- Saudi Arabia

- /

- Chemicals

- /

- SASE:2350

Shareholders in Saudi Kayan Petrochemical (TADAWUL:2350) are in the red if they invested three years ago

If you love investing in stocks you're bound to buy some losers. But the long term shareholders of Saudi Kayan Petrochemical Company (TADAWUL:2350) have had an unfortunate run in the last three years. So they might be feeling emotional about the 53% share price collapse, in that time. And over the last year the share price fell 39%, so we doubt many shareholders are delighted. The falls have accelerated recently, with the share price down 14% in the last three months. However, one could argue that the price has been influenced by the general market, which is down 9.7% in the same timeframe.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

View our latest analysis for Saudi Kayan Petrochemical

Saudi Kayan Petrochemical isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Saudi Kayan Petrochemical saw its revenue shrink by 10% per year. That is not a good result. The share price decline of 15% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Having said that, if growth is coming in the future, now may be the low ebb for the company. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

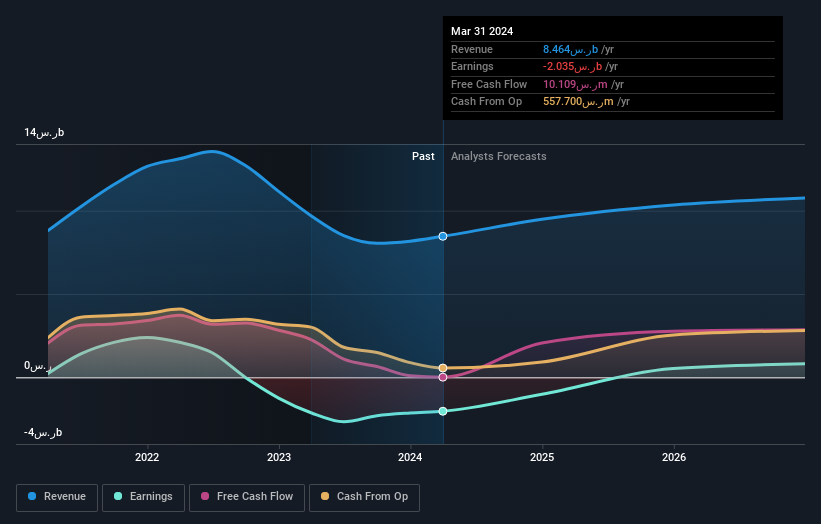

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that Saudi Kayan Petrochemical shareholders are down 39% for the year. Unfortunately, that's worse than the broader market decline of 3.7%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like Saudi Kayan Petrochemical better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2350

Saudi Kayan Petrochemical

Manufactures and sells chemicals, polymers, and specialty products.

Good value with reasonable growth potential.