- Saudi Arabia

- /

- Basic Materials

- /

- SASE:3003

City Cement And 2 Other Undiscovered Gems In Middle East Stocks

Reviewed by Simply Wall St

As most Gulf bourses gain momentum with rising oil prices and investor anticipation of corporate earnings, the Middle East market presents intriguing opportunities for discerning investors. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be key to uncovering undiscovered gems like City Cement and others in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

City Cement (SASE:3003)

Simply Wall St Value Rating: ★★★★★★

Overview: City Cement Company, along with its subsidiaries, is engaged in the manufacturing and sale of cement within the Kingdom of Saudi Arabia, with a market capitalization of SAR2.24 billion.

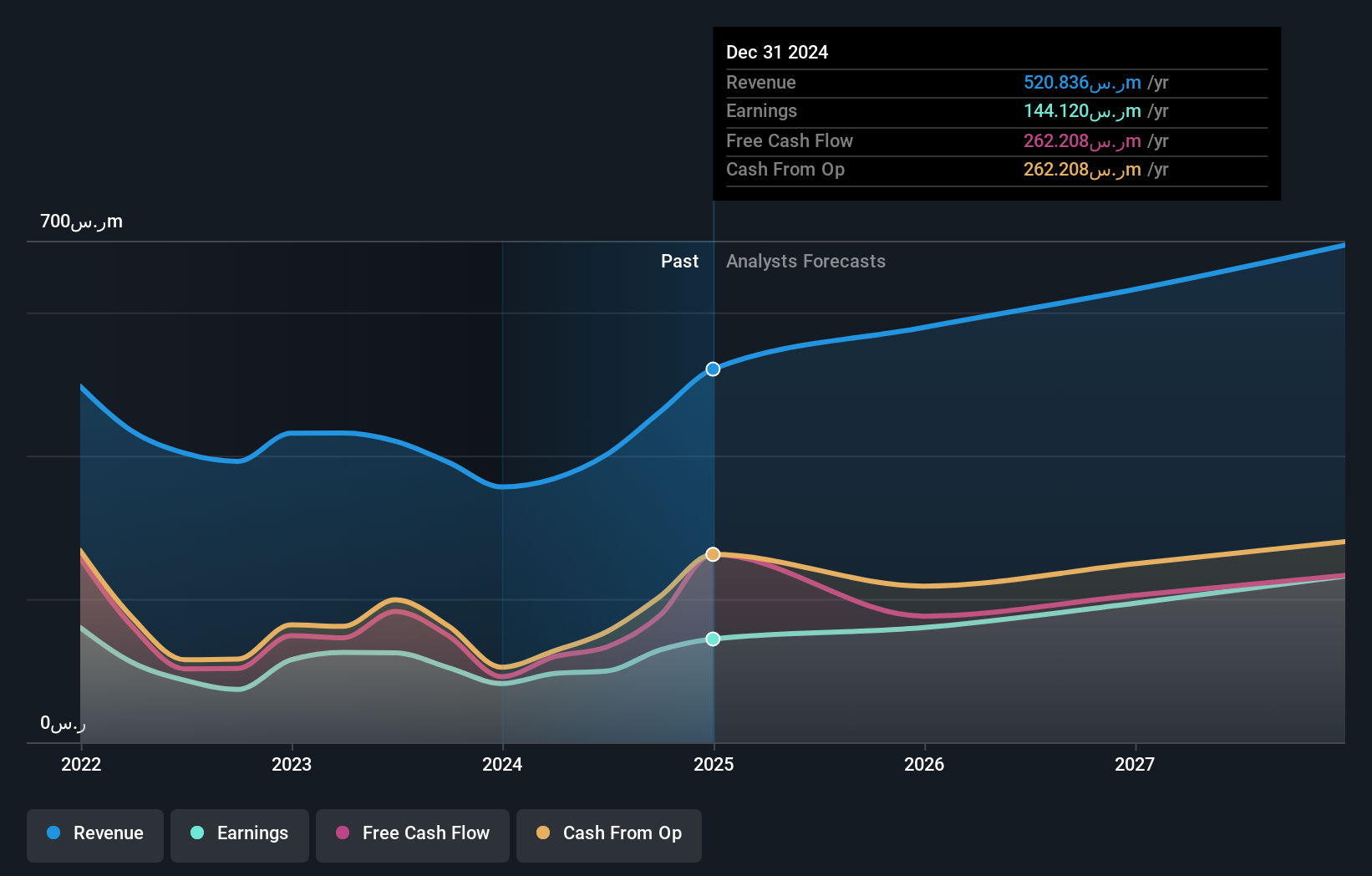

Operations: The primary revenue stream is derived from the sale of cement products within Saudi Arabia. The company's net profit margin has shown fluctuations, reflecting variations in operational efficiency and market conditions.

City Cement, a promising player in the Middle East's cement industry, has shown robust financial performance with earnings growing by 63.5% over the past year, outpacing the Basic Materials industry growth of 57%. The company is debt-free and trading at 32.8% below its estimated fair value, suggesting potential for value appreciation. Recent earnings reports highlight sales of SAR 139.49 million for Q2 2025 compared to SAR 111.28 million a year ago, with net income rising to SAR 36.38 million from SAR 27.78 million last year. Additionally, dividends have been increased to SAR 0.65 per share for H1 2025.

- Get an in-depth perspective on City Cement's performance by reading our health report here.

Assess City Cement's past performance with our detailed historical performance reports.

Saudi Cement (SASE:3030)

Simply Wall St Value Rating: ★★★★★★

Overview: Saudi Cement Company is engaged in the manufacture and sale of cement and related products both domestically within Saudi Arabia and internationally, with a market capitalization of SAR6.12 billion.

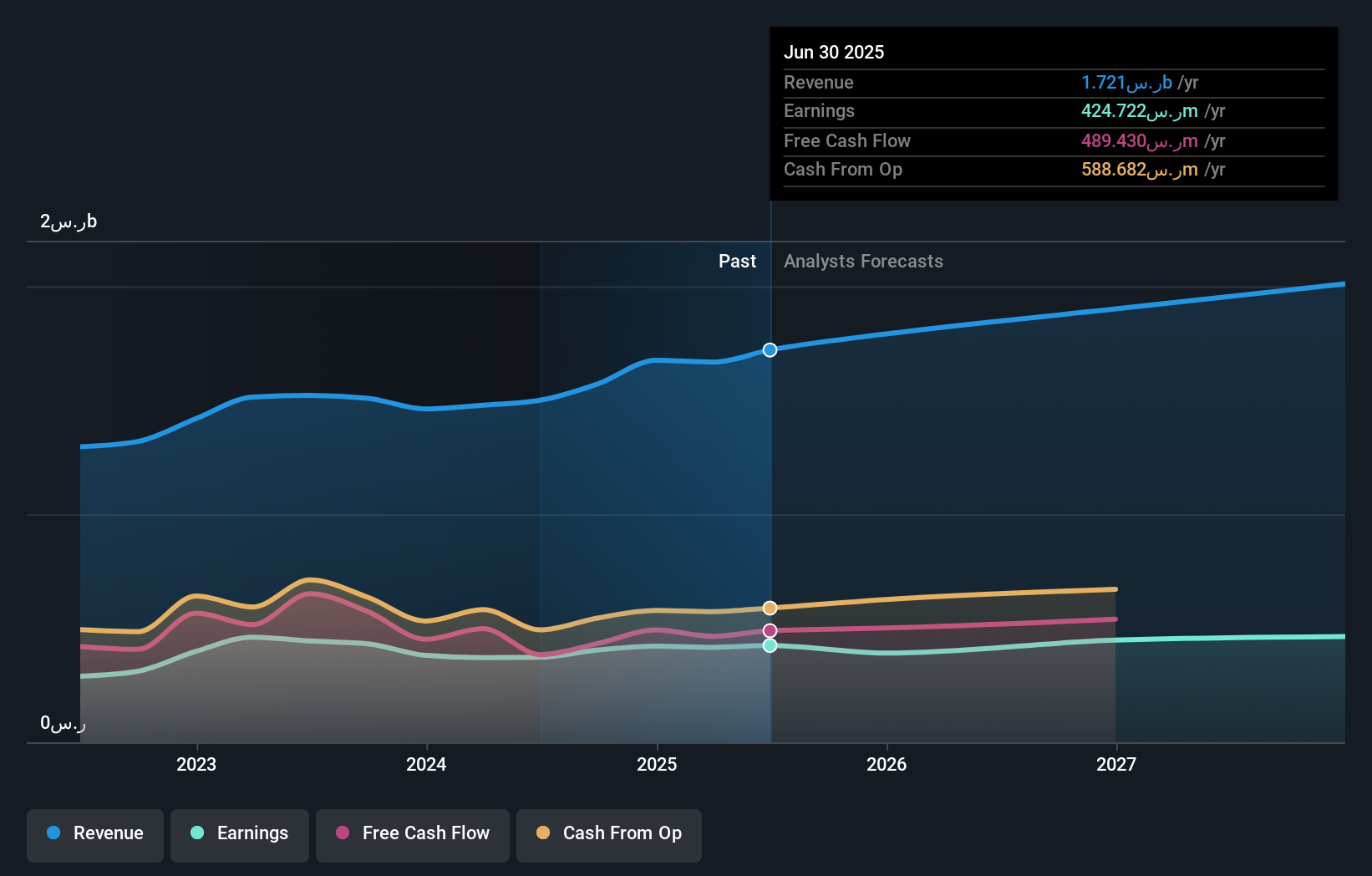

Operations: The primary revenue stream for Saudi Cement comes from its cement sector, generating SAR1.72 billion.

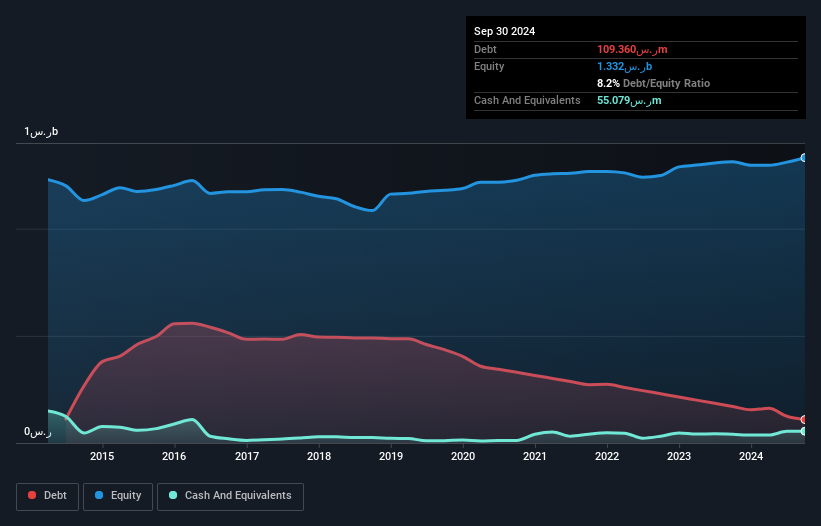

Saudi Cement, a notable player in the Middle Eastern market, has shown resilience with its recent earnings report. For the second quarter of 2025, sales reached SAR 431.53 million, up from SAR 378.13 million the previous year, while net income rose to SAR 95.46 million from SAR 87.35 million. The company's net debt to equity ratio stands at a satisfactory 8.7%, reflecting strong financial health over five years as it reduced from 32.8% to 16.7%. With EBIT covering interest payments by an impressive factor of 20x and trading at good value compared to peers, Saudi Cement seems poised for steady growth amidst industry challenges.

Tabuk Cement (SASE:3090)

Simply Wall St Value Rating: ★★★★★★

Overview: Tabuk Cement Company is engaged in the manufacturing and sale of cement within the Kingdom of Saudi Arabia, with a market capitalization of SAR953.10 million.

Operations: Revenue for Tabuk Cement primarily comes from the sale of packed and unpackaged cement, totaling SAR307.97 million.

Tabuk Cement, a small player in the Middle East's cement industry, showcases a mixed performance. Despite trading at 46.5% below its estimated fair value, recent earnings for Q2 2025 were SAR 14.13 million, down from SAR 29.26 million last year, reflecting challenges in sales which dropped to SAR 69.41 million from SAR 85.44 million previously. However, the company boasts high-quality past earnings and strong financial health with a net debt to equity ratio of just 3.1%, and interest payments well covered by EBIT at a substantial multiple of 22x, indicating robust operational efficiency amidst market fluctuations.

- Unlock comprehensive insights into our analysis of Tabuk Cement stock in this health report.

Examine Tabuk Cement's past performance report to understand how it has performed in the past.

Taking Advantage

- Gain an insight into the universe of 208 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:3003

City Cement

Manufactures and sells cement in the Kingdom of Saudi Arabia.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives