High Growth Tech And 2 Other Promising Stocks For Your Portfolio

Reviewed by Simply Wall St

With global markets experiencing a downturn and the S&P 500 Index suffering its worst weekly drop in 18 months due to economic slowdown concerns, investors are increasingly cautious. Amid this backdrop, identifying high-growth tech stocks and other promising opportunities requires careful consideration of market resilience and potential for innovation-driven growth.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Ascendis Pharma | 39.71% | 68.43% | ★★★★★★ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.81% | ★★★★★★ |

| UTI | 114.97% | 134.61% | ★★★★★★ |

Click here to see the full list of 1285 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

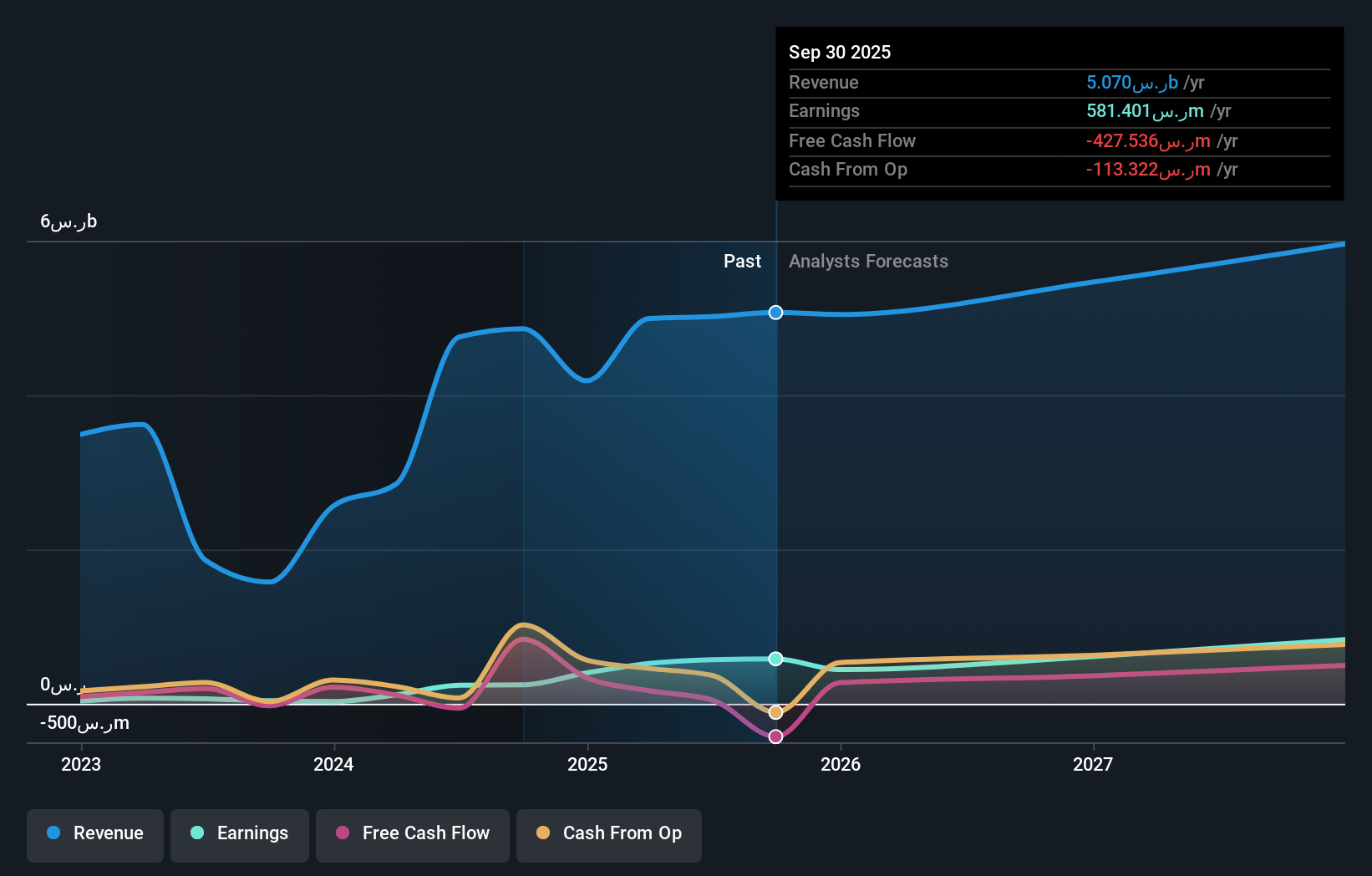

MBC Group (SASE:4072)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MBC Group is a media company with operations in the United Arab Emirates, Saudi Arabia, Egypt, Iraq, North Africa, and internationally, and has a market cap of SAR14.96 billion.

Operations: MBC Group generates revenue primarily from advertising, subscription services, and content sales across its media platforms. The company operates in multiple regions including the UAE, Saudi Arabia, Egypt, Iraq, and North Africa.

MBC Group's earnings are set to grow at an impressive 33.9% annually, significantly outpacing the SA market's 7%. With revenue growth forecasted at 14.5% per year, it reflects strong future potential despite not reaching the high-growth tech threshold of 20%. The company's recent addition to the S&P Global BMI Index and S&P Pan Arab Composite underscores its rising prominence. Notably, MBC's R&D expenses have supported innovation in media services, contributing to a robust earnings increase of 76.5% over the past year.

- Take a closer look at MBC Group's potential here in our health report.

Examine MBC Group's past performance report to understand how it has performed in the past.

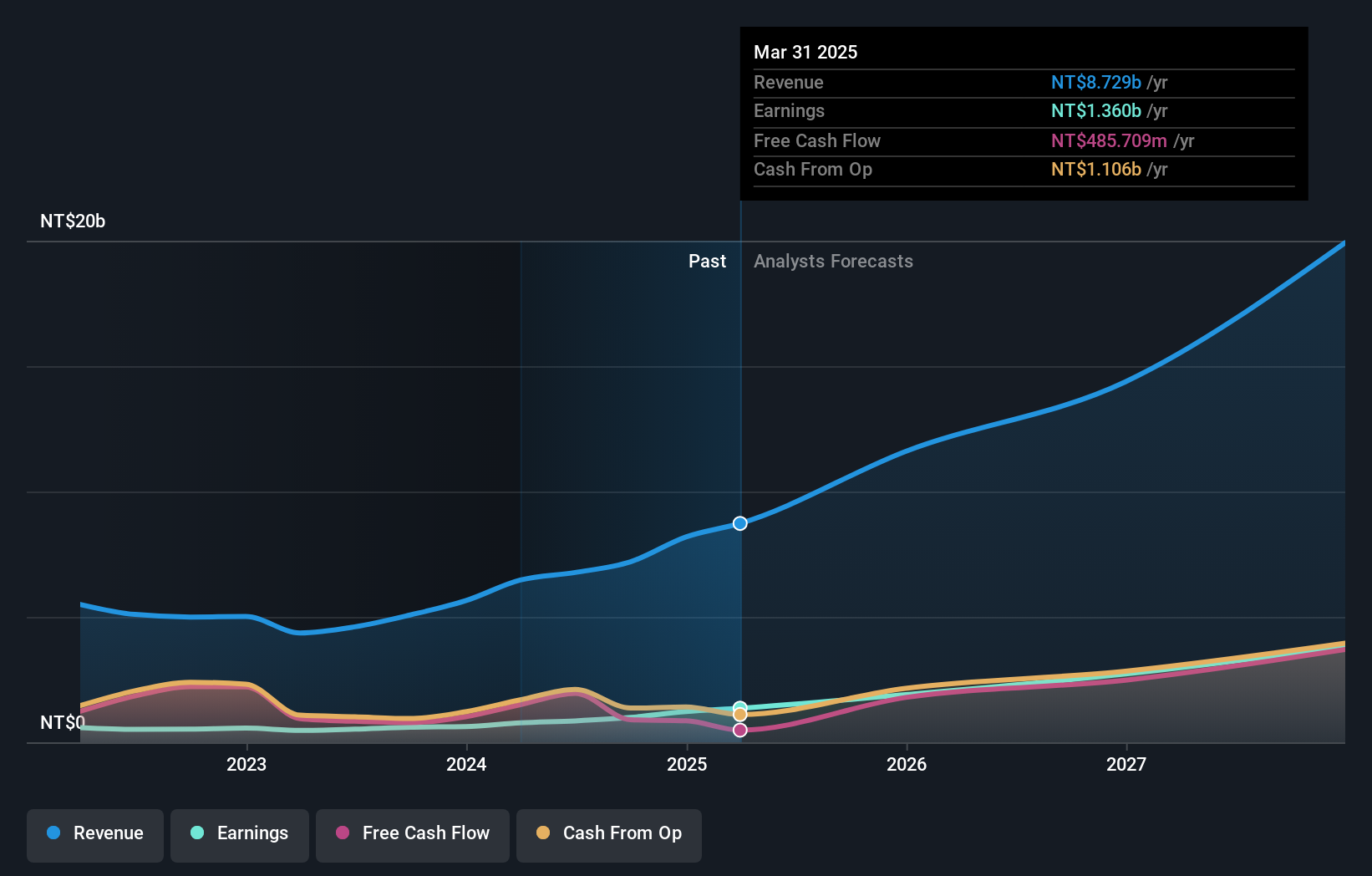

PharmaEssentia (TWSE:6446)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaEssentia Corporation is a biopharmaceutical company involved in developing treatments for human diseases in Taiwan and internationally, with a market cap of NT$226.38 billion.

Operations: PharmaEssentia Corporation focuses on the research and development of new drugs, generating NT$6.91 billion in revenue from this segment. The company operates both in Taiwan and internationally.

PharmaEssentia's revenue is projected to grow at 41.5% annually, outpacing the TW market's 11.6%. The company's earnings are forecasted to surge by an impressive 86.2% per year, significantly higher than the TW market's 18.2%. PharmaEssentia recently secured approval for Ropeginterferon alfa-2b in China and entered into a licensing agreement with FORUS Therapeutics for BESREMi in Canada, potentially earning up to $107 million USD in milestone payments. Their R&D expenses have been instrumental in driving innovation, contributing to their robust financial performance and future growth prospects.

- Navigate through the intricacies of PharmaEssentia with our comprehensive health report here.

Evaluate PharmaEssentia's historical performance by accessing our past performance report.

Fositek (TWSE:6805)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fositek Corp. engages in the manufacture and wholesale of electronic materials and components, with a market cap of NT$52.24 billion.

Operations: Fositek Corp. focuses on the production and distribution of electronic materials and components. The company generates revenue primarily from its Electronic Components & Parts segment, which reported NT$6.77 billion in sales.

Fositek's revenue is projected to grow at an impressive 42% annually, significantly outpacing the TW market's 11.6%. Their earnings, forecasted to increase by 48.1% per year, reflect robust financial health and a promising future. Recent Q2 results showed sales of TWD 1.72 billion and net income of TWD 256 million, marking substantial growth from the previous year. The company repurchased shares in the past year while maintaining high R&D expenses that drive innovation and sustain competitive advantage in tech advancements.

- Click to explore a detailed breakdown of our findings in Fositek's health report.

Review our historical performance report to gain insights into Fositek's's past performance.

Taking Advantage

- Delve into our full catalog of 1285 High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6446

PharmaEssentia

A biopharmaceutical company engages in treatment for human diseases in Taiwan and internationally.

Flawless balance sheet with high growth potential.