- Saudi Arabia

- /

- Basic Materials

- /

- SASE:9601

Unveiling Three Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and concerns over consumer spending, major U.S. indices such as the S&P 500 experienced sharp declines after reaching record highs earlier in the week. Amidst this backdrop of volatility and uncertainty, small-cap stocks often present unique opportunities for investors seeking growth potential, particularly when they exhibit strong fundamentals and resilience in challenging economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Gallantt Ispat | 15.54% | 34.24% | 41.38% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bharat Rasayan | 5.93% | -0.16% | -5.78% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 56.23% | 33.99% | 34.28% | ★★★★★★ |

| Bengal & Assam | 4.72% | -3.69% | 46.32% | ★★★★★☆ |

| Rir Power Electronics | 21.19% | 21.54% | 38.94% | ★★★★★☆ |

| Kalyani Investment | NA | 25.45% | 12.48% | ★★★★★☆ |

| Monarch Networth Capital | 8.98% | 32.34% | 49.29% | ★★★★☆☆ |

| Western Carriers (India) | 34.72% | 9.79% | 14.42% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Mohammed Hadi Al-Rasheed (SASE:9601)

Simply Wall St Value Rating: ★★★★★☆

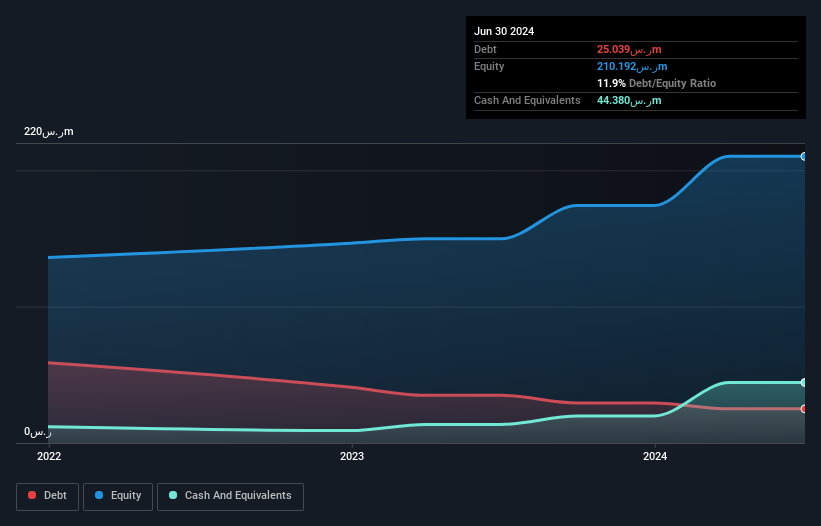

Overview: Mohammed Hadi Al-Rasheed Company is involved in the production of silica sand for various industrial applications and has a market capitalization of SAR1.86 billion.

Operations: The company's primary revenue stream comes from sales, contributing SAR246.94 million, while contracting adds SAR7.73 million.

Mohammed Hadi Al-Rasheed, a small cap entity, has demonstrated impressive earnings growth of 142% over the past year, significantly outpacing the Basic Materials industry's 12%. The company is in a strong financial position with more cash than total debt and earns more interest than it pays. Despite its profitability and positive free cash flow reaching US$53.78 million recently, share price volatility remains high over the last three months. While these factors highlight its potential, investors should be aware of this volatility as they consider future prospects within this dynamic industry landscape.

- Dive into the specifics of Mohammed Hadi Al-Rasheed here with our thorough health report.

Assess Mohammed Hadi Al-Rasheed's past performance with our detailed historical performance reports.

C&D Property Management Group (SEHK:2156)

Simply Wall St Value Rating: ★★★★★★

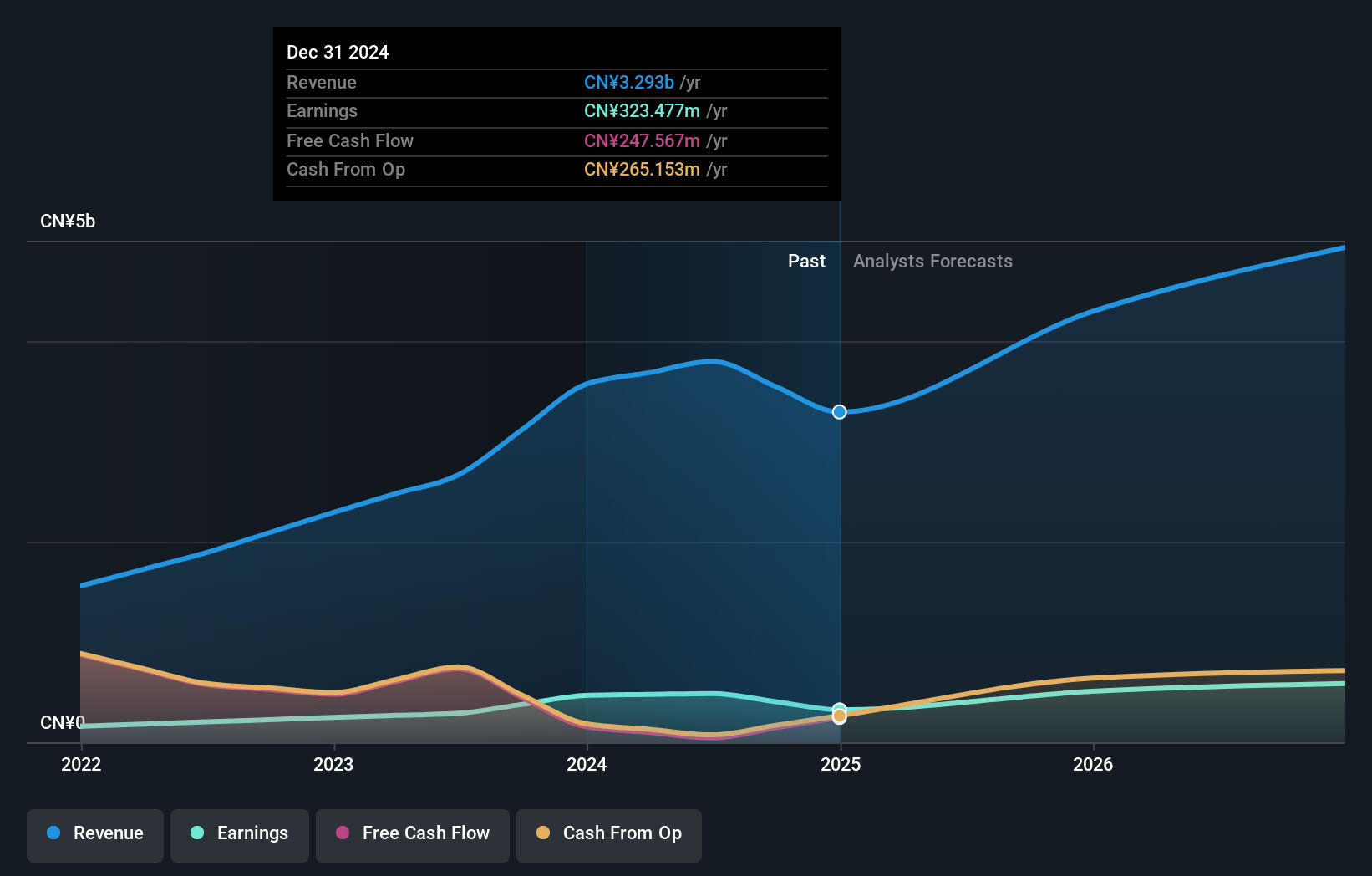

Overview: C&D Property Management Group Co. Limited is an investment holding company that offers property management services for residential and non-residential properties in the People’s Republic of China, with a market capitalization of HK$3.70 billion.

Operations: The primary revenue stream for C&D Property Management Group comes from its property management services and value-added services, generating CN¥3.80 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

C&D Property Management Group has shown remarkable financial resilience, with its debt to equity ratio plummeting from 439.2% to just 1.3% over five years, reflecting a solid balance sheet. Its earnings have surged by 68.4% in the past year, outpacing the Real Estate industry's -15.9%, suggesting strong operational performance and market positioning. The company enjoys a favorable price-to-earnings ratio of 7.1x compared to the Hong Kong market's average of 10.4x, indicating potential undervaluation in investor eyes. These figures highlight C&D's robust financial health and suggest promising growth prospects within its sector.

Polenergia (WSE:PEP)

Simply Wall St Value Rating: ★★★★★☆

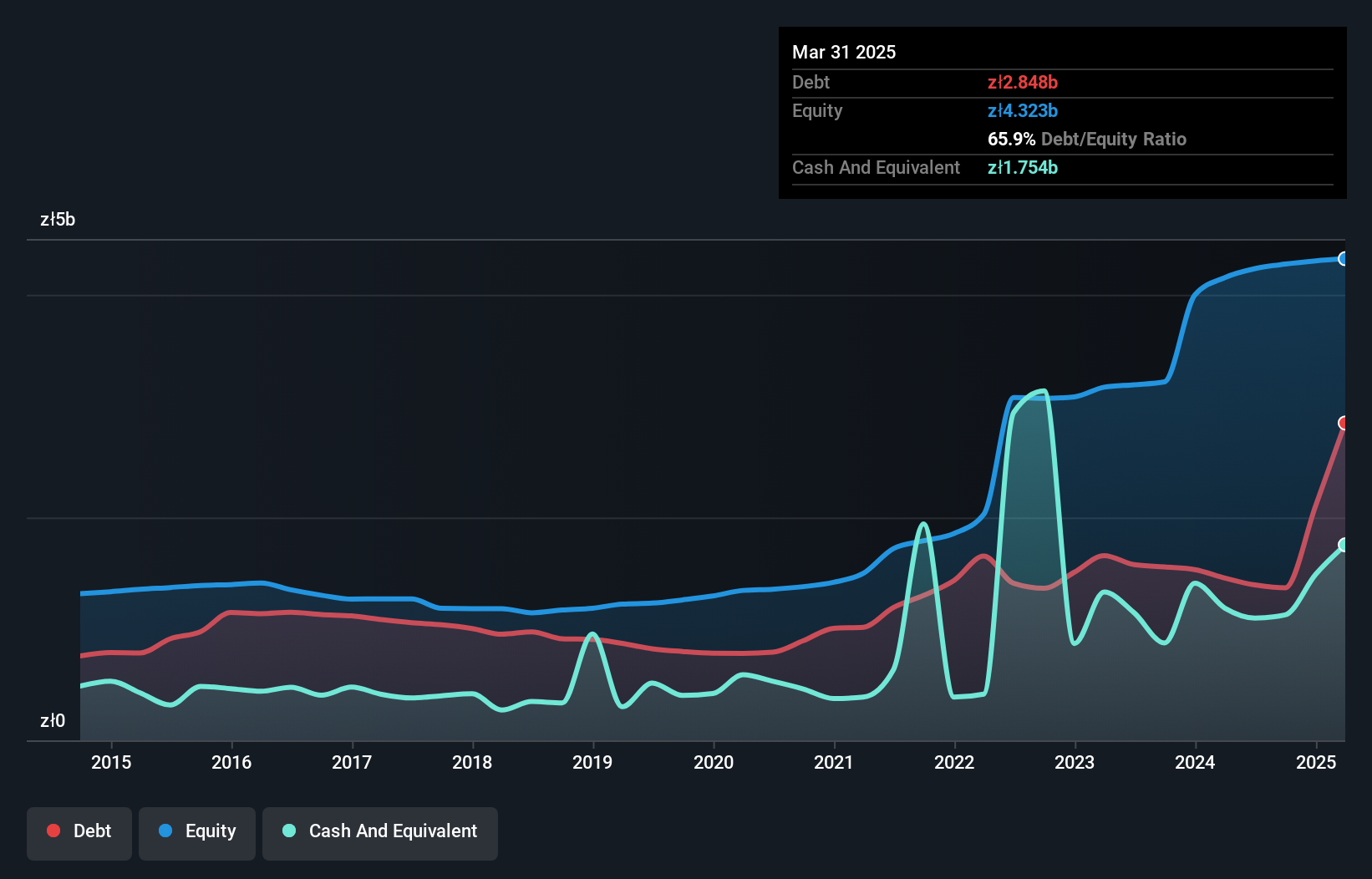

Overview: Polenergia S.A. is a company that operates in the generation, distribution, trading, and sale of electricity both in Poland and internationally, with a market capitalization of PLN5.33 billion.

Operations: The primary revenue streams for Polenergia come from Trading and Sales, which generated PLN3.38 billion, and Onshore Wind Farms, contributing PLN750.04 million. The company's involvement in Gas and Clean Fuel added PLN129.12 million to its revenues, while Distribution and eMobility accounted for PLN205.31 million. Notably, the net profit margin exhibits a distinct trend worth exploring further in financial analyses.

Polenergia, a notable player in the renewable energy sector, has shown impressive growth with earnings surging by 34% last year. This outpaces the industry average of -14%, highlighting its competitive edge. The company's net debt to equity ratio is at a satisfactory 5.7%, reflecting prudent financial management over five years as it reduced from 63% to 32%. Trading at a significant discount of 87% below estimated fair value, Polenergia seems undervalued. However, forecasts suggest earnings may decline by an average of 15% annually over the next three years, which could impact future performance despite current strengths.

- Navigate through the intricacies of Polenergia with our comprehensive health report here.

Gain insights into Polenergia's historical performance by reviewing our past performance report.

Next Steps

- Click through to start exploring the rest of the 4749 Undiscovered Gems With Strong Fundamentals now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9601

Mohammed Hadi Al-Rasheed

Produces silica sand for various industrial applications.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion