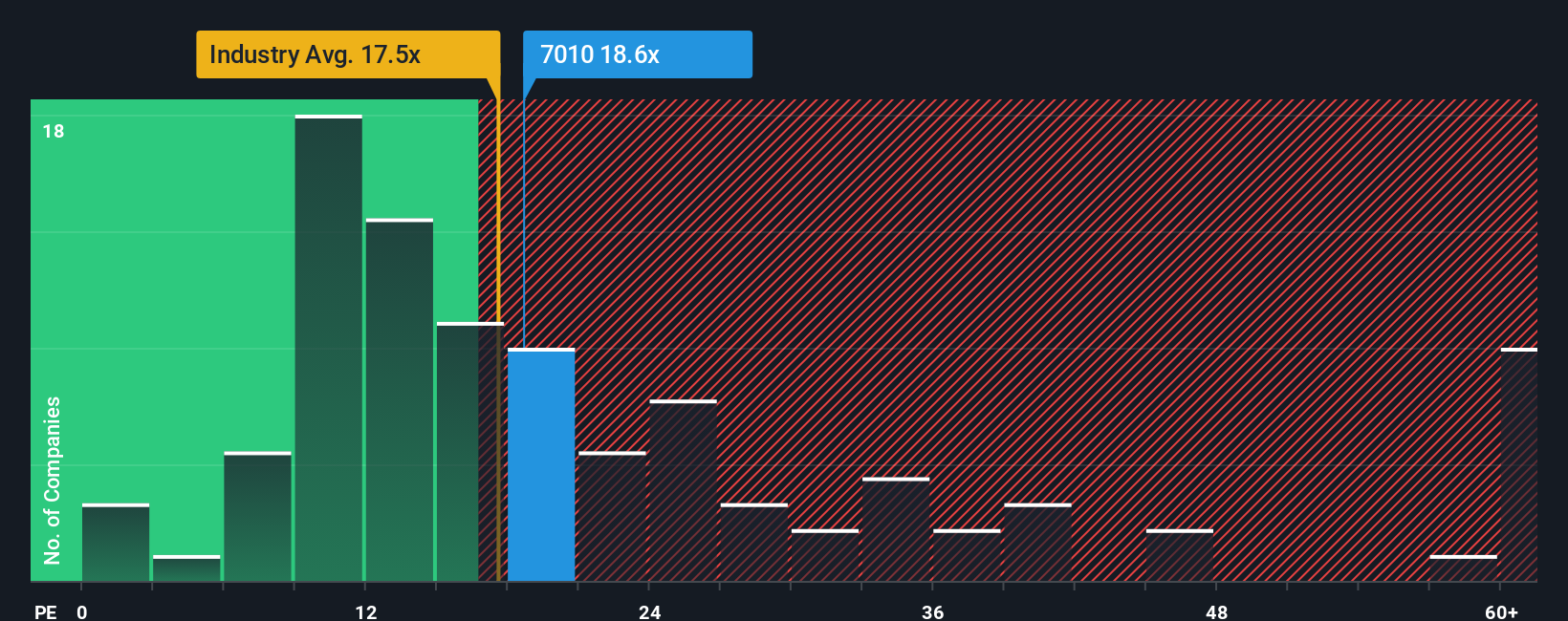

There wouldn't be many who think Saudi Telecom Company's (TADAWUL:7010) price-to-earnings (or "P/E") ratio of 18.6x is worth a mention when the median P/E in Saudi Arabia is similar at about 20x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Saudi Telecom hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Saudi Telecom

Does Growth Match The P/E?

In order to justify its P/E ratio, Saudi Telecom would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's bottom line. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 12% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 13% per year, which is not materially different.

In light of this, it's understandable that Saudi Telecom's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Saudi Telecom's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Saudi Telecom maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Saudi Telecom that you should be aware of.

You might be able to find a better investment than Saudi Telecom. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:7010

Saudi Telecom

Provides telecommunications, information, media, and digital payment services in the Kingdom of Saudi Arabia and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives