- Saudi Arabia

- /

- Media

- /

- SASE:4070

Shareholders of Tihama Advertising and Public Relations (TADAWUL:4070) Must Be Delighted With Their 455% Total Return

When you buy shares in a company, there is always a risk that the price drops to zero. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! Take, for example Tihama Advertising and Public Relations Co. (TADAWUL:4070). Its share price is already up an impressive 126% in the last twelve months. The last week saw the share price soften some 2.0%. The longer term returns have not been as good, with the stock price only 21% higher than it was three years ago.

Check out our latest analysis for Tihama Advertising and Public Relations

Because Tihama Advertising and Public Relations made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Tihama Advertising and Public Relations saw its revenue shrink by 8.2%. We're a little surprised to see the share price pop 126% in the last year. It just goes to show the market doesn't always pay attention to the reported numbers. Of course, it could be that the market expected this revenue drop.

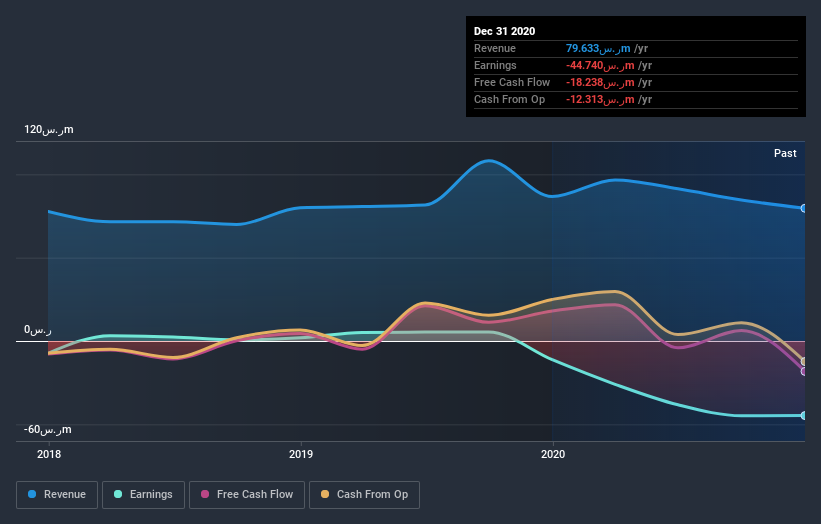

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Tihama Advertising and Public Relations' financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered Tihama Advertising and Public Relations' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Tihama Advertising and Public Relations hasn't been paying dividends, but its TSR of 455% exceeds its share price return of 126%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We're pleased to report that Tihama Advertising and Public Relations shareholders have received a total shareholder return of 455% over one year. That's better than the annualised return of 11% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Tihama Advertising and Public Relations you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

If you decide to trade Tihama Advertising and Public Relations, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tihama for Advertising Public Relations and Marketing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:4070

Tihama for Advertising Public Relations and Marketing

Engages in the commercial advertising, public relations, marketing, publishing, and distribution businesses in the Kingdom of Saudi Arabia.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success