- United Arab Emirates

- /

- Consumer Services

- /

- ADX:DRIVE

Three Undiscovered Gems in Middle East Stocks with Strong Potential

Reviewed by Simply Wall St

The Middle East stock markets have been experiencing a positive trend, with most Gulf indices gaining ground due to progress in U.S. trade agreements and strong performances in key sectors like finance and energy. As regional benchmarks such as Dubai's index reach multi-year highs, investors are increasingly looking towards small-cap stocks that offer robust fundamentals and growth potential amidst the evolving economic landscape. In this context, identifying stocks with solid financial health and strategic market positions can be particularly rewarding for those seeking to capitalize on these emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Emirates Driving Company P.J.S.C (ADX:DRIVE)

Simply Wall St Value Rating: ★★★★★★

Overview: Emirates Driving Company P.J.S.C., along with its subsidiaries, focuses on managing and developing motor vehicle driving training in the United Arab Emirates, with a market cap of AED3.33 billion.

Operations: Emirates Driving Company generates revenue primarily from car and related services, amounting to AED589.90 million. The company's financial performance is reflected in its market capitalization of AED3.33 billion.

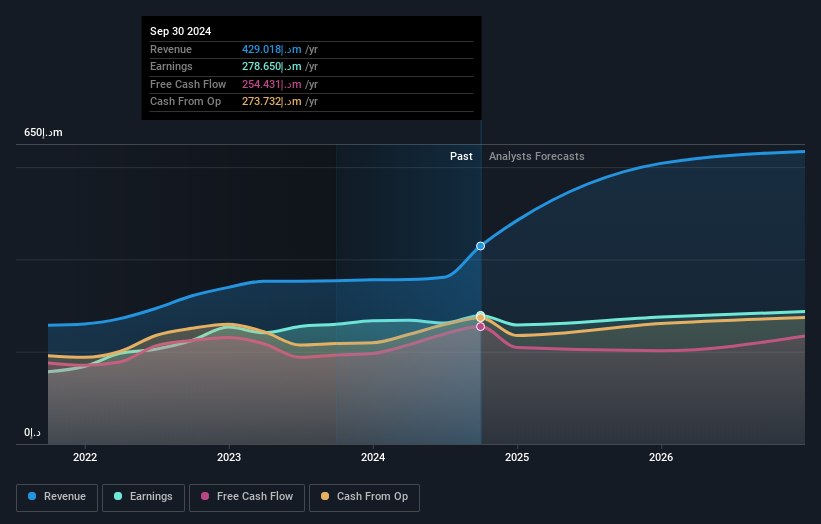

Emirates Driving Company, a small player in the Middle East market, showcases strong financial health with no debt over the past five years and high-quality earnings. Despite a dip in net profit margins from 75.2% to 47.4%, its earnings have grown at an impressive rate of 18.5% annually over five years, though recent growth of 4.4% lags behind industry rates of 6.7%. Trading at around 30.7% below estimated fair value, it presents a good relative value compared to peers, with first-quarter sales jumping to AED167 million from AED90 million year-on-year and net income rising slightly to AED66 million from AED64 million.

- Dive into the specifics of Emirates Driving Company P.J.S.C here with our thorough health report.

Understand Emirates Driving Company P.J.S.C's track record by examining our Past report.

Tourism Enterprise Company (Shams) (SASE:4170)

Simply Wall St Value Rating: ★★★★★★

Overview: Tourism Enterprise Company (Shams) focuses on managing tourism projects in the Kingdom of Saudi Arabia, with a market capitalization of SAR1.03 billion.

Operations: Shams generates revenue primarily from its Casinos & Resorts segment, which contributes SAR10.00 million. The company has a market capitalization of SAR1.03 billion.

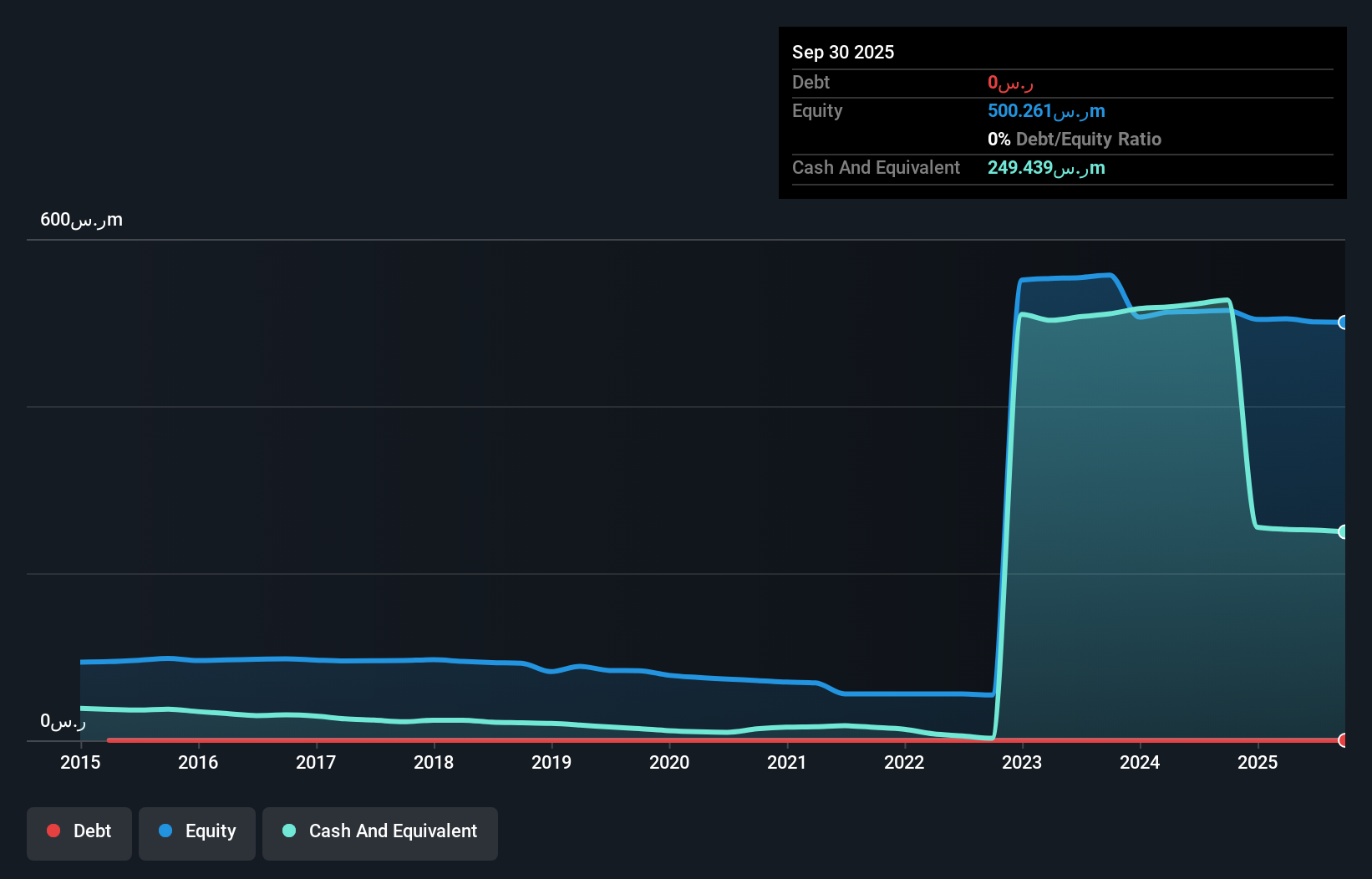

Shams, a niche player in the Middle East's hospitality sector, recently reported first-quarter sales of SAR 1.41 million, showing slight growth from SAR 1.39 million the previous year. Despite this increase in sales, net income fell to SAR 0.73 million from SAR 6.04 million a year ago, reflecting some challenges in profitability. The company remains debt-free and has not carried any debt for the past five years, which is reassuring for investors wary of leverage risks. With high-quality earnings and positive free cash flow standing at SAR 16.64 million as of September 2024, Shams seems well-positioned financially despite its modest revenue scale.

Nice One Beauty Digital Marketing (SASE:4193)

Simply Wall St Value Rating: ★★★★★★

Overview: Nice One Beauty Digital Marketing Company operates an e-commerce platform offering beauty and personal care products in Saudi Arabia, with a market cap of SAR3.90 billion.

Operations: The company generates revenue of SAR1.08 billion through its e-commerce platform focused on beauty and personal care products in Saudi Arabia.

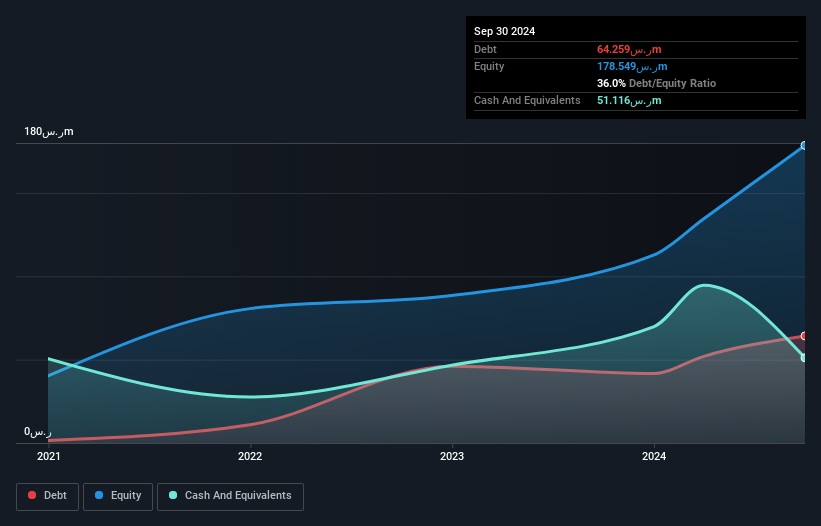

Nice One Beauty Digital Marketing, a nimble player in the Middle East, has shown impressive earnings growth of 62% over the past year, outpacing its industry peers. The company operates without debt, which simplifies financial management and eliminates interest payment concerns. Despite not being free cash flow positive recently, it trades at a notable 34% below its estimated fair value. Recent inclusion in major indices like the S&P Global BMI Index highlights its growing recognition. Adjustments to bylaws suggest strategic shifts are underway, potentially enhancing governance and operational focus for future growth.

- Click to explore a detailed breakdown of our findings in Nice One Beauty Digital Marketing's health report.

Learn about Nice One Beauty Digital Marketing's historical performance.

Next Steps

- Navigate through the entire inventory of 219 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emirates Driving Company P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:DRIVE

Emirates Driving Company P.J.S.C

Manages and develops motor vehicles driving training in the United Arab Emirates.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives