3 Global Stocks Estimated To Be Trading At Discounts Of Up To 44.7%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances and cautious economic outlooks, investors are increasingly attentive to opportunities that may arise from undervalued stocks. In such an environment, identifying companies trading at discounts can be a strategic approach for those looking to capitalize on potential value amidst broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Roche Bobois (ENXTPA:RBO) | €35.00 | €69.88 | 49.9% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.16 | CN¥26.22 | 49.8% |

| NEUCA (WSE:NEU) | PLN778.00 | PLN1553.92 | 49.9% |

| Kotobuki Spirits (TSE:2222) | ¥1734.50 | ¥3450.73 | 49.7% |

| Jiangxi Rimag Group (SEHK:2522) | HK$17.24 | HK$34.25 | 49.7% |

| GN Store Nord (CPSE:GN) | DKK93.34 | DKK186.26 | 49.9% |

| EROAD (NZSE:ERD) | NZ$1.585 | NZ$3.15 | 49.7% |

| Bonesupport Holding (OM:BONEX) | SEK199.10 | SEK395.70 | 49.7% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.18 | CN¥56.35 | 50% |

| Allegro.eu (WSE:ALE) | PLN32.225 | PLN64.22 | 49.8% |

Underneath we present a selection of stocks filtered out by our screen.

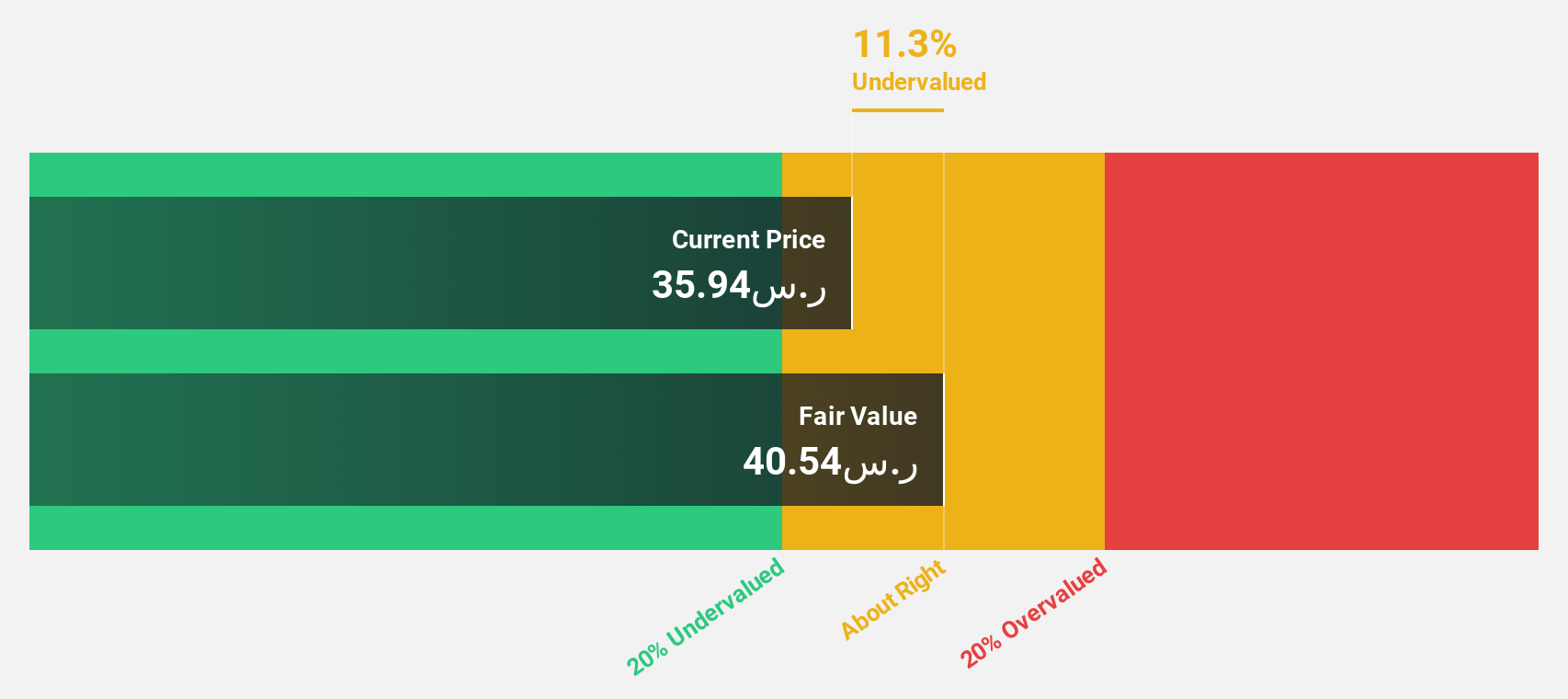

MBC Group (SASE:4072)

Overview: MBC Group is a media and entertainment company operating in the United Arab Emirates, Saudi Arabia, Egypt, Iraq, North Africa, and internationally with a market cap of SAR11.11 billion.

Operations: The company's revenue segments include Shahid at SAR1.29 billion, M&E Initiatives at SAR1 billion, and Broadcasting and Other Commercial Activities at SAR2.79 billion.

Estimated Discount To Fair Value: 17.3%

MBC Group is currently trading at SAR 33.42, below its estimated fair value of SAR 40.4, indicating potential undervaluation based on cash flows. Despite recent volatility, the company's earnings have grown significantly by over 138% in the past year and are expected to continue growing at a robust rate of over 22% annually. Recent developments include securing a government project that exceeds 5% of total revenue and completing a significant stake acquisition by the Public Investment Fund.

- Our comprehensive growth report raises the possibility that MBC Group is poised for substantial financial growth.

- Dive into the specifics of MBC Group here with our thorough financial health report.

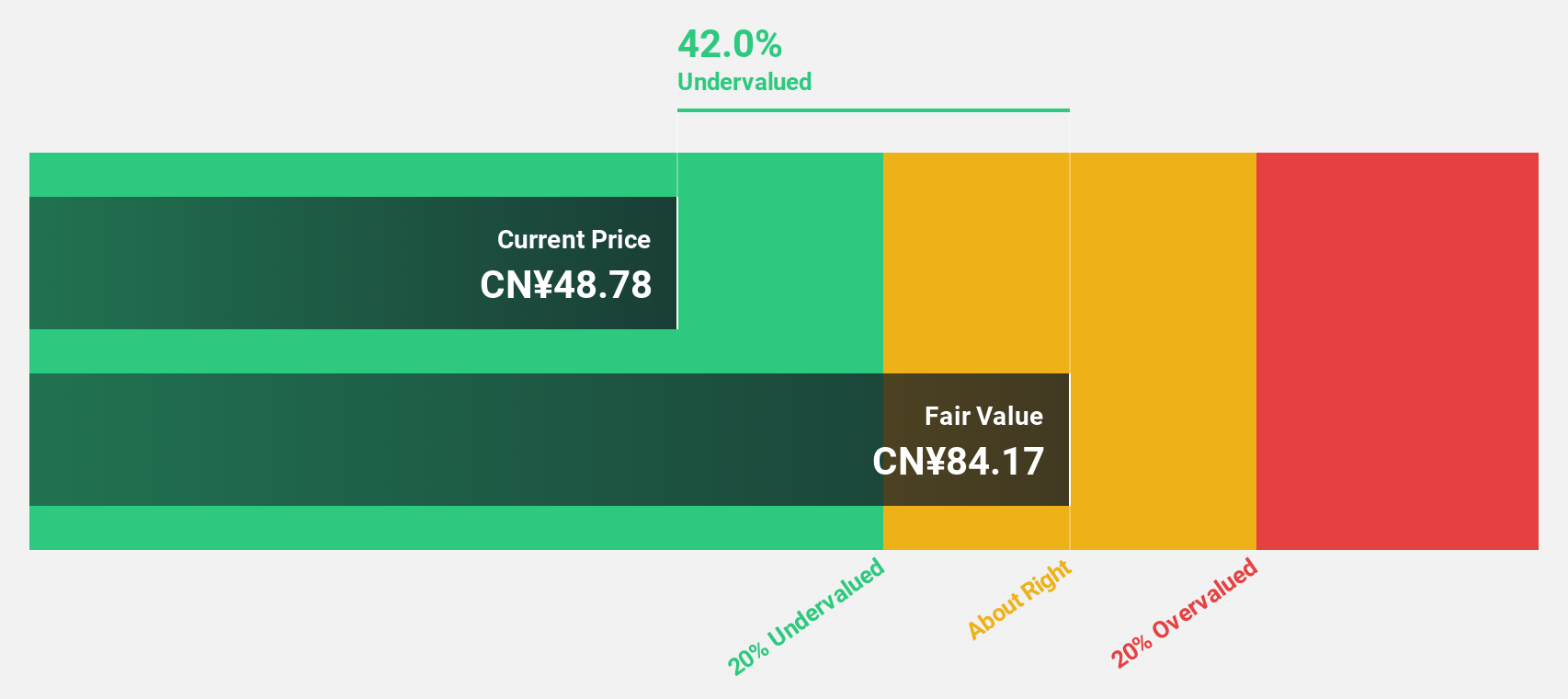

EverProX Technologies (SZSE:300548)

Overview: EverProX Technologies Co., Ltd. engages in the research, development, production, and sale of integrated optoelectronic devices for optical communications both in China and internationally, with a market cap of CN¥29.06 billion.

Operations: EverProX Technologies Co., Ltd. generates revenue through the research, development, production, and sale of integrated optoelectronic devices for optical communications across domestic and international markets.

Estimated Discount To Fair Value: 44.7%

EverProX Technologies is trading at CN¥104.77, well below its estimated fair value of CN¥189.54, highlighting its potential undervaluation based on cash flows. The company's earnings have surged, with net income reaching CN¥249.97 million for the nine months ended September 2025 compared to CN¥37.5 million a year ago, reflecting strong growth momentum. Despite a volatile share price recently, revenue and earnings are forecasted to grow significantly faster than the market average in China.

- Our earnings growth report unveils the potential for significant increases in EverProX Technologies' future results.

- Take a closer look at EverProX Technologies' balance sheet health here in our report.

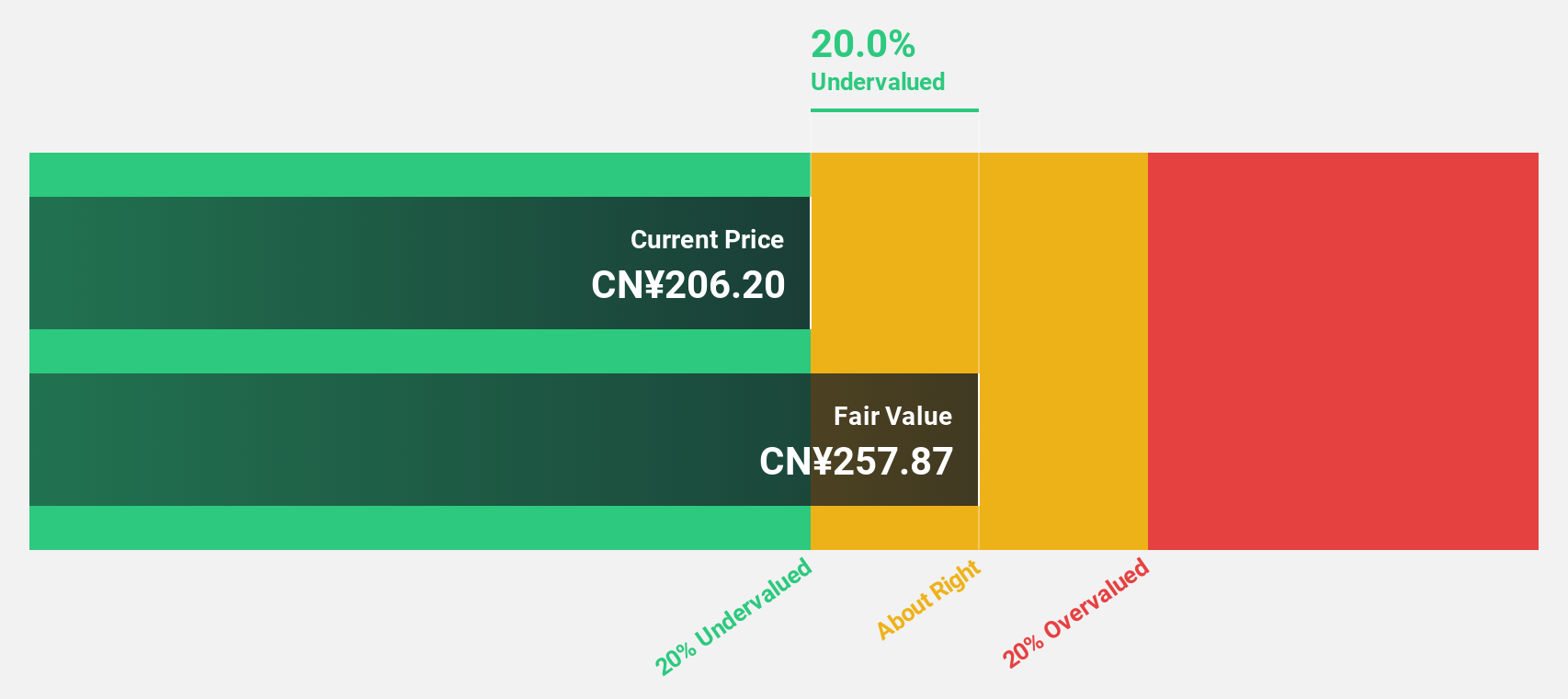

Zhejiang Taotao Vehicles (SZSE:301345)

Overview: Zhejiang Taotao Vehicles Co., Ltd. is involved in the research, development, production, and sale of motorcycles, electric vehicles, and ATVs both in China and internationally with a market cap of CN¥22.10 billion.

Operations: The company's revenue segments include the research, development, production, and sale of motorcycles, electric vehicles, and ATVs across domestic and international markets.

Estimated Discount To Fair Value: 19%

Zhejiang Taotao Vehicles is trading at CN¥209, below its estimated fair value of CN¥258.1, suggesting it may be undervalued based on cash flows. The company reported robust earnings growth with net income for the nine months ended September 2025 reaching CNY 606.54 million from CNY 301.36 million a year ago. While earnings are projected to grow at 25.3% annually, slightly slower than the market average, revenue growth is expected to outpace the market significantly at 26% per year.

- Our expertly prepared growth report on Zhejiang Taotao Vehicles implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Zhejiang Taotao Vehicles.

Seize The Opportunity

- Investigate our full lineup of 503 Undervalued Global Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Taotao Vehicles might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301345

Zhejiang Taotao Vehicles

Engages in the research and development, production, and sale of motorcycles, electric vehicles, and ATVs in China and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives