- Saudi Arabia

- /

- Construction

- /

- SASE:2320

Exploring Undiscovered Gems in the Middle East July 2025

Reviewed by Simply Wall St

As geopolitical tensions in the Middle East ease and optimism grows around potential ceasefire agreements, stock markets in the United Arab Emirates have shown slight gains, with a notable boost from the AI sector. This positive market sentiment creates an opportune environment for identifying promising stocks that leverage technological advancements and stability-driven growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Besler Gida Ve Kimya Sanayi ve Ticaret Anonim Sirketi | 40.12% | 43.54% | 38.87% | ★★★★★★ |

| Vakif Gayrimenkul Yatirim Ortakligi | 0.00% | 50.97% | 56.63% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.53% | 7.56% | 49.01% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 6.88% | 51.77% | 67.59% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.80% | 49.41% | 66.89% | ★★★★★☆ |

| Segmen Kardesler Gida Üretim ve Ambalaj Sanayi Anonim Sirketi | 2.02% | -10.23% | 74.54% | ★★★★☆☆ |

| Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi | 12.49% | -23.32% | 41.51% | ★★★★☆☆ |

| Dogan Burda Dergi Yayincilik Ve Pazarlama | 64.82% | 46.23% | -12.39% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Ege Gübre Sanayii (IBSE:EGGUB)

Simply Wall St Value Rating: ★★★★★★

Overview: Ege Gübre Sanayii A.S., along with its subsidiary TCE EGE Konteyner Terminal Isletmeleri A.S., specializes in providing port services in Turkey and has a market capitalization of TRY10.32 billion.

Operations: Ege Gübre Sanayii generates revenue primarily from port services, accounting for TRY2.46 billion, with a smaller contribution from chemical fertilizers at TRY25.12 million. The company's financial performance is influenced by its net profit margin trends over time.

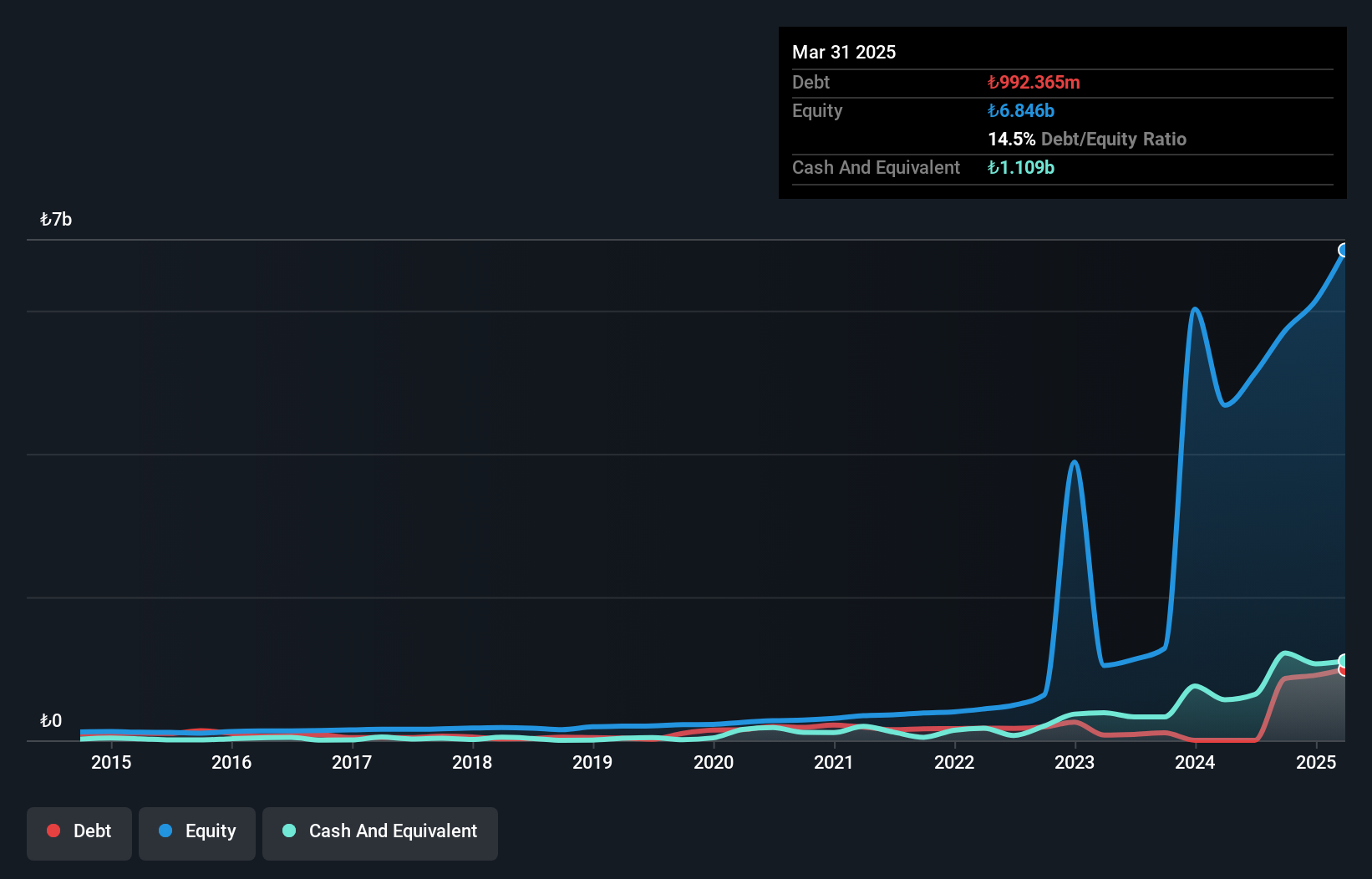

Ege Gübre Sanayii, a relatively small player in the Middle East, has shown promising financial health with significant improvements. Over the past five years, its debt to equity ratio impressively dropped from 58.8% to 14.5%, indicating effective debt management. The company’s earnings have grown at an average of 35.5% annually over this period, though recent growth of 3.5% lagged behind the industry’s 9.6%. Recent earnings reports reveal a turnaround with net income reaching TRY 76 million for Q1 2025 compared to a loss last year, showcasing resilience and potential for continued recovery in its operations.

Al-Babtain Power and Telecommunications (SASE:2320)

Simply Wall St Value Rating: ★★★★★☆

Overview: Al-Babtain Power and Telecommunications Company, along with its subsidiaries, manufactures lighting poles and power transmission towers in the United Arab Emirates, Saudi Arabia, and the Egyptian Arabic Republic, with a market capitalization of SAR3.52 billion.

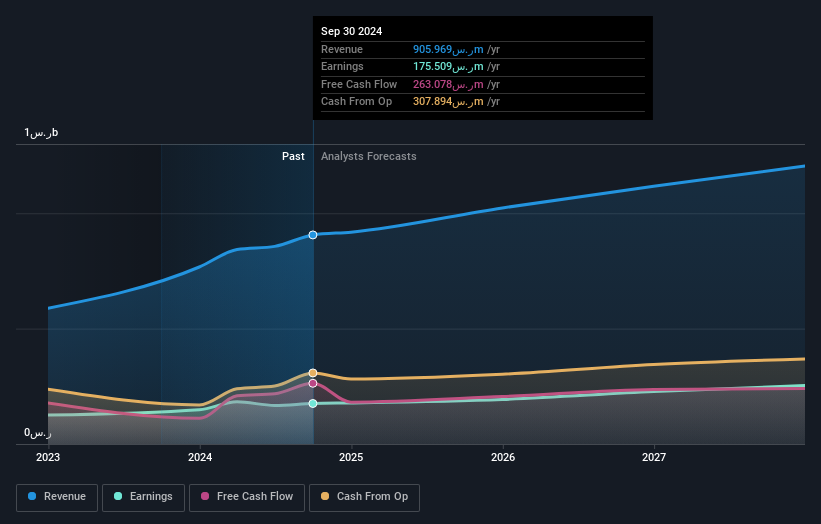

Operations: The company's revenue streams are primarily derived from the Towers and Metal Structures Sector, generating SAR1.18 billion, followed by the Solar Energy Sector at SAR592.76 million. The Columns and Lighting segment contributes SAR571.13 million, while Design, Supply and Installation adds SAR404.90 million to the total revenue.

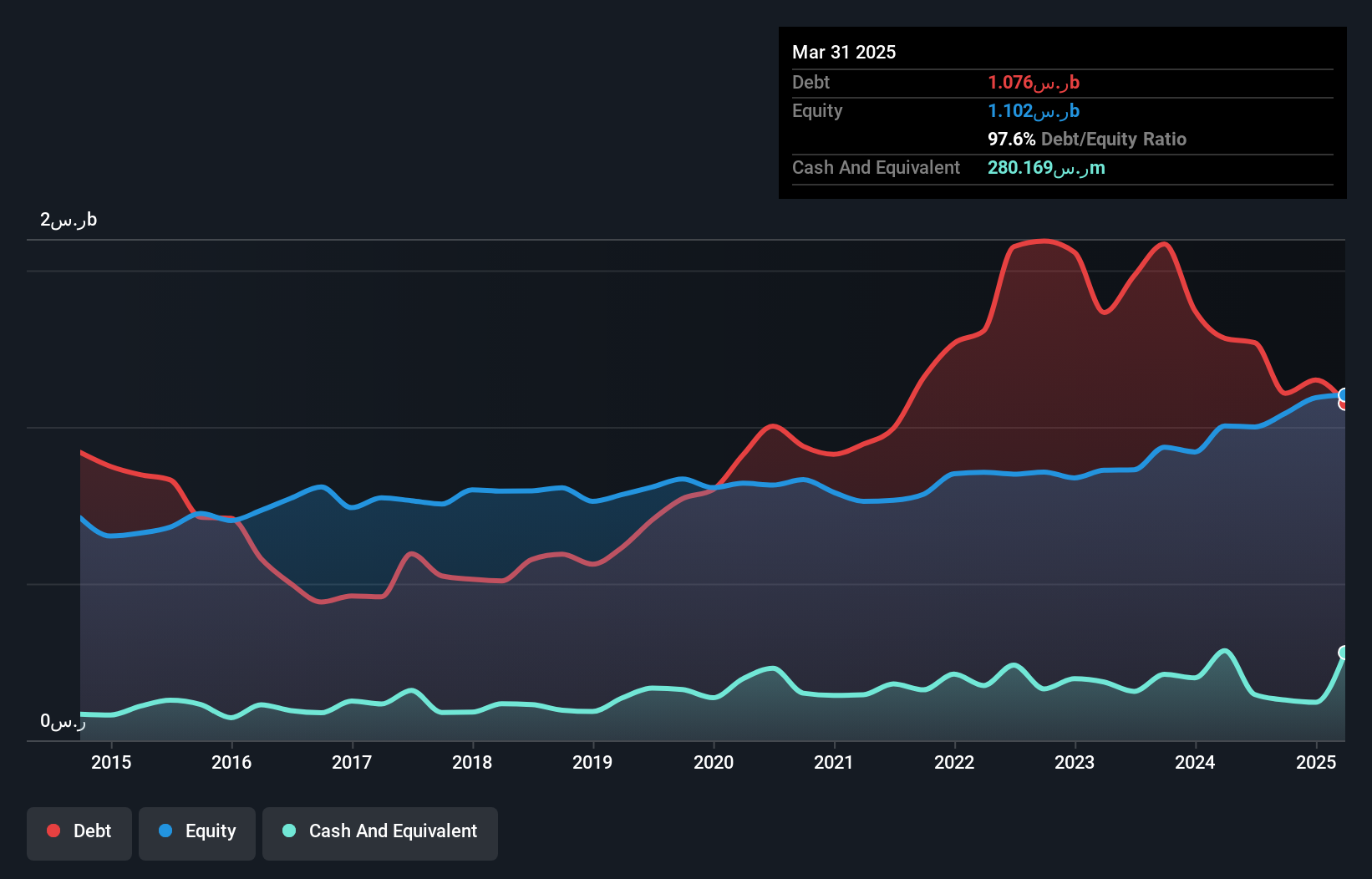

Al-Babtain Power and Telecommunications, a smaller player in the Middle East market, showcases robust earnings growth of 29.3% over the past year, outpacing the construction industry's 12.5%. Despite a high net debt to equity ratio at 72.2%, its interest payments are well covered by EBIT at 4.9 times coverage. The company reported first-quarter sales of SAR 631 million with net income rising to SAR 88 million compared to last year's SAR 82 million, indicating solid profitability despite sales slipping from SAR 699 million previously. Trading at a price-to-earnings ratio of just 13.4x suggests it offers good value relative to peers and industry standards in Saudi Arabia's market context.

Al Majed for Oud (SASE:4165)

Simply Wall St Value Rating: ★★★★★★

Overview: Al Majed for Oud Company operates in the wholesale and retail trade of perfumes across Saudi Arabia and the Gulf countries, with a market cap of SAR3.75 billion.

Operations: The primary revenue stream for Al Majed for Oud comes from its retail trade in perfumes, generating SAR1.08 billion. The company's net profit margin is 23.5%.

Al Majed for Oud's recent performance paints a promising picture, with earnings surging by 17.1% over the past year, outpacing the Specialty Retail industry's 10%. The company is debt-free and boasts high-quality earnings, underscoring its financial robustness. Its price-to-earnings ratio of 17.6x remains attractive compared to the Saudi market's 21.7x. For Q1 2025, sales reached SAR 410 million from SAR 257 million a year prior, while net income jumped to SAR 120.9 million from SAR 64 million previously. Basic EPS climbed to SAR 4.84 from SAR 2.56, reflecting strong operational momentum and potential for sustained growth in this niche sector.

Seize The Opportunity

- Access the full spectrum of 219 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2320

Al-Babtain Power and Telecommunications

Produces lighting poles, power transmission towers, accessories, and communication towers in the United Arab Emirates, Saudi Arabia, and Egyptian Arabic Republic.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives