- Saudi Arabia

- /

- Insurance

- /

- SASE:8070

Undiscovered Gems And 2 Other Small Caps With Potential

Reviewed by Simply Wall St

As global markets navigate a period of fluctuating consumer confidence and mixed economic indicators, small-cap stocks have shown resilience amidst broader market volatility. In this environment, identifying undiscovered gems can be particularly rewarding, as these companies often possess unique growth potential that may not yet be fully recognized by the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 9.82% | 7.91% | 12.42% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| QuickLtd | 0.62% | 9.82% | 15.64% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AJIS | 0.79% | 1.12% | -12.92% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 136.00% | 2.73% | 2.17% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Banan Real Estate (SASE:4324)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Banan Real Estate Company is involved in owning and leasing both residential and non-residential properties in Saudi Arabia, with a market capitalization of SAR1.37 billion.

Operations: Banan Real Estate generates revenue primarily through its rental segment, which brought in SAR101.56 million.

Banan Real Estate, a small player in its sector, has shown impressive growth with earnings increasing by 60.9% over the past year, outpacing the industry average of 15%. The company's net debt to equity ratio stands at a satisfactory 2.2%, indicating manageable leverage. Recent financial results highlight strong performance with third-quarter sales reaching SAR 19.98 million and net income of SAR 10.04 million, both up from the previous year. Despite its volatile share price recently, Banan trades at a significant discount to fair value and boasts high-quality earnings with well-covered interest payments by EBIT at an impressive 11.7x coverage.

- Click to explore a detailed breakdown of our findings in Banan Real Estate's health report.

Understand Banan Real Estate's track record by examining our Past report.

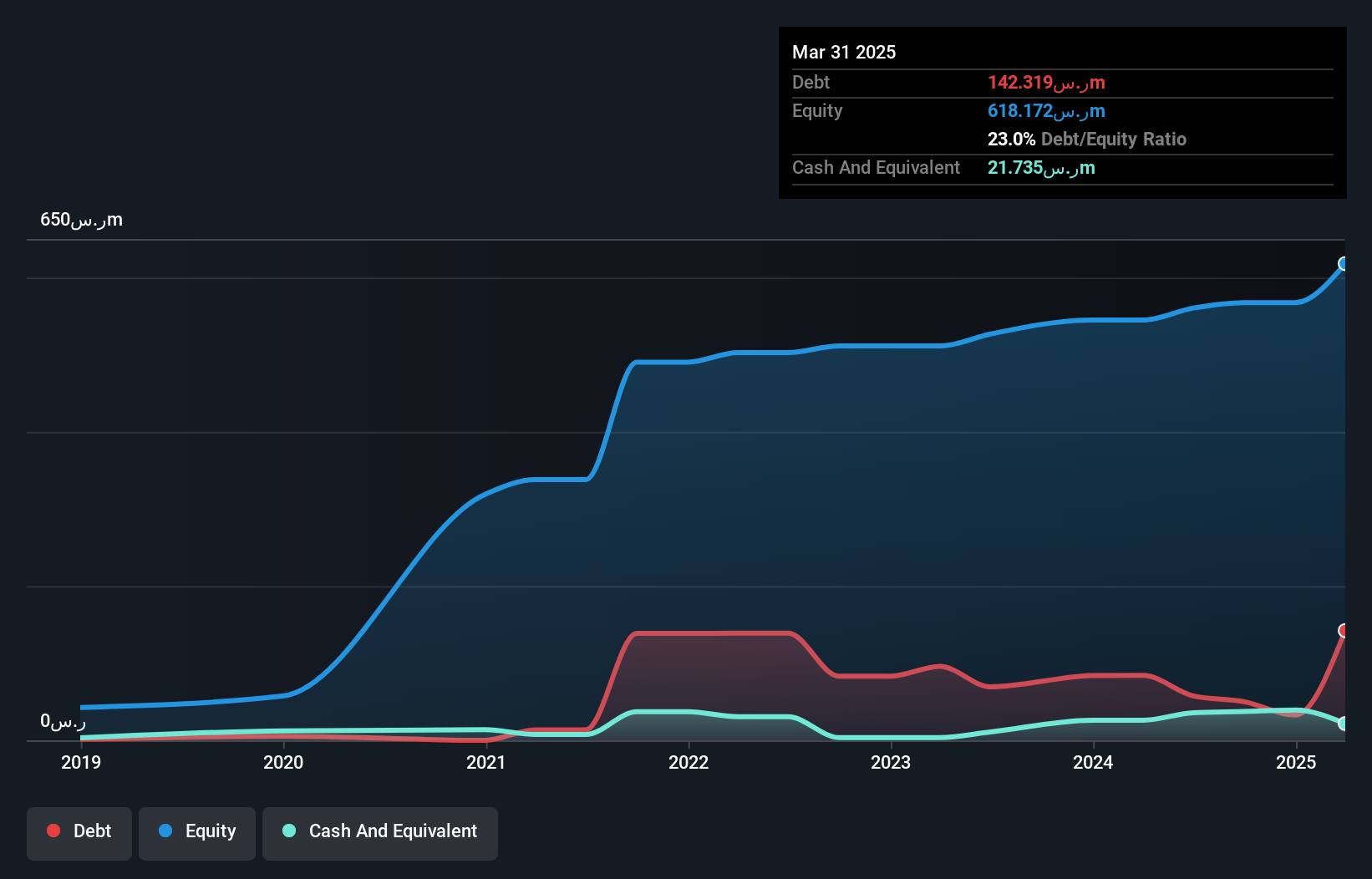

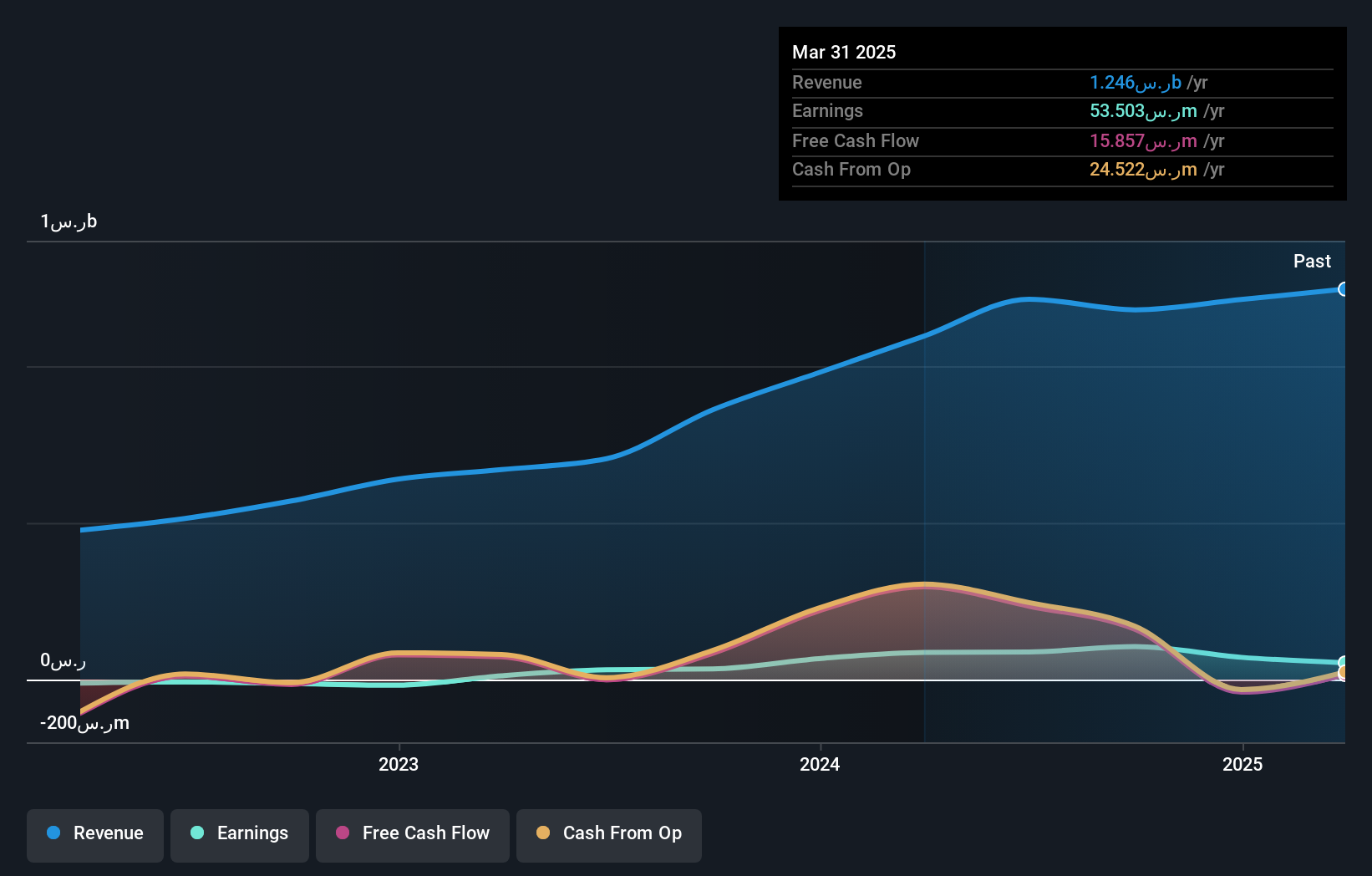

Arabian Shield Cooperative Insurance (SASE:8070)

Simply Wall St Value Rating: ★★★★★★

Overview: Arabian Shield Cooperative Insurance Company offers a range of insurance products in the Kingdom of Saudi Arabia and has a market capitalization of SAR 1.53 billion.

Operations: The company's primary revenue streams are derived from its insurance operations, with the medical and motor segments generating SAR 553.18 million and SAR 293.14 million, respectively. The protection & savings segment contributes SAR 31.44 million to the overall revenue.

Arabian Shield Insurance shines with a robust earnings growth of 142.7% over the past year, outpacing the industry average. The company is debt-free, eliminating concerns over interest payments and showcasing strong financial health. Recent earnings reflect this strength with net income for Q3 at SAR 23 million, up from SAR 6 million a year ago, and basic EPS rising to SAR 0.29 from SAR 0.1. Despite shareholder dilution in the past year, its price-to-earnings ratio of 18.6x remains attractive compared to the SA market's average of 23.3x, indicating potential value for investors seeking opportunities in smaller insurance players.

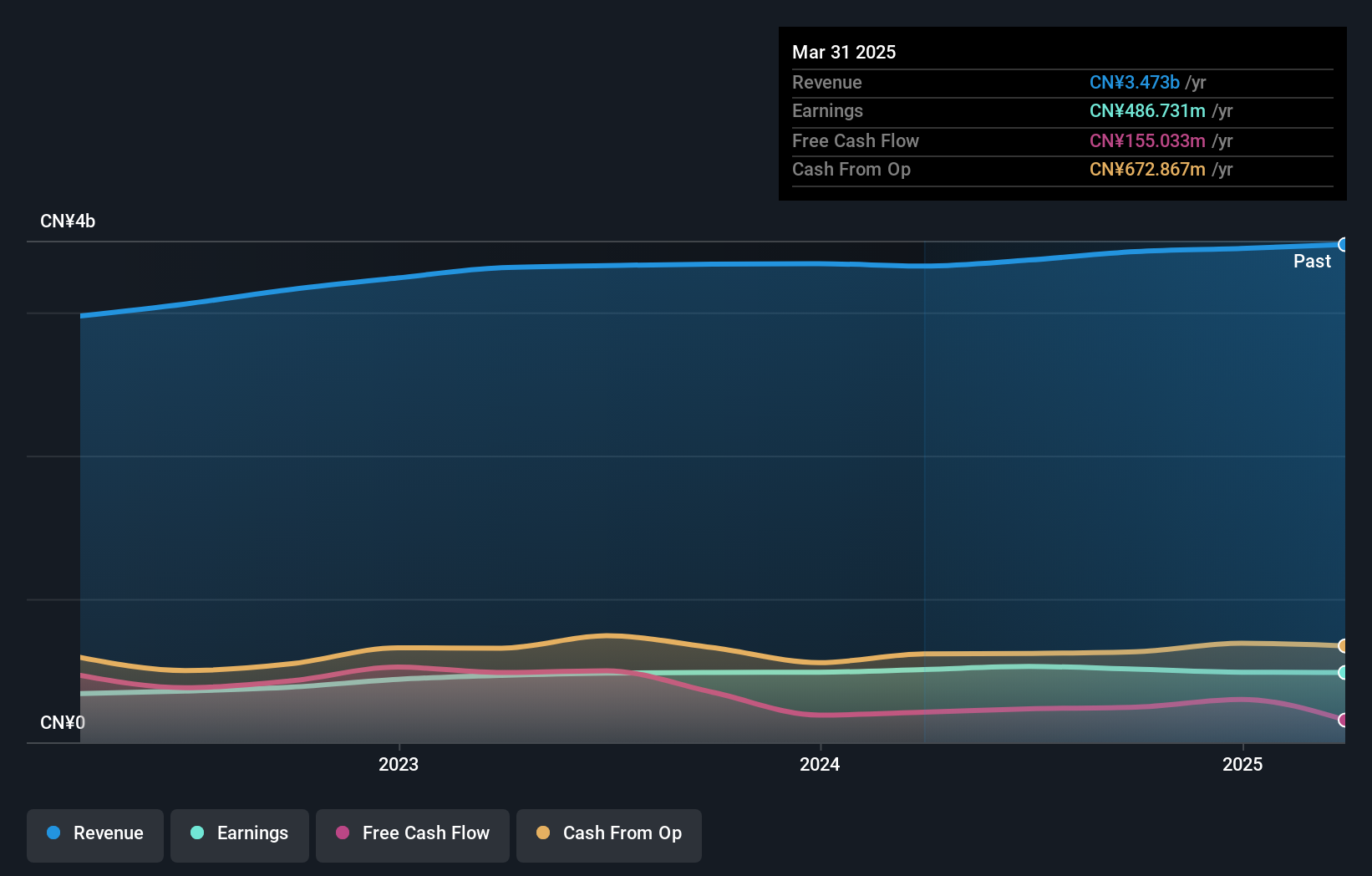

Beijing Foyou PharmaLTD (SHSE:601089)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Foyou Pharma Co., Ltd. focuses on the research, development, production, and sale of pharmaceutical preparations and medical equipment, with a market cap of CN¥7.32 billion.

Operations: Foyou Pharma generates revenue primarily from pharmaceutical preparations and medical equipment. The company's net profit margin has shown a notable trend, reaching 15% in the most recent period.

Beijing Foyou Pharma, a small player in the pharmaceutical industry, has shown promising financial health with earnings growth of 4.6% over the past year, outpacing the industry's -2.5%. The company's debt to equity ratio impressively decreased from 36.3% to 1.9% over five years, indicating strong financial management and more cash than total debt. Its price-to-earnings ratio stands at a favorable 14.7x compared to the broader CN market's 35.9x, suggesting potential undervaluation. Recent buybacks saw CNY 176 million spent repurchasing shares this year, potentially boosting shareholder value and signaling confidence in future prospects.

Seize The Opportunity

- Gain an insight into the universe of 4629 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:8070

Arabian Shield Cooperative Insurance

Provides various insurance products in the Kingdom of Saudi Arabia.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives