- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:4143

Al Taiseer Group TALCO Industrial And 2 Other Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

In a week marked by mixed performances across major stock indices, the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite reached record highs while the Russell 2000 Index saw a decline after previously outperforming larger-cap peers. Amid this backdrop of economic reports highlighting job growth and potential interest rate cuts, investors are increasingly focused on identifying small-cap stocks with strong fundamentals that can thrive in such dynamic conditions. In this context, Al Taiseer Group TALCO Industrial and two other promising companies stand out as undiscovered gems with robust potential for those seeking opportunities beyond the well-trodden paths of large-cap stocks.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Nestlé Pakistan | 40.95% | 14.04% | 17.18% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

| TopGum Industries | 37.34% | 18.35% | 31.91% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Al Taiseer Group TALCO Industrial (SASE:4143)

Simply Wall St Value Rating: ★★★★★☆

Overview: Al Taiseer Group TALCO Industrial Company specializes in designing, manufacturing, and marketing a variety of aluminum products, with a market capitalization of SAR2.29 billion.

Operations: TALCO Industrial generates revenue primarily from its Forming and Aluminum segment, contributing SAR581.06 million, followed by Thermo-Set Coating at SAR67.60 million and Aluminum Accessories at SAR39.39 million. The net profit margin demonstrates a key financial insight into the company's profitability trends over time.

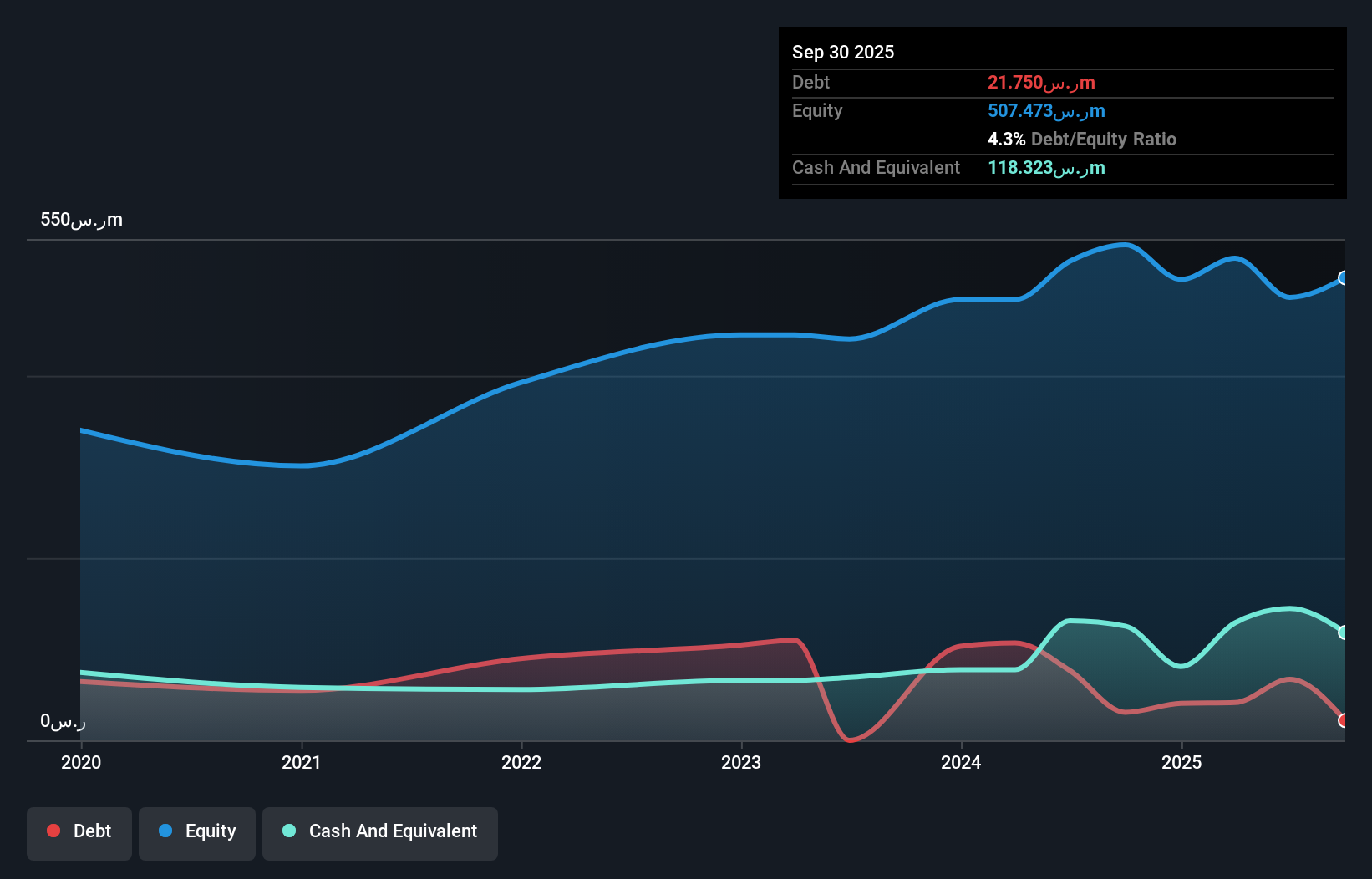

TALCO Industrial, a small player in the metals and mining sector, showcases a solid financial foundation with high-quality earnings and more cash than total debt. The company's price-to-earnings ratio of 27.5x is attractive compared to the industry average of 38x, while EBIT covers interest payments 76.7 times over. Despite earning growth lagging behind industry rates at 3.9% last year, TALCO has seen earnings grow by an impressive 19% annually over five years. Recent results show third-quarter sales at SAR167 million and nine-month net income at SAR60 million, reflecting stable performance despite slight fluctuations in net income figures year-on-year.

Tianjin Port Development Holdings (SEHK:3382)

Simply Wall St Value Rating: ★★★★★★

Overview: Tianjin Port Development Holdings Limited is an investment holding company that operates the port of Tianjin in the People’s Republic of China, with a market capitalization of HK$3.76 billion.

Operations: Tianjin Port Development Holdings generates revenue primarily from Sales (HK$3.78 billion), Cargo Handling (HK$7.62 billion), and Other Port Ancillary Services (HK$3.14 billion).

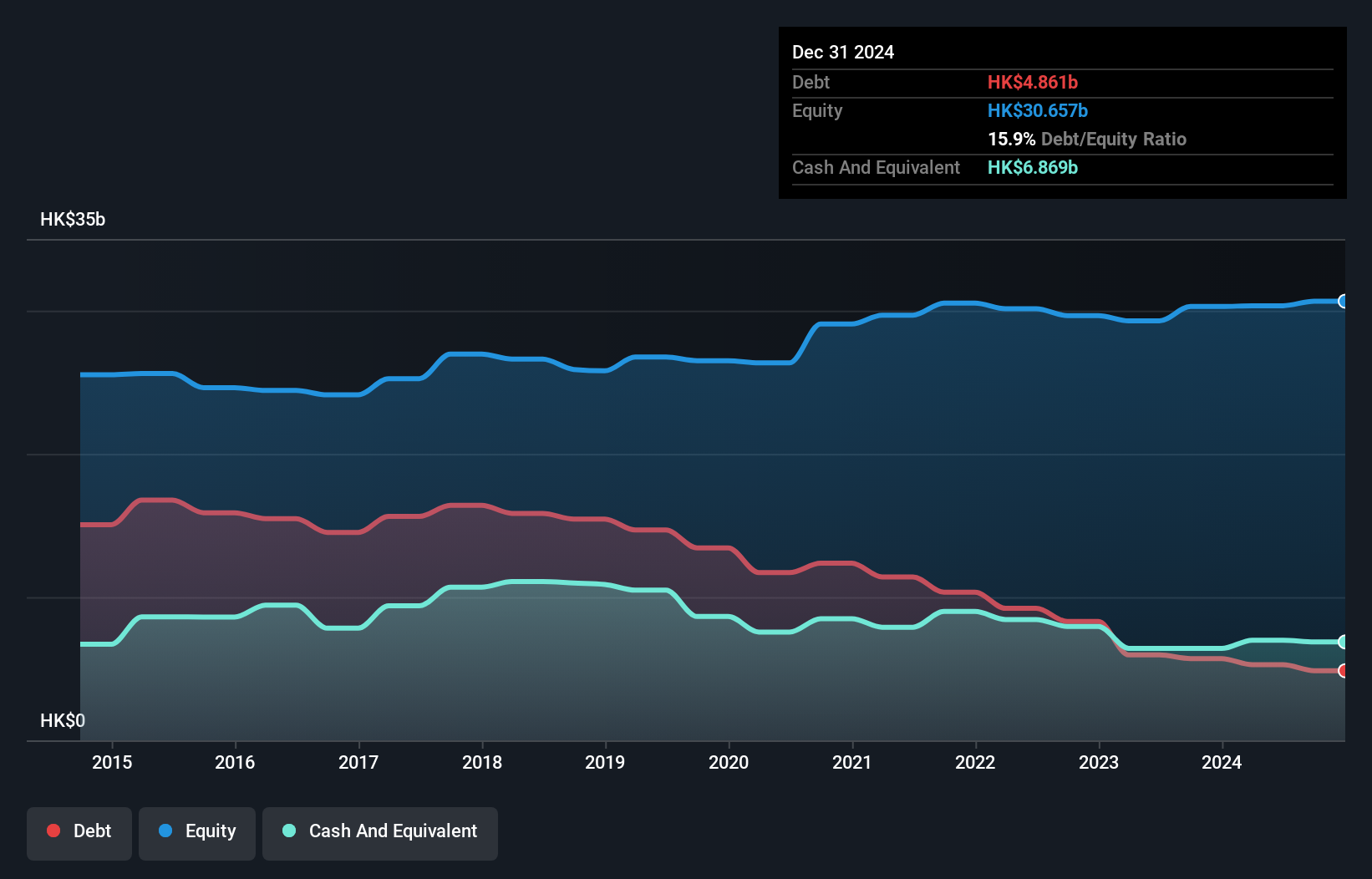

Tianjin Port Development Holdings, a notable player in the infrastructure sector, shows promising potential with its high-quality earnings and impressive financial standing. Trading at 71% below fair value, it offers an attractive proposition for investors. The company's debt to equity ratio has improved significantly from 54.9% to 17.4% over five years, indicating effective debt management. With earnings growth of 26%, outpacing the industry's average of 6.7%, Tianjin Port is on a growth trajectory. Additionally, its interest payments are well covered by EBIT at a robust 13.8 times coverage, underscoring solid financial health and stability in operations.

Digital Arts (TSE:2326)

Simply Wall St Value Rating: ★★★★★★

Overview: Digital Arts Inc. develops and markets internet security software and appliances across Japan, the United States, Europe, and the Asia Pacific with a market cap of ¥82.94 billion.

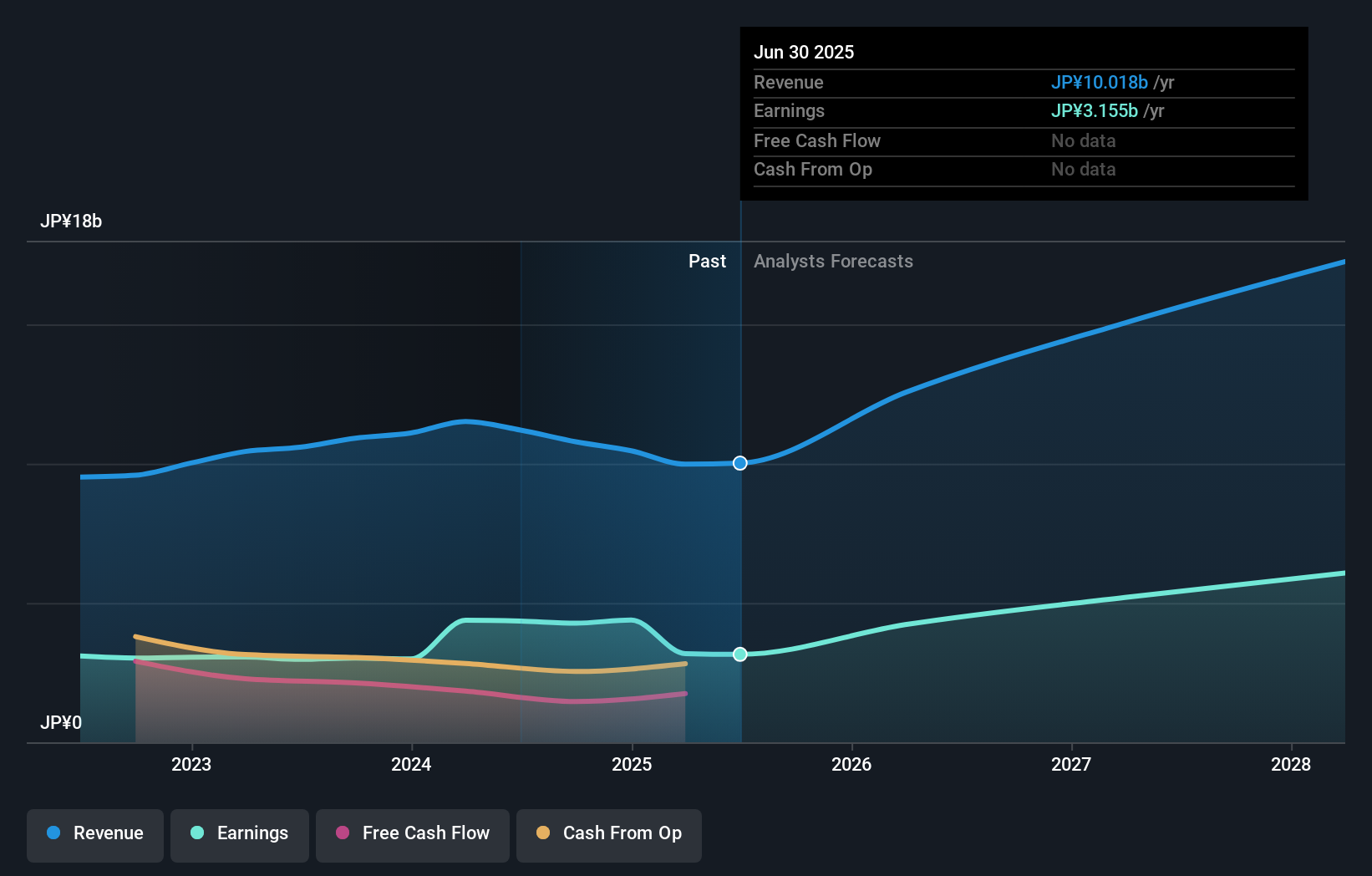

Operations: Digital Arts generates revenue primarily from its Security Business, amounting to ¥10.79 billion. The company's financial performance is highlighted by a focus on this segment as its main revenue stream.

Digital Arts, a nimble player in the software sector, has posted impressive earnings growth of 41% over the past year, outpacing the industry average of 16%. The company operates debt-free, eliminating concerns about interest coverage and showcasing financial resilience. A notable ¥1.9 billion one-off gain has influenced recent results, suggesting potential volatility in earnings quality. Despite this fluctuation, Digital Arts appears to offer good value with a price-to-earnings ratio of 20x compared to the industry’s 21.9x average. Future prospects seem promising with forecasted earnings growth at 7% annually, indicating steady expansion ahead.

- Navigate through the intricacies of Digital Arts with our comprehensive health report here.

Assess Digital Arts' past performance with our detailed historical performance reports.

Taking Advantage

- Access the full spectrum of 4647 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4143

Al Taiseer Group TALCO Industrial

Engages in the designing, manufacturing, and marketing a range of aluminum products in Oman, Kuwait, Bahrain, Egypt, Iraq, the United Arab Emirates, Lebanon, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives