- Israel

- /

- Oil and Gas

- /

- TASE:EQTL

Taaleem Holdings PJSC Leads 3 Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

The Middle East stock markets have recently experienced a rebound, driven by positive corporate earnings and optimism surrounding international trade deals, such as the recent U.S.-Japan agreement. In this environment of renewed investor confidence, identifying stocks with strong fundamentals and growth potential becomes crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 1.05% | 36.24% | 62.25% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Taaleem Holdings PJSC (DFM:TAALEEM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Taaleem Holdings PJSC is a company that provides and invests in education services in the United Arab Emirates, with a market capitalization of AED4.11 billion.

Operations: Taaleem Holdings generates revenue primarily from school operations, amounting to AED1.10 billion. The company's financial performance can be analyzed through its net profit margin, which reflects its profitability after accounting for all expenses and taxes.

Taaleem Holdings PJSC is making strides in the UAE's education sector, aiming to boost revenue and profitability by expanding student capacity. The company plans to add 10,000 seats through mergers and new schools between 2024 and 2026. Despite a debt-to-equity ratio increase from 25% to 30% over five years, Taaleem maintains more cash than total debt. Recent earnings reports show net income of AED82 million for Q3, slightly down from AED86 million last year, with sales rising to AED336 million from AED282 million. Analysts foresee annual revenue growth of nearly 15%, though profit margins may dip from 15% to around 10%.

Al Rajhi REIT Fund (SASE:4340)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Al Rajhi REIT Fund, listed on Tadawul, is a Sharia compliant investment fund focused on generating periodic income through real estate assets in Saudi Arabia and has a market cap of SAR2.28 billion.

Operations: The fund primarily generates revenue from its commercial real estate investments, totaling SAR260.26 million.

Al Rajhi REIT Fund's earnings surged by 148% last year, outpacing the REIT industry average of -14%. Trading at a notable 50% below fair value estimates, it presents an intriguing opportunity. The fund's debt to equity ratio improved from 50.1% to 39.8% over five years, with a satisfactory net debt to equity of 34%. However, recent board changes and decreased dividends—SAR0.12 per share for July—might raise eyebrows among investors. A significant SAR65 million one-off gain influenced its financials recently, hinting at potential volatility in reported earnings despite strong performance metrics.

Equital (TASE:EQTL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Equital Ltd. operates in real estate, oil and gas, and residential construction sectors both in Israel and internationally, with a market cap of ₪5.79 billion.

Operations: Equital Ltd. generates revenue primarily from oil and gas operations in Israel (₪1.77 billion) and property rental and management in Israel (₪947.02 million). The company also derives income from oil and gas activities in the USA (₪707.49 million) and building construction for sale in Israel (₪141.63 million).

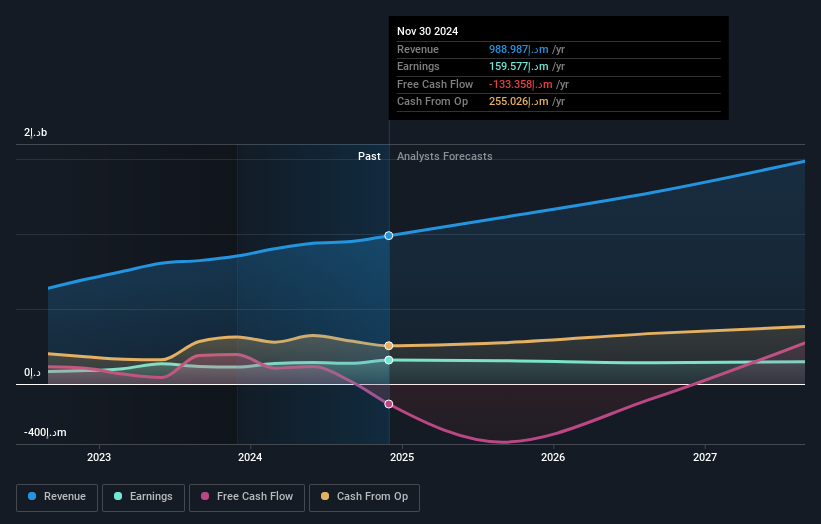

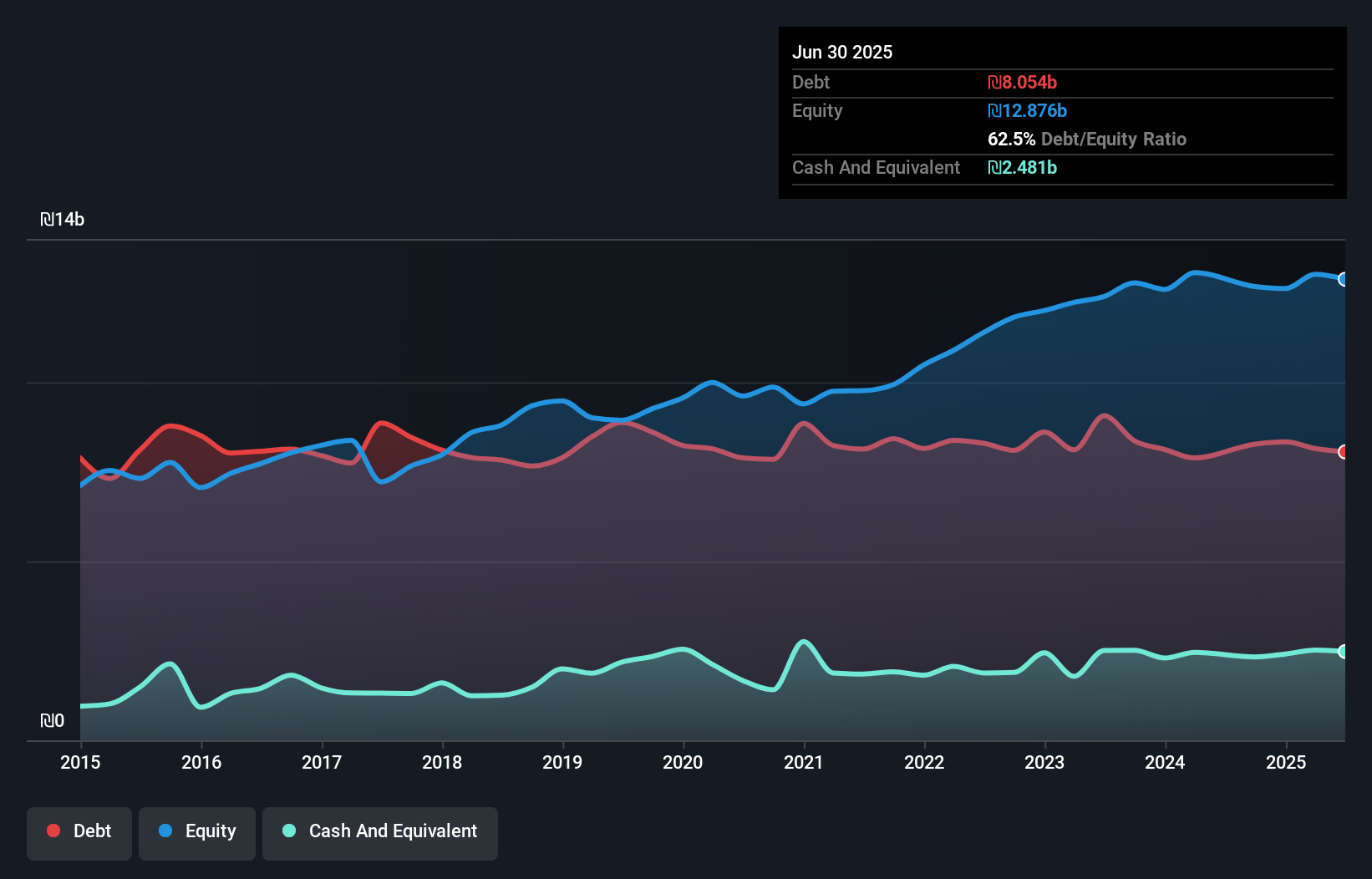

Equital, a smaller player in the Middle East market, has seen its debt to equity ratio decrease from 81.5% to 62.6% over five years, indicating improved financial management. Despite a high net debt to equity ratio of 43.2%, its interest payments are well covered by EBIT at 8.4 times, suggesting strong operational earnings quality. Recent figures show revenue growth from ILS 836.97 million to ILS 930.68 million year-over-year; however, net income fell from ILS 196.54 million to ILS 129.41 million due to factors like higher capital expenditure of ILS -299 million and changes in working capital impacting cash flows positively at ILS -360 million this year.

- Click here to discover the nuances of Equital with our detailed analytical health report.

Examine Equital's past performance report to understand how it has performed in the past.

Taking Advantage

- Navigate through the entire inventory of 224 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:EQTL

Equital

Through its subsidiaries, engages in the oil and gas business in Israel and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives